This week, I started researching methods to earn interest on my BTC/ETH. I perused Loanscan.io, and I came across Crypto.com. I saw those juicy 6% interest rates for both BTC and ETH. I had to investigate further...

In this article, i’m going to examine the Crypto.com platform, as well as its two token economy.

I’ll answer the following questions: Does Crypto.com work as advertised? How does the EARN platform work? How does MCO staking work? What is CRO used for?

What is Crypto.com?

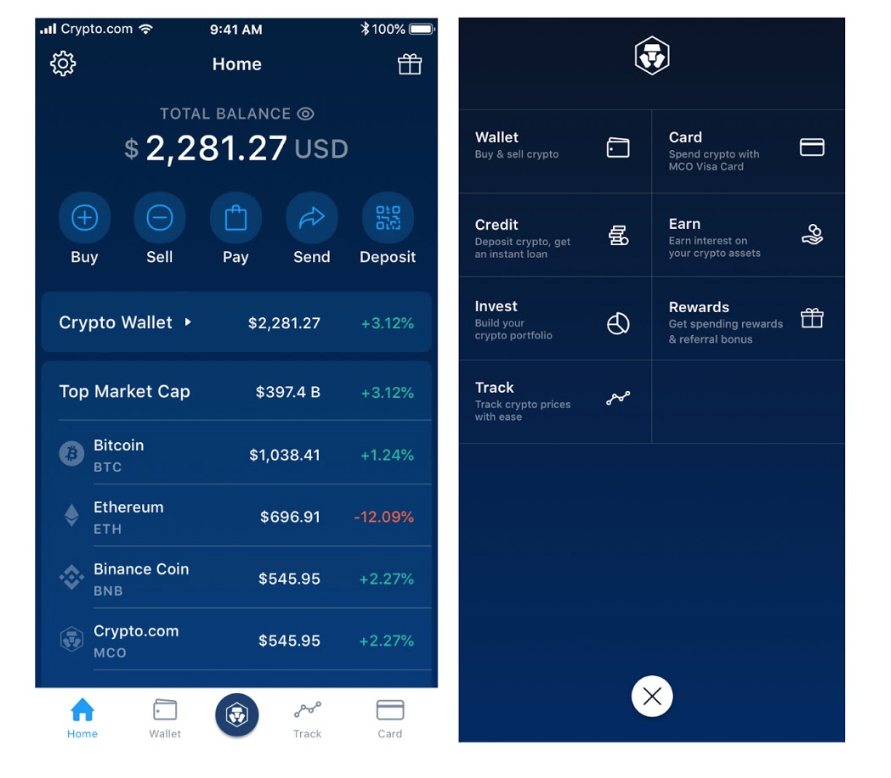

Crypto.com is an ‘all-in-one’ platform for crypto payments, staking, lending, and interest. It also has a nice app, and UI.

It will soon launch its exchange in 2020 (the beta is live now). It will include margin and derivatives trading.

The Crypto.com 2 token ecosystem: MCO and CRO Tokens

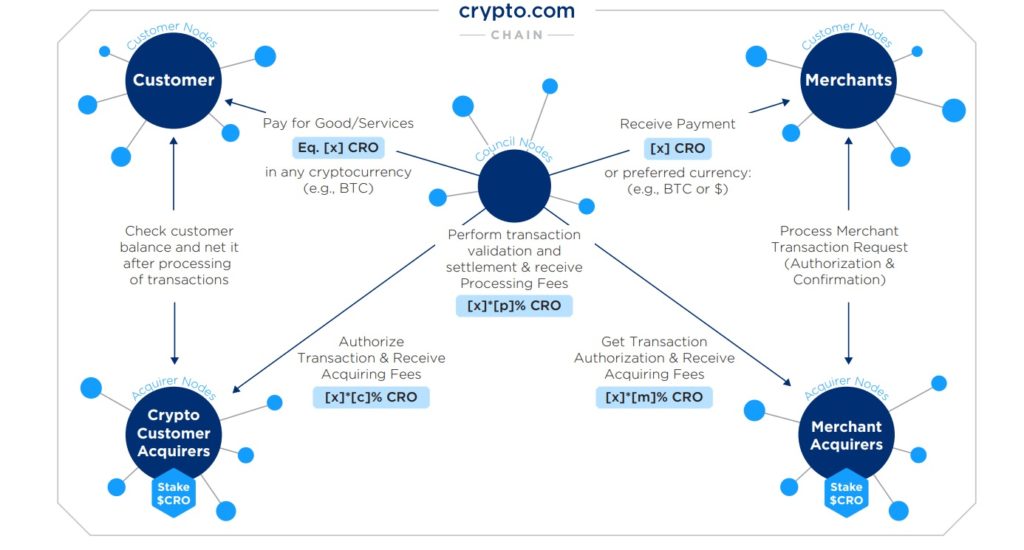

Crypto.com’s ecosystem is composed of two different tokens, CRO and MCO.

MCO is an ERC-20 token used to stake with its Visa debit card. CRO is crypto.com’s other coin, built on their own chain.

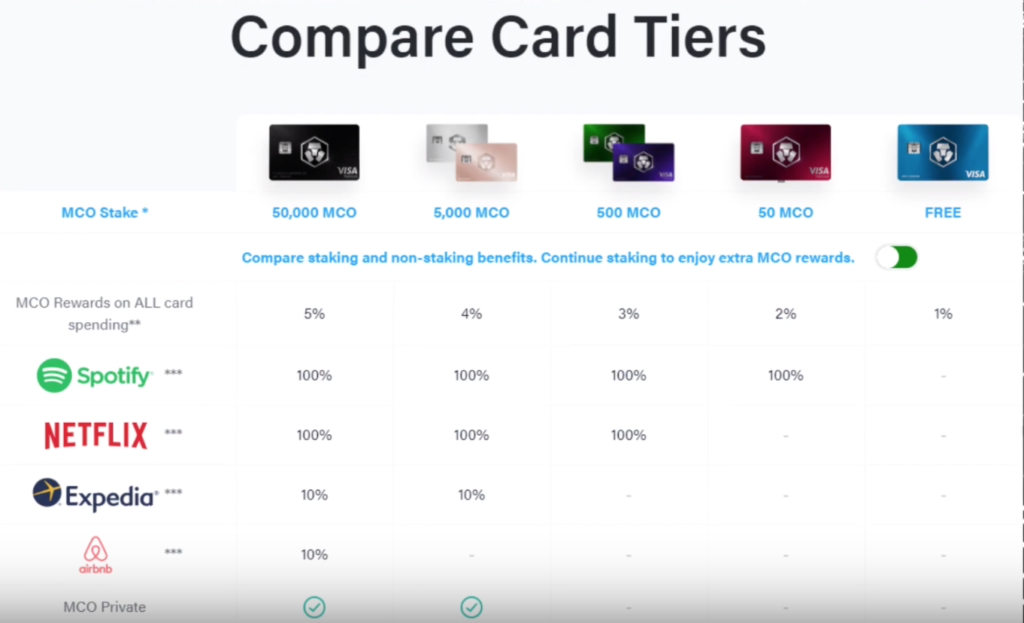

MCO can be staked in a 5 tier system, to generate rewards. Users receive cashback on their purchases, ranging from 1- 5%. The tiers below for MCO staking are for: 50,000, 5000, 500, 50, and 0.

At its current price of $6, the card with the highest rewards would require a user to stake $300,000 worth of MCO!

CRO is crypto.com’s other coin, which is built on their own chain. Crypto.com plans to use it for future applications like a payment network, and defi apps. CRO is being built with functionality not capable in an ERC-20 environment. It will be used to provide additional features on the exchange like: lower prices, and improved liquidity.

THE EARN PLATFORM: How to generate interest

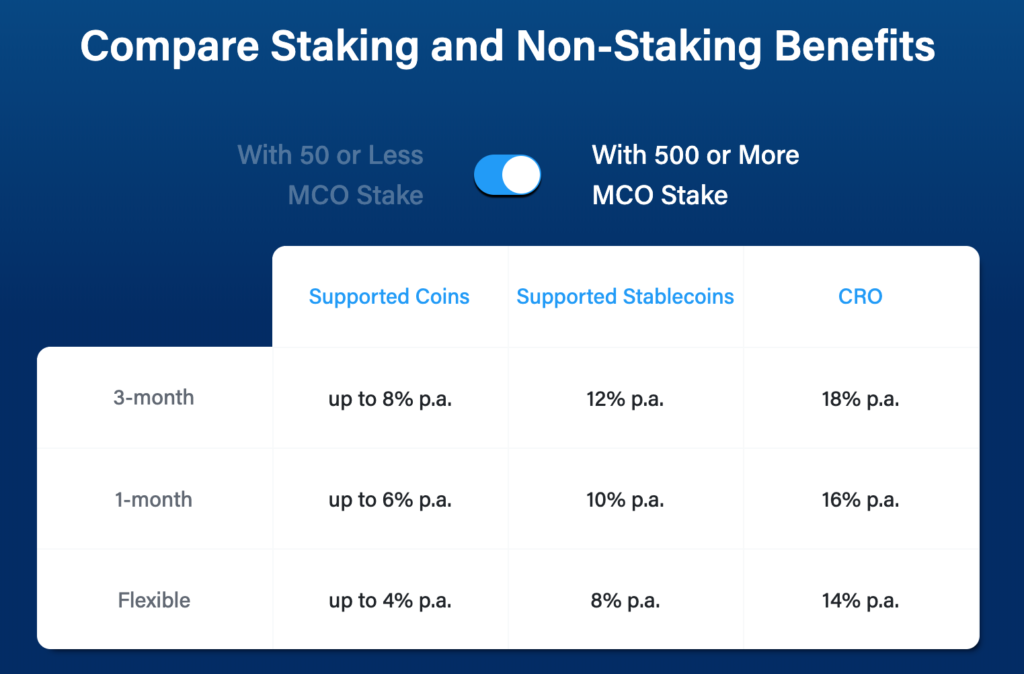

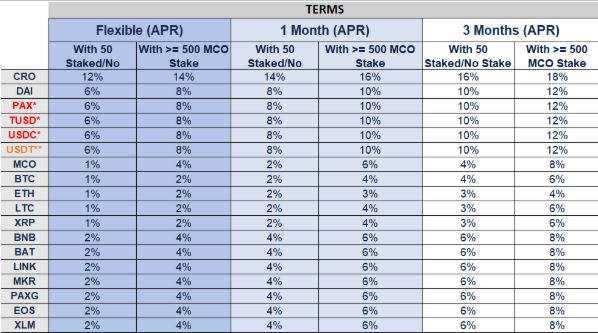

You can earn a maximum interest rate of 18% interest on Crypto.com. Rates vary, depending if you have 500 MCO staked, which crypto you have locked, and the amount of time it is locked. You can increase your interest rates if you lockup the CRO token. They max rate is 18%.

You will get the maximum rate of 18%, ONLY if you lock-up CRO for a 3 month period.

Two TEIR Interest System: Staking and Non-Staking

Interest rates vary. This depends whether you have 500 MCO staked, the coin type, and the lockup period. 500 MCO coin staking will improve interest rates by 2%. The highest rates are earned on a 3 month staking period. Once you come out of a fixed term, you will automatically move into a flexible term.

The chart below shows the difference between staked and non-staked coins.

Earn up to 5% cash back with The Crypto.com Visa Debit Card

Crypto.com also has a Visa debit card with cash-back. It has 5 tiers of color-coded metal cards: black, silver, green, red, and blue.

The color-coded tier depends on the amount of MCO staked. Users receive greater MCO rewards, depending on their tier. The tiers are for: 50,000, 5000, 500, 50, and 0 MCO staked.

Cash-back rewards are paid out in MCO tokens. The MCO can be held, or sold for cash. Additional rewards include: Spotify and Netflix for free, 10% off Air-BnB and Expedia, as well as free Netflix and Spotify.

I’m personally very interested in the debit card. It would allow me to maintain my exposure to BTC, make payments, and get crypto rewards. It would allow me to stay exposed to BTC (or another crypto), then covert it into USD, as I need it for spending.

What are the DEBIT CARD fees?

There are NO fees to maintain the debit card. BUT, users must keep their MCO staked, or they will lose ALL benefits.

The debit card has a $10,000 per month spend limit for free. There is a small fee after that. The card offers a monthly withdrawal limit of $800, then a 2% afterwards.

What are the Negatives of the DEBIT Card?

One negative of the cards, is that they are expensive. Especially for the higher tiers. $3000 for the middle tier. Other negatives include: No option for the cash back to be paid back in the crypto of your choice, and no airline miles.

crypto.com CUSTODY of funds

All custody for crypto.com is done through Ledger Vault. It offers an institutional grade custody service which holds customer funds in cold storage. Ledger Vault has insurance coverage of up to $250 million dollars to protect against theft or loss. The USD wallet is insured by FDIC for $250,000.

The hot wallet for Crypto.com is composed of non-user funds. This exposes the business to the majority of the risk, not you.

A non-custodial wallet app will likely arrive in 2020. It allow users to control their own private keys.

Crypto.com’s 2020 Roadmap

Below is the the official Crypto.com roadmap for 2020:

Conclusion: What is my impression of crypto.com?

To be honest, i saw the 6% interest rate and thought, it might be a scam, or have alot of hidden fees. But, on further inspection, i was pleasantly surprised. It looks like a great project.

I can see the overall vision for Crypto.com. They started off with a top level.com domain name, then are developing it into an all-in-one platform for all types of user-levels. There goal is to be a hub of crypto activity. With staking, trading, lending, interest, and rewards, there is something for everyone, with lots of room to grow. They also has a great app and nice UI. This is a project with potential. i’m gonna keep a close eye on it.