Below, I’ll discuss 5 upcoming Polkadot projects. All of these projects have tokens, which haven’t yet been released as of Sept 23.

The tokens are: POLS, PSWAP, ACA, GLMR, and BOND.

*Note – I’m not saying to buy these tokens, or giving financial advice. This is just a place to start your research.

PolkaStarter

PolkaStarter (POLS)- Polkastarter is an upcoming cross-chain DEX and auction project. It has a governance model, dutch and sealed bid auctions, closed password protected pools, as well as fixed and dynamic swaps. It is a place to launch new tokens, in an optionally KYC compliant environment.

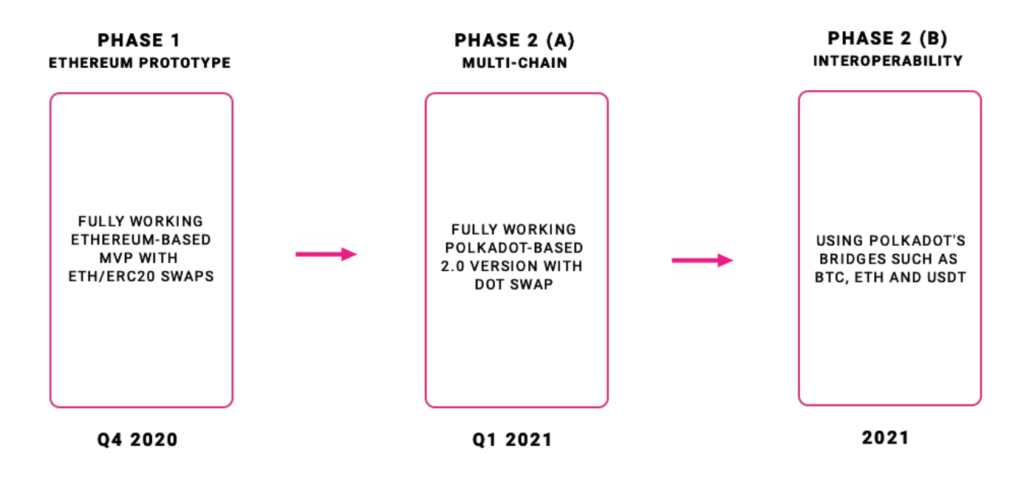

The POLS token will be listed on Uniswap at the end of September! (check the telegram here) The plans are to launch the product on ETH 2020 Q4, then on Polkadot in Q1 of 2021. They also have a new partnership with Mantra DAO.

POLS Tokenomics – The total supply of POLS is 100,000,000, with an initial Uniswap listing price of $0.05 cents. (This price would put it a fully diluted cap of $5 mil.) POLS is a utility token which is used for governance and transaction fees. Pool creators will need to hold POLS.

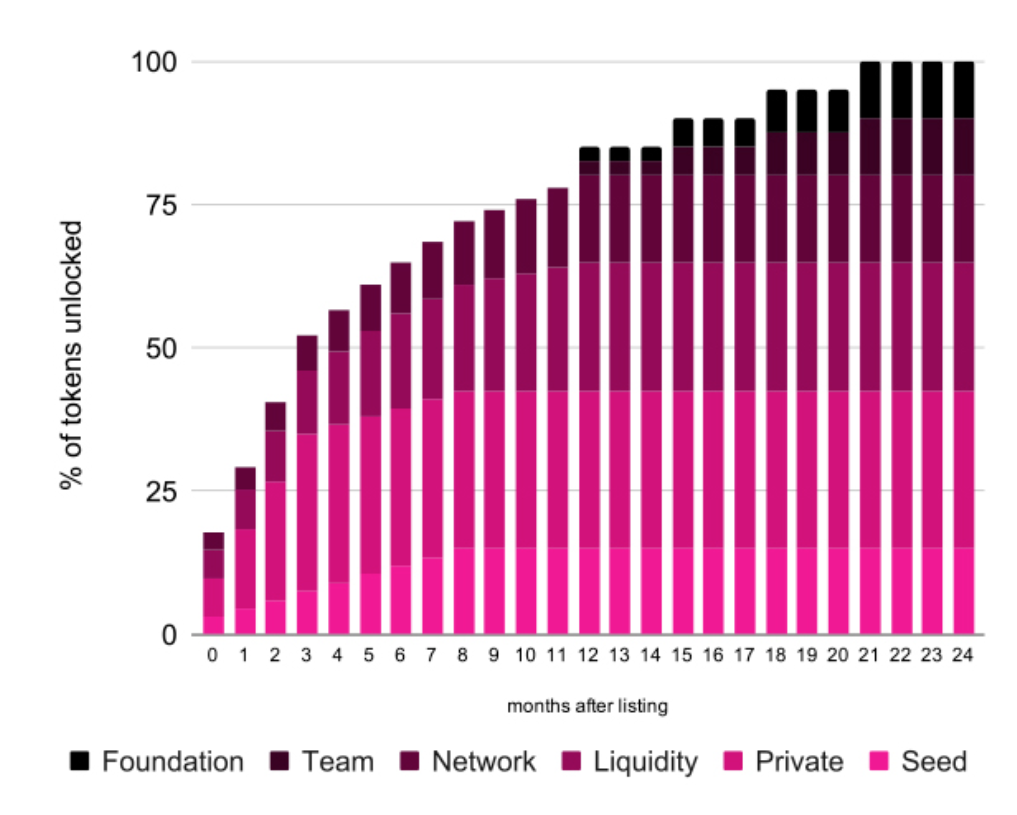

Below is the token allocation and release schedule:

The Team – the team is small, but public with a history of successful crypto and internet projects.

PolkaSwap

PolkaSwap is an interoperable AMM DEX, like Uniswap. It has the ability to list and exchange tokens on other chains like DOT, ETH, and BTC. Its native token is PSWAP. PSWAP will not be sold in an ICO or private sale.

Tokenomics of PSWAP – The PSWAP token can be earned by providing liquidity. It is a deflationary token. Trading fees of 0.3% on Polkaswap are used to buy and burn PSWAP. PSWAP is used to reward liquidity providers. Rewards start at 100% of burned trading fees, but reduce down to 35% of burned fees after 5 years.

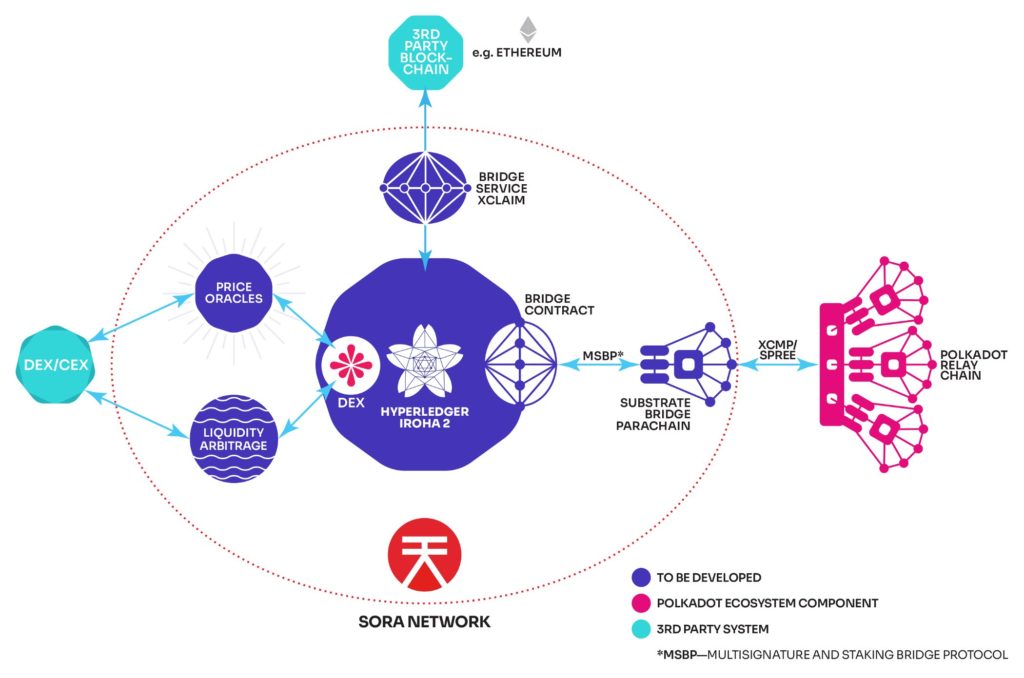

The XOR token (SORA network) is also used in the ecosystem. It is used for gas and liquidity provision. PolkaSwap is an app in the SORA network.

The image below shows how PSWAP with fit into the SORA network:

Acala Network

Acala Network is a cross-chain stablecoin and defi platform. It allows users to lend, borrow, trade, and govern. It is similar to MakerDAO, offering multi-collateral CDP’s. Collateral can be from Polkadot, or other chains connected to Polkadot. ACA is the native token of Acala. The ACA token is not yet available for sale, check the telegram group for details.

Here’s a blog post about what Acala’s accomplished in September.

ACA tokenomics – The ACA token serves three purposes in the ecosystem. It is a utility token paying for transaction fees, stability fees, and penalty fees. It is also for governance, and for a contingency solution in case there was a collapse of a collateral asset.

Acala uses the Homa protocol, which lets users trade staked assets as l- assets, or “locked” assets.

Moonbeam Network

Moonbeam is an Ethereum compatible smart contract parachain on Polkadot. It is being developed by Purestake. It offers support for many types of Solidity based smart contracts. It allows developers to use tools like Truffle or Metamask. Glimmer (GLMR) is its native token.

The goal is to launch Q2 2021 on Polkadot, and on Kusama Q4 of 2020.

Important Links:

GLMR tokenomics – GLMR is a utility token which is used to pay for smart contract execution, smart contract storage, transaction fees, on-chain governance, and cross-chain messaging. The plans for the token sale haven’t been announced yet, no info yet about supply.

Bondly Finance

Bondly.Finance is an ecosystem of defi products. It’ll start out with three projects: Bondswap, Bond Dex, and Bond Protect. The apps will allow peer to peer trading via chat apps, (as seen with wechat), a DEX, and escrow services.

The native token is $BOND. Note that there are multiple projects with the $BOND ticker!

Important Links:

Below are the three dapps in the ecosystem:

BONDSWAP (BSWAP)

Bondswap is similar to Binance OTC trading portal. Trading is done directly on-chain, via chat apps.

BSWAP allows you to:

- sell low liquidity tokens with no slippage

- sell NFTs, domains, artwork

- buy crypto with a credit card

- send a link to a buyer through a chat app

BOND DEX

Bond Dex is a cross-chain dex built around liquidity pools. Liquidity Providers can earn rewards for providing funds (similarly to uniswap). It also has a price matching engine. The BOND token serves as a reward.

BOND PROTECT (BPROTECT)

Bprotect is an escrow service. It allows peer-to-peer transactions with escrow. It protects buyers and sellers from fraud. It also allows for subscriptions, or recurrent payments.

BOND Tokenomics – The BOND token is a utility token which can be used for collateral in the marketplace, liquidity rewards, and more.

The team is experienced with other crypto projects under their belt.

If you liked this article, please follow me @defipicks