AkropolisOS is a framework to create financial DAOs, dapps, and protocols. It’s a smart contract toolkit to build community driven financial services, with no central counter-party. It helps users work together to earn, save, invest, and lend. It can even provide under-collateralized loans! This is very unique in defi, which tends to focus on over-collateralized loans.

This project allows users to create and control pools of capital, under DAO governance. These pools of money can be configured into: pension funds, savings accounts, insurance accounts, group investments, or community lending pools. DAO members receive incentives for providing pool liquidity, for staking to fund loans, and voting. Groups of DAOs can even organize into Guilds.

Originally Akropolis was started to create a distributed savings/pension fund, but it has morphed far beyond that. Its overall goal is to replace many banking services, using the model of “coops or mutuals”. This creates a more fair type of banking system, and removes predatory middlemen. Users are always in full control of their funds. They can “rage quit” the DAO at any time.

- Akropolis lunched its mainnet in June, 2020. There are major updates coming, including: liquidity mining, a rebalancing module, and Opyn support. The roadmap can be seen here.

Important Akropolis links:

A Tale of Two Capital Pools: Sparta and Delphi

The Akropolis team has seeded the first two defi products into the AkropolisOS ecosystem: The Sparta and Delphi pools.

1) The Sparta Pool: This is a community owned capital pool. It is used to issue under-collateralized loans, save money, or farm yield for a co-op. It can be thought of as a community bank, run by DAO governance.

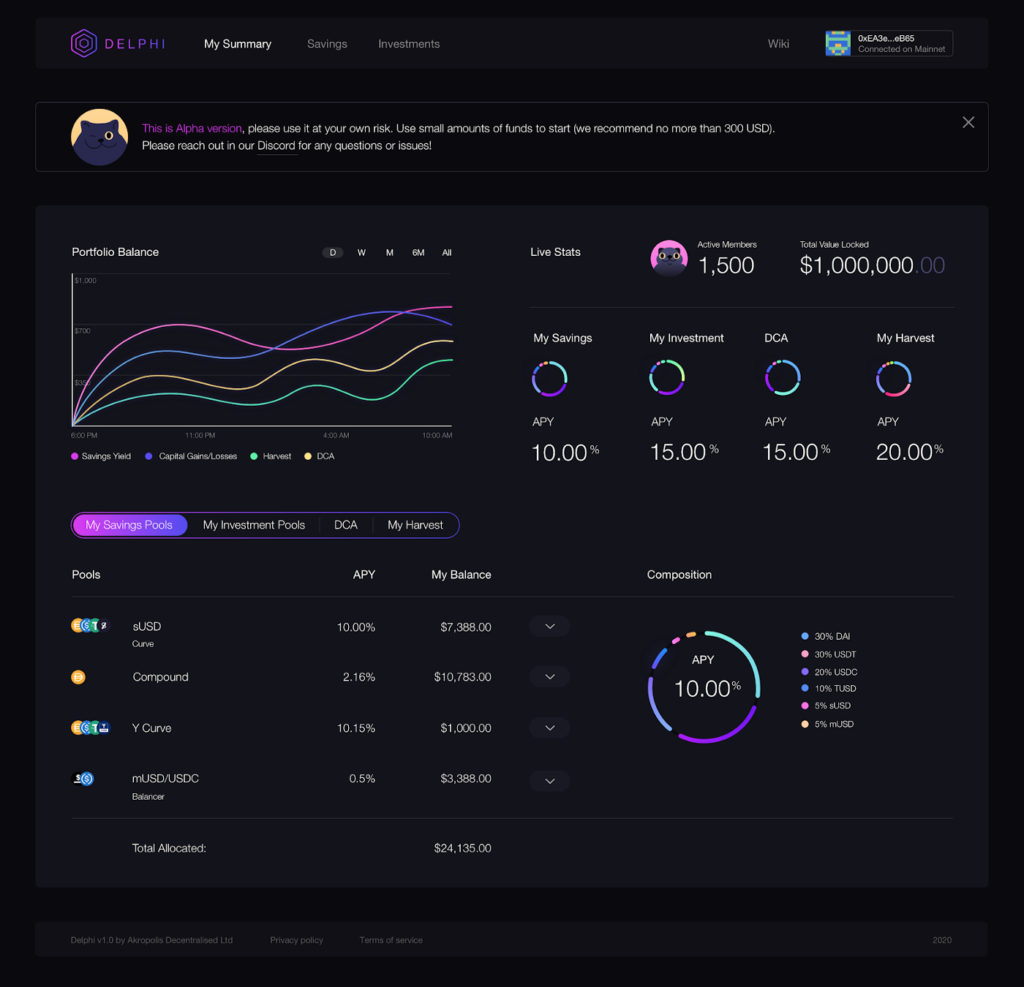

2) The Delphi Pool: This pool helps members dollar cost average (DCA) into BTC and ETH. It lets them earn interest via defi protocols (Compound, Aave, dYdX, etc.) and participate in liquidity mining. Members can also farm governance tokens like COMP, BAL, and MTA. Here is a prototype of the Delphi pool.

$ADEL is a recently launched governance token for the Delphi pools. It is earned by contributing liquidity, and by actively governing the pool. In addition to being a a part of governance, “ADEL will also have a shared claim on any future fees of Delphi.”

Below is the Delphi UI Alpha.

Pool Growth and Liquidity Incentivization

Both pools are designed to offer incentives for: early pool membership, capital growth, participation in lending, and voting. Users can buy into a pool, by purchasing pool tokens (pTokens). pTokens are priced according to a bonding curve. The bonding curve allows early adopters to cash out at a higher price, if the liquidity increases.

Undercollateralized Loans via Staking

I think a stand out feature of Akropolis, is its ability to give under-collateralized loans. This sets it apart in the defi landscape.

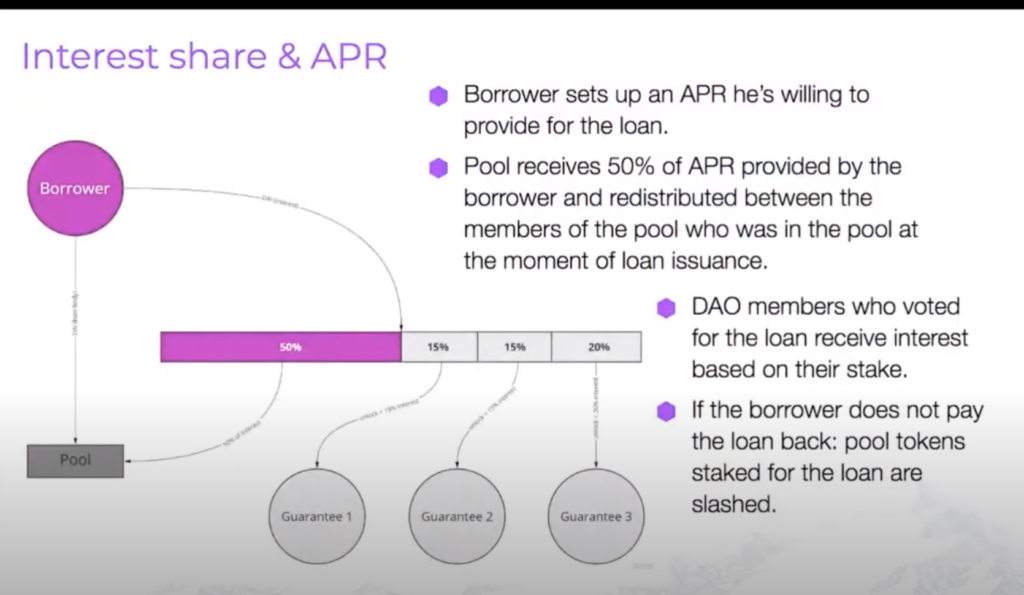

Members can get an undercollateralized loan, by requesting it from the pool. The borrower must provide 50% of the collateral themselves. The remaining 50%, must be staked by other DAO members. Members use on-chain social reputation, along with identity metrics, and 3rd party credit scoring to assess risk of the borrower.

Staking on a loan application creates a credit scoring system, used to evaluate the loan’s risk.

(The image below shows how loans work in the DAO)

Pensify: The On-Chain Pension Fund

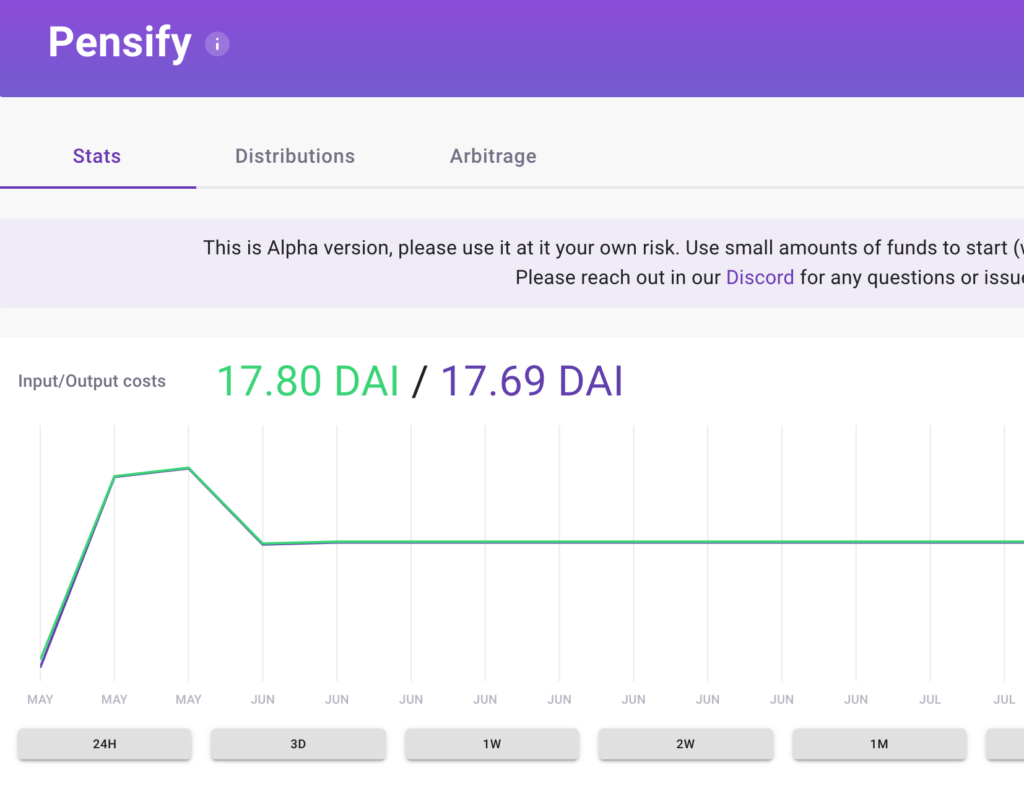

Pensify was created in an Akropolis hackathon. Its a pension dapp, that allows its members to farm yield. It offers flash loan arbitrage, yield rebalancing, and increases its token’s value, with the bonding curve.

When a member retires, they can withdrawal their pension funds based on the plan they chose. (Below is a screenshot from the UI.)

Tokenomics

There are 4 tokens used in the Akropolis economy: AKRO (governance token/liquidity incentive), pTokens (pool token), ADEL (governance of Delphi pools/ liquidity incentive), and DAI (to fund loans).

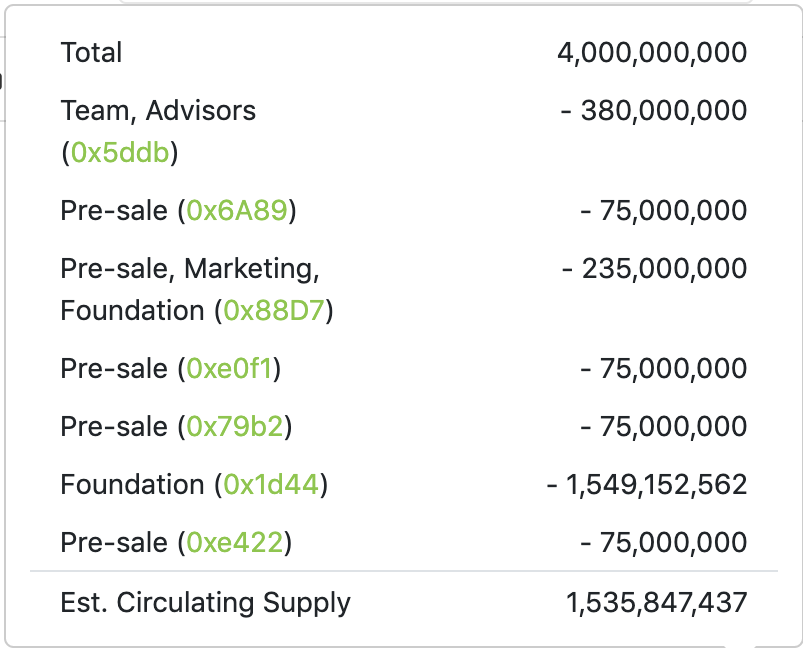

The total supply of AKRO is 4,000,000,000. AKRO is used for network governance, and liquidity incentivization. AKRO holders can vote on pool parameters like: the bonding curve, and the loan collateralization rate.

AKRO tokens are deflationary. AKRO is bought and burned, when there is a gain between pToken entry and exit on the bonding curve.

AKRO’s allocation is shown below:

ADEL is a newly added governance token for Delphi pools. A fixed supply of 60,000,000 will be minted and distributed over 6 months. It can be mined by adding liquidity to these pools.

pTokens represent a user’s share in a capital pool. Its price is based on the bonding curve, which rises as more tokens are minted. The pToken’s value is tied to the amount of capital in a pool.

DAI is used to fund loans.

Whats Coming Soon for Akropolis?

Akropolis has many new features coming like: gasless transactions (using GSN), insurance options via Nexus Mutual and Opyn, automatic rebalancing (RAY, Curve), and liquidity mining. Governance improvements and new tokenomics, are also being tested.

The team is addressing interoperability with Polkadot, by launching their own parachain.

My Conclusion on Akropolis

I think DAO governance can fix the problems created by the centralized control of our banking system. Akropolis’ DAO controlled capital pools, can build a more fair system. It removes middlemen, and gives the voice back to consumers.

Akropolis gives multiple incentives to users, for contributing to the network. Members can earn two governance tokens (AKRO and ADEL) for providing liquidity. Early pool members can also profit off the bonding curve, if liquidity grows. They can also stake on a loan, to earn interest.

It’s exciting to consider the possibilities of these DAO managed pools. I can see them being utilized in: group investments of non-crypto assets, DAO betting (harnessing the wisdom of the group), and as a way for non-savvy traders to pool with more experienced traders. I think community banking and savings just scratches the surface.

The Akropolis team seems to be smart, capable, and experienced. They have backgrounds in fund management, insurance, pensions, and previous blockchain startups.

Akropolis is early in its development, but its community is already growing. Members have built dapps including: Pensify and Cash Flow Financing. AkropolisOS seems like a financial swiss army knife. It’s a springboard to launch hundreds of user-controlled banking products.

If you liked this review, please follow me @defipicks