Aave is an open-source lending protocol with over 15 million dollars total locked up, as of Feb. 2020. This protocol generates interest bearing tokens called aTokens, when a user locks ETH collateral in a CDP. The tokens are pegged 1:1 to the collateral, which is held in a smart contract.

aTokens increase in number as interest is generated. They do not gain value. If you have aTokens in your wallet, your balance will increase over time along with the interest rate.

If you want to borrow, or earn 6.5% interest on Aave, go here.

(follow me on Twitter here —> @defipicks)

- In this article, i’ll talk about Aave’s decentralized lending pool model, the flash loan controversy, the stable interest rate, the lend token, and governance…

What is a DECENTRALIZED LENDING POOL?

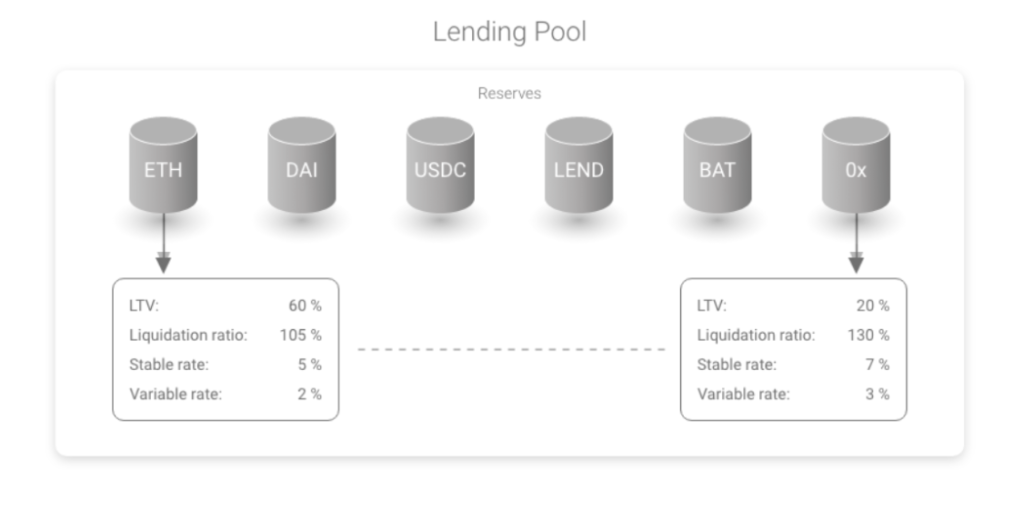

Aave uses a decentralized lending pool model (or DLP). Its model was switched from a direct “lender-to-borrower” matching model to a DLP, when they rebranded from ETHLend to Aave. With a DLP model, the borrower receives funds from a large pool of funds held in a reserve, instead of directly matching users.

The interest rate for borrowing and lending is decided algorithmically. It will fluctuate based on supply and demand in the market.

Users place their ETH collateral into a CDP (collateralized debt position), in order to withdraw a percentage of the funds out as a loan. The amount of funds a user can withdraw depends on the LTV, or loan-to-value ratio for a cryptocurrency. Each different type of crypto (ETH, BAT, DAI, etc) has a different Loan-To-Value ratio or (LTV), or amount of ETH collateral needed to withdraw a specific amount of DAI.

FLASH LOANS:Innovative, BUT Controversial

Flash loans are a new type of uncollateralized loan. Their use-cases are just being discovered and implications for the defi community are unsure. There were two major oracle attacks involving flash loans on the BZX dex within 2 days. Other use cases that i have heard for flash loans include things like arbitrage between DEXs, liquidation of loans, and refinancing. Here is a great article discussing flash loans by the ArbitrageDAO.

Flash loans require NO COLLATERAL, BUT, also require that the loan be repaid in the time the ETH block is mined. If this criteria isn’t met, the loan is reverted and never existed! This is a powerful new tool in the defi ecosystem, but it has the potential to cause havoc. For an example of this, read below…

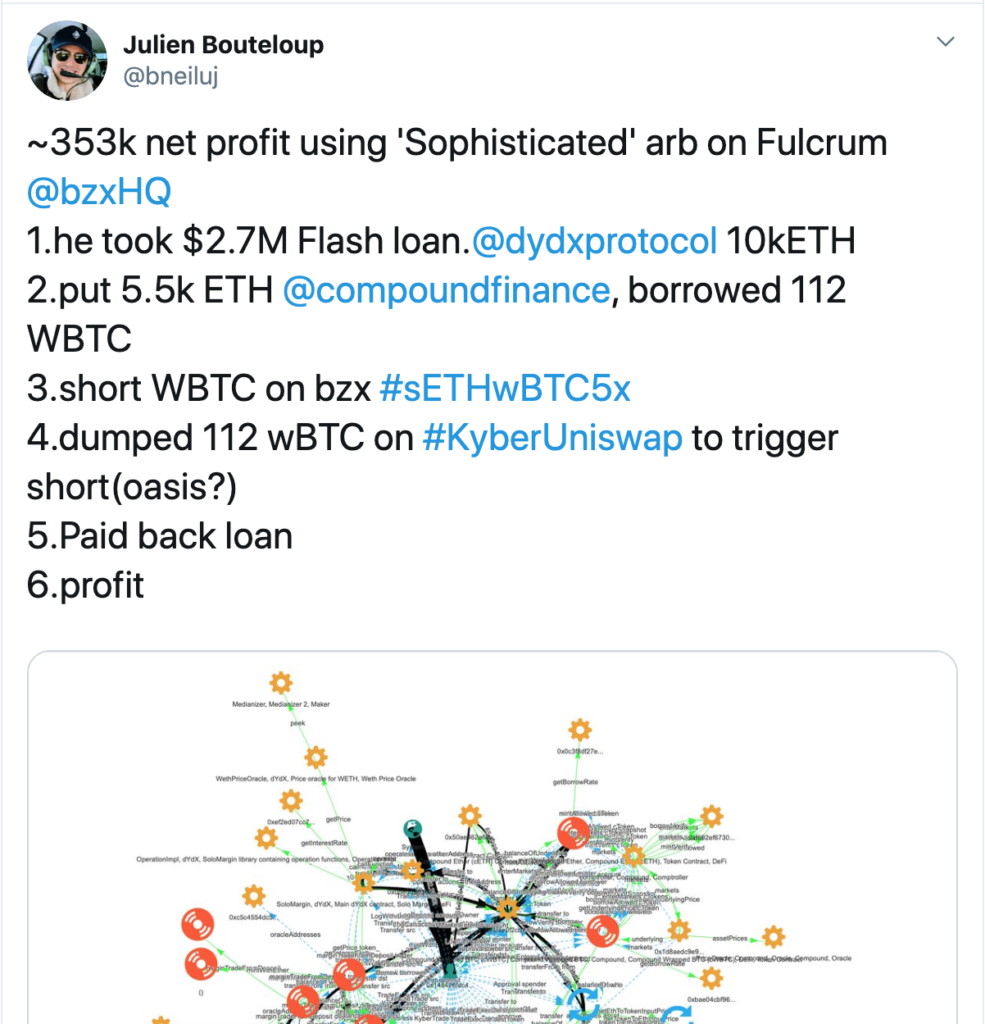

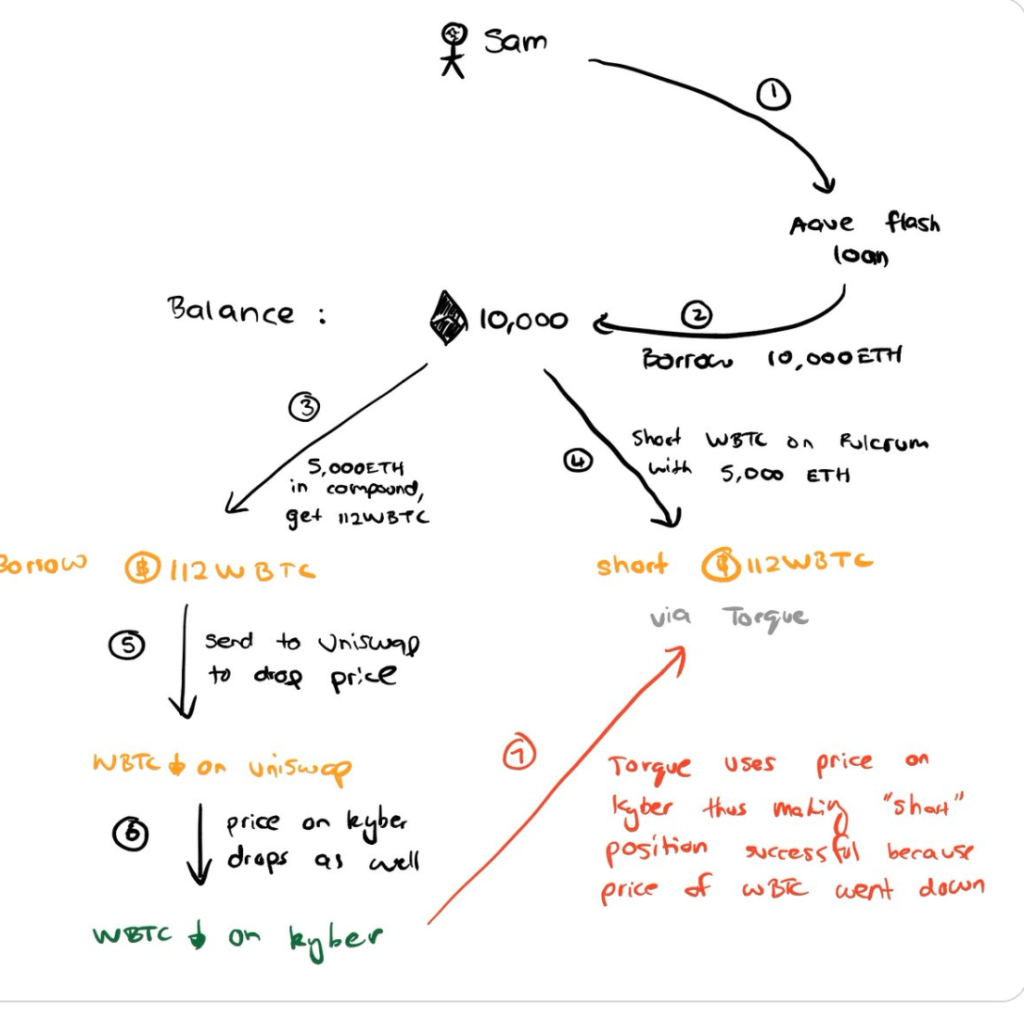

Below is an example of a flash loan which made $353k profits, all done in a single transaction. Some say that it was illegal market manipulation. It’s definitely a grey area. Here’s an in depth explanation of how the loan worked.

Here is a twitter post discussing the $350k profit, possibly illegal flash loan.

Here is another take on it.

Here is a 3rd analysis of the Flash Loan Arbitrage, with detailed profit analysis.

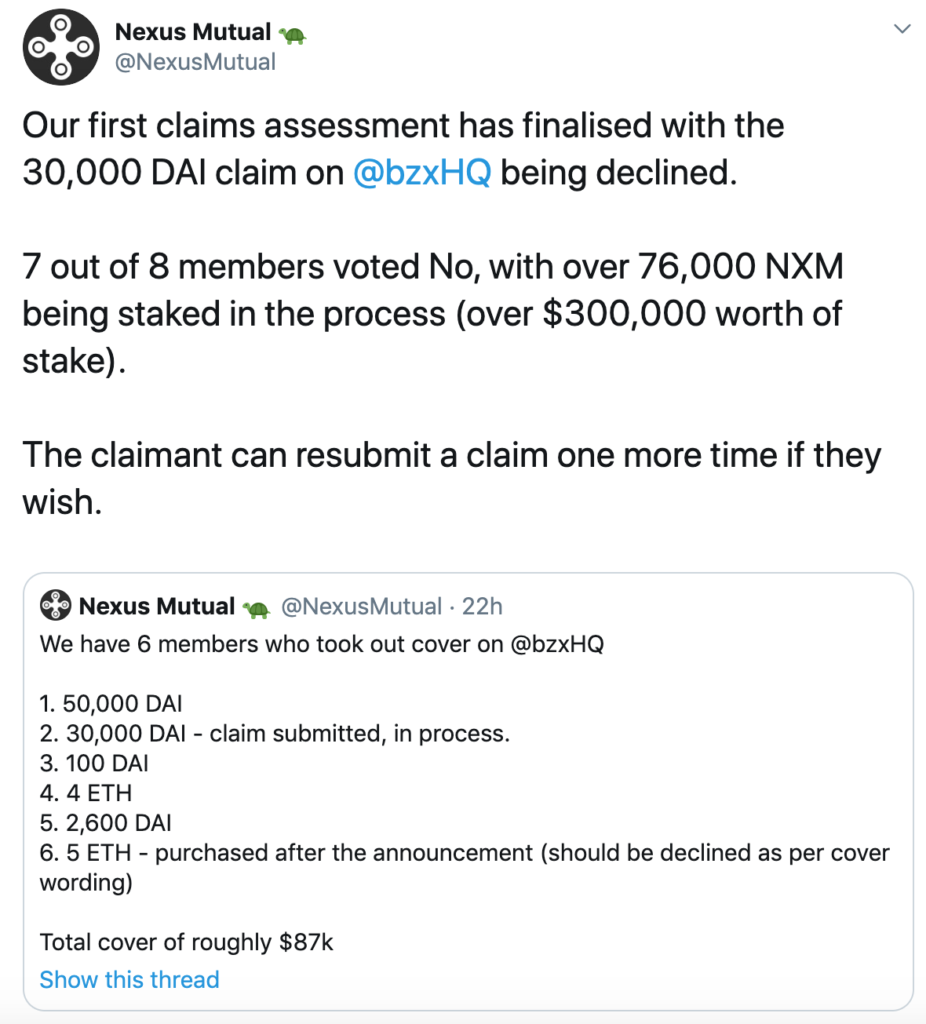

There was even an insurance claim submitted to Nexus Mutual against the trade, which some branded as a “flash attack”. Here is the result of the claim.

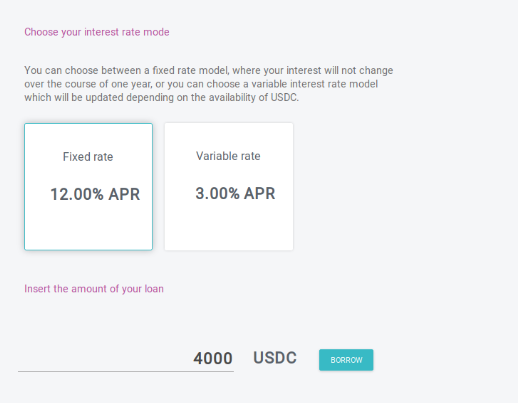

Does Aave use a fixed or variable Interest rate?

Aave uses a stable rate loan, which acts like a fixed rate loan in the short term, BUT it can be rebalanced if there are severe interest rate changes. The loan is provided without any duration or repayment schedule.

Stable rate loans give users the flexibility to switch between fixed and variable interest rates. They won’t be locked into a skyrocketing rate.

What is the LEND Token used For?

The LEND token is the utility token of the Aave network. It is used for governance and fee reduction. It provides zero-fee borrowing rates of the lend token, as well as a 50% fee reduction if LEND is the collateral. It provides liquidity on the network. It also entitles holders to airdrops.

Developers are currently considering additional use cases, to encourage users to hold the token. Here is a reddit thread which brainstorms additional uses for the LEND token.

What does aave use for its Price Oracle?

Aave uses the decentralized oracle called Chainlink for its price feeds. Some believe that a decentralized oracle solution like Chainlink makes it less vulnerable to attacks. The BZX exchange, who was the victim of the flash loan oracle attack, is considering a switch to chainlink, which may be more robust against oracle manipulation.

Community Governance

Aave was built with the intent to hand over decision making to its users through governance contracts. Governance will initially be maintained by its dev team. Currently, governance is managed by the DAOStack Framework. Soon the power will be migrated to its users via governance contracts. After this, LEND holders will vote on smart contract upgrades and configuration changes.

Security Auditing

Aave has had a review and security auditing by Trail of Bits, and Open Zepplin here. They will soon be announcing a bug bounty.

Conclusion

Aave has grown quickly with over 15 million locked by offering impressive products like interest accruing tokens, stable rate loans, community governance, and flash loans.

The aspect that i think needs improvement, is LEND’s token model. I think its utility can be improved and value propositions can be added for LEND token holders. Here is a reddit thread which gives ideas about how to improve the LEND token’s utility and governance.

Follow me for more defi content here —> @defipicks)