What is mStable?

mStable is a platform for users to mint a customizable stable-asset called mUSD. It can also perform no-slippage stablecoin swaps, and generate yield.

What is mUSD?

mUSD is a stable asset which offers high value stability, native yield, and protection from permanent capital loss. It is minted from a tokenized basket of base stable-coin assets. These base-assets can include: USDC, USDT, sUSD, TUSD, or DAI. Benefits of mUSD are: 1) a high native interest rate, 2) recollateralization mechanisms, 3) reduced centralization, 4) and community governance.

What is Meta ($MTA)?

Meta (MTA) is the second token in the mStable economy. It is used for user rewards, governance, and to help re-collateralize assets in-case of currency collapse of a stablecoin.

Important Links:

The 5 products: MINT, SAVE, EARn, SWAP, and REDEEM

How to MINT mUSD from Base Assets

The MINT feature allows users to create mUSD from base assets in a 1:1 ratio. Base assets can include: USDC, USDT, sUSD, TUSD, and DAI. Users earn MTA rewards for minting mUSD.

The image (below) shows how users can choose which stablecoins they want to mint, and the percentage they want allocated.

SAVE: How to generate Interest with mUSD

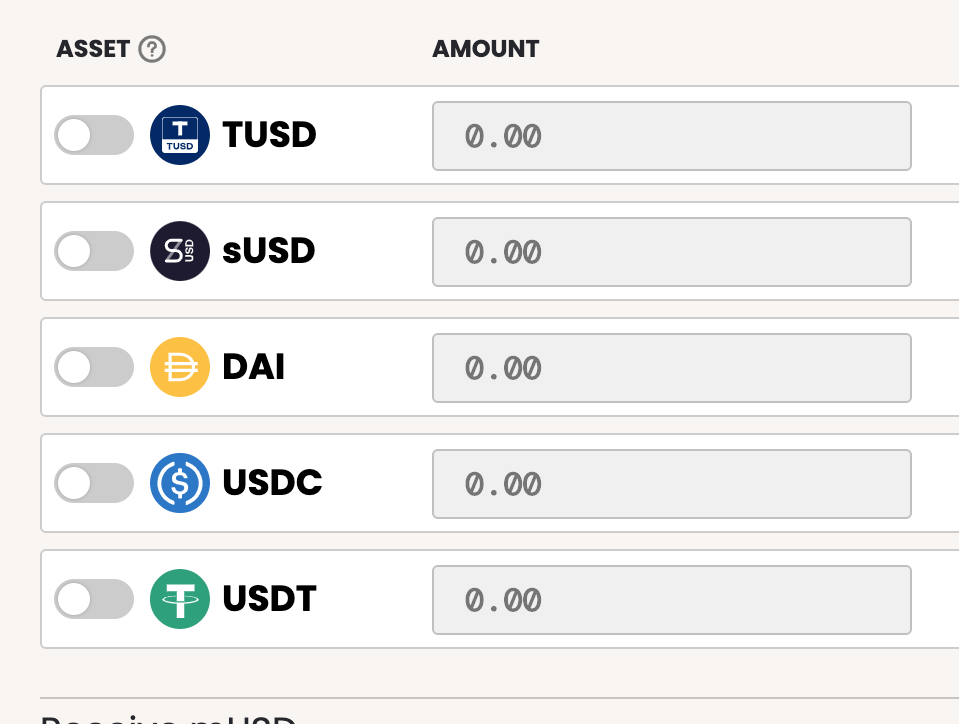

The SAVE feature lets users deposit mUSD, to earn a variable interest rate.

Interest is generated in 2 ways:

- mStable lends funds to protocols like Aave and Compound.

- mStable takes 0.06% fees on swaps.

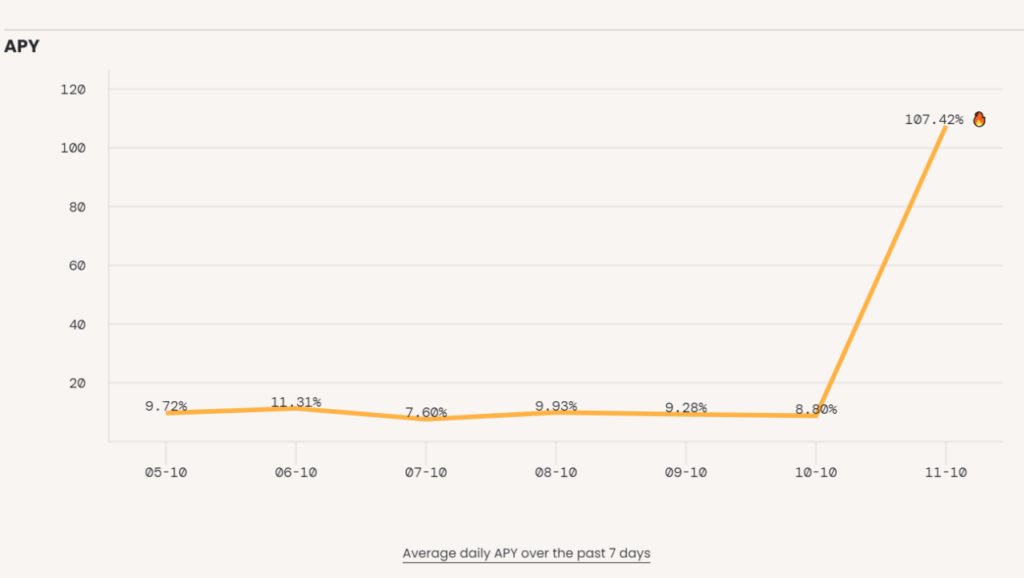

Swap fees generate significant APY when swap amounts are high. (Notice image below, where the APY rocketed to 107% on a day, due to high swap activity.)

EARN: Provide Liquidity to earn rewards

EARN is mStable’s liquidity mining program.

Users can stake pool tokens from Uniswap, Curve, or Balancer, to earn MTA (Meta) rewards.

SWAP your stablecoins

The SWAP feature lets users trade base stable assets. Assets can be traded with zero slippage, regardless of size! This creates arbitrage opportunities.

The video below shows you how to find arbitrage opportunities in defi.

REDEEM: untokenize a basket of coins

The REDEEM function swaps mUSD for individual base-assets. These assets can be redeemed in any ratio, as long as they don’t go over the “max weight”. This would expose the network to more risk. The fee for redeeming mStable assets, goes to the stakers of mUSD.

mStable’s Constant Sum AMM (automatic market maker)

$MTA TOKEN Utility

The MTA token serves three purposes.

- its a safeguard against collapse of base-assets

- it is used for governance on the platform

- it rewards users for providing liquidity, creating mAssets, and engaging in governance.

- How MTA protects against currency collapse

MTA is a safeguard, in case a stablecoin loses its peg. It can be minted and sold, to make up for losses in a currency collapse. MTA holders could be diluted if a currency collapses.

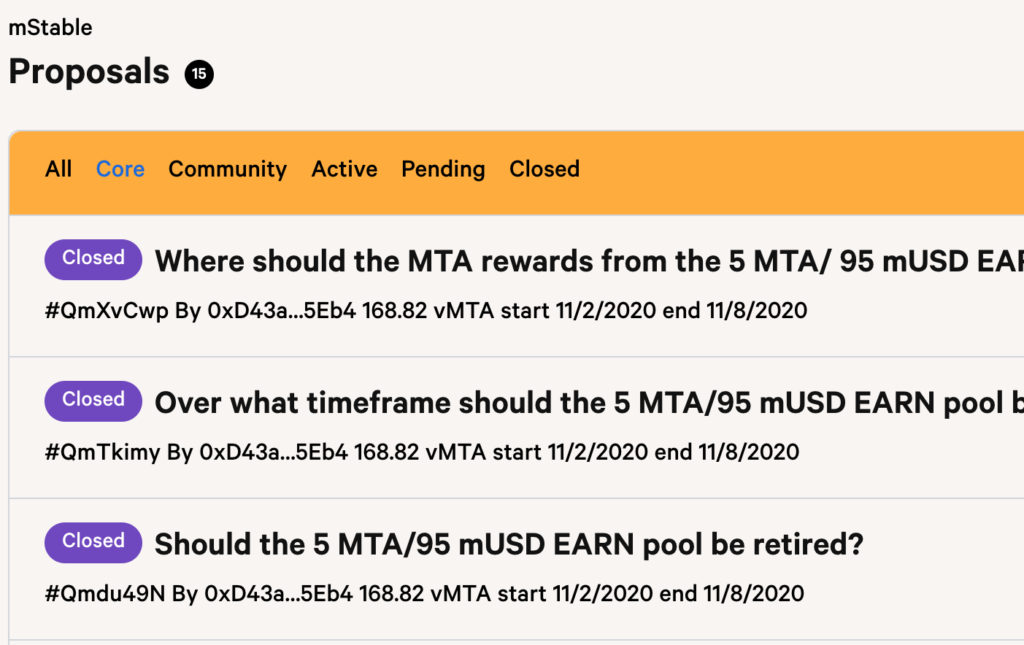

- MTA is a governance token

MTA incentivizes governance. MTA holders must stake, to vote and earn interest. Governance is currently centralized, in the hands of the core team. It will soon be transitioned to the community under a DAO.

Users vote on: adding and removing assets, adding/removing collateral assets, the max weight of collateral assets, redemption fees, oracles, and upgradability.

- MTA incentivizes liquidity

Liquidity is incentivized with MTA tokens. Users can stake LP tokens from Curve, Uniswap, or Balancer to earn rewards. This does come at the risk of impermanent loss.

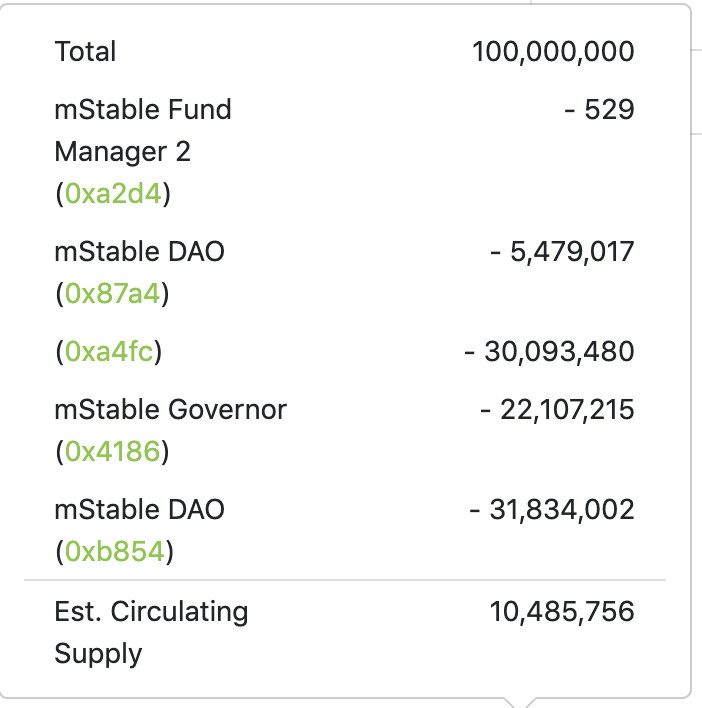

$MTA Tokenomics

MTA’s max supply is 100 million. It is used for rewards, governance, and to re-collateralize assets in-case of currency collapse.

Below is the token allocation of MTA:

My Conclusion on mUSD and mStable

I think mUSD is a superior stablecoin. It offers 5 significant advantages over individual stable assets.

The advantages of mUSD include:

- Reduced vulnerability of currency collapse.

- Less centralization.

- A mechanism to re-collateralize in case a currency fails.

- Above average yield.

- Governance.

mUSD is extemely safe, and beneficial for holders. But, mUSD stakers do take on some risk. Stakers can be liquidated, if a base currency, like USDT collapses. mUSD stakers are rewarded with yield, for assuming this risk.

The platform also offers arbitrage opportunities. It provides zero-slippage stablecoin swaps. Periods of high swap volume can boost interest rewards to mUSD stakers. Arbitrage has caused liquidity issues for certain assets. But…devs say this is being addressed in a future update.

I’ve also read that a tokenized BTC basket might be coming in the future. This is a product i’m interested in. It would be very nice if a tokenized BTC basket could earn the native interest rate as well! That will make for a superior form of tokenized BTC.

Better stability, re-collateralization, and high interest rates make the platform’s tokenized baskets, preferable to holding the individual assets. I hope mStable’s roster grows to offer more types of tokenized products. I would love to see a tokenized defi index that earns interest 😉

If you liked this article, please follow me @defipicks