DxDAO was constructed in May of 2019, by the Gnosis and DaoStack teams. Initially, it was built to manage, upgrade, and govern the DutchX decentralized exchange protocol. It has since morphed into a leaderless collective, with the goal of building/growing defi’s infrastructure. DxDAO aims to keep defi free of corruption by centralized powers. It also aims to put the ecosystem’s revenue in the hands of DXD token holders.

DXD is the DAO’s native token. Revenues from the ecosystem are the right of all DXD holders. Payment is distributed, via its token buyback program. Additional utility may be added to the DXD token, such as product suite rights, and discounts.

DxDAO is made up of capable members including developers from: Loopring, Gnosis, and Ethereum. The project is still in its infancy, but it could grow to play a major role in decentralized finance.

- Here is what Consensys has to say about DxDao.

- Here is DxDao’s FAQ.

- Here is the Governance Guidebook for DxDao stakeholders.

- Dxdao whitepaper

What is a DAO? How do users govern the DxDAO?

A DAO is a transparent organization, with automated management, that is coded directly into software. DAOs can coordinate groups, provide feedback, and give financial incentives to members that work on the project. It is a governance system that prevents malicious groups from swaying decisions.

DxDAO is built on the DaoStack framework. It is managed here. Users are paid for development and marketing work, via a system of proposals and voting. Proposals are filtered, via staking with Daostack’s GEN token. Staking prevents members from being bogged down by bad proposals.

DxDAO’s Voting, Staking, and Holographic Consensus

DxDAO employs a system of holographic consensus. This type of consensus addresses scaling issues, and allows the DAO to make decisions quickly.

Any DxDao member can create a proposal. Members then vote to approve/deny the proposals. Votes are amplified by a user’s Reputation (or REP). Members can earn REP by providing work to the DAO. They can also earn REP by creating and passing proposals. REP is given to a wallet address, and is non-transferable.

Staking acts as a filtering mechanism for proposals. Users can stake for or against a particular proposal, using GEN tokens. GEN is DaoStack’s native token. Staking allows proposals to pass or fail with a lower voting threshold. “GEN is used in a prediction layer that allows DAOs to scale their decision-making frequency without sacrificing representativity.”

Below you can see a proposal for DxDAO development work. The proposal system can be viewed here.

DxDao’s Growing Ecosystem of Dapps

DxDAO members are currently developing, building, and managing a growing suite of defi applications. Its eco-system includes: The DutchX Trading Protocol, Mix.eth, Omen.eth, Mesa.eth, DxSwap, and DxPay.

DxDao was recently gifted the layer 2 payment solution, Loopring Pay UI (below).

The DxDAO Dapp Suite

1) DutchX Trading Protocol

DutchX is a decentralized trading protocol. It conducts an auction in a more fair manner for all parties. DutchX is a permissionless, censorship-resistant protocol, to trade ERC-20 coins. Users can add any token pair.

2) OMEN prediction market

Omen is a decentralized prediction market, built on Gnosis conditional token contracts. Omen markets use liquidity pools, similar to Uniswap. Anyone can earn 4% fees on a prediction market, by providing liquidity to it. A liquidity pool allows more markets to be openly traded. This addresses a problem faced with other types of prediction markets, like Augur.

Omen markets are divided into binary (Yes or No), and categories (multiple choice). The more category outcomes, the more expensive the transaction is for liquidity providers in gas fees. This is a problem that the developers are working to solve.

Omen’s developer believes it could kill Augur’s marketshare. With Omen, any market has the chance to provide betting, which is one of Augur’s main problems. Omen almost always lets a user buy and sell outcomes, compared to Augur, which often has empty orders.

Here is a deep-dive into the Omen platform.

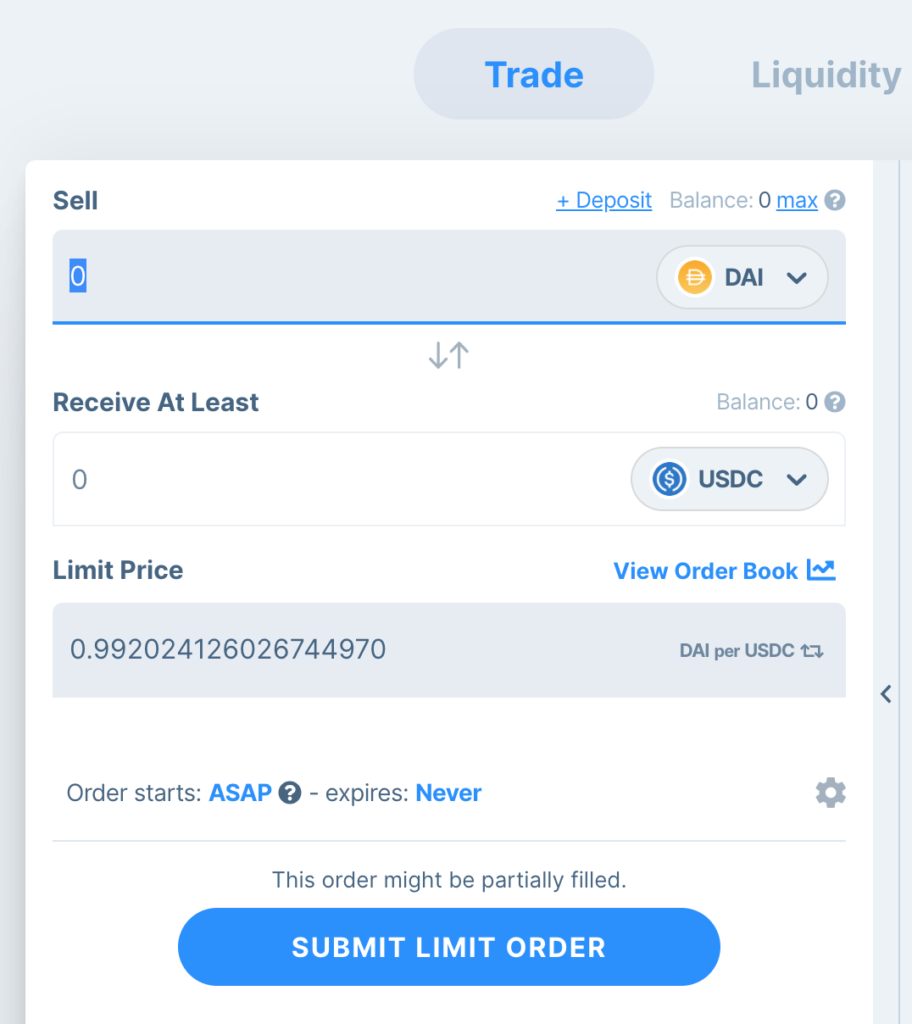

3) MESA

Mesa is an Open Source trading interface for the Gnosis Protocol.

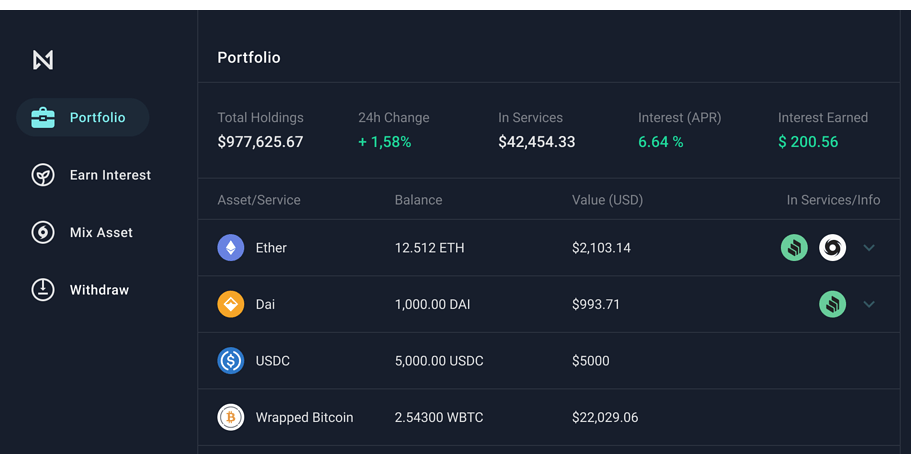

4) MIX

Mix is a portfolio tracker for Ethereum tokens, and defi services. It even allows users to anonymize tokens, with services like Tornado.cash. Users can earn interest, via services like Maker and Compound.

DxSwap

The team is working on a fork of Uniswap, called DxSwap. The difference is that the DAO will have control over the trading and provider fees.

LoopRing Pay UI

Loopring Pay is a working second layer scaling project, utilizing zk-rollups. It was recently gifted to the DxDao community. It is an excellent addition to the eco-system, bringing low gas fees, and faster TPS.

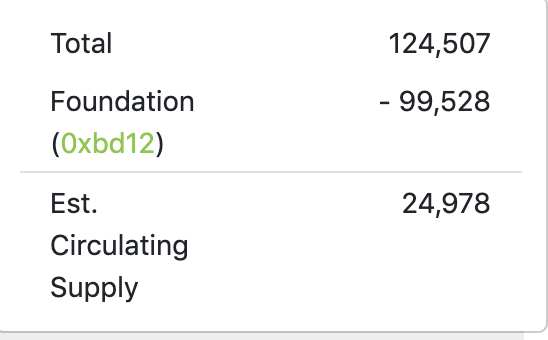

DXD Token Supply and Allocation

The DxD supply currently consists of 124,507 tokens. 100,000 tokens are held by the treasury. The 24,507 tokens, are minted from the issuance curve. “The amount issued is infinite, BUT the price goes up with each token (+1 ETH/DXD every 50k minted iirc), so eventually the tokens minted will be miniscule. “

DXD tokens represent a claim on revenue from the ecosystem. Revenue currently goes toward a buy-back program, supporting the bonding curve on DXTrust. There has been a discussion to revamp the DXD tokenomics. The addition of utility, distribution of revenues, and rights to use the product suite may change in the future.

DXD token ecosystem

5 tokens are utilized in the DxDAO economy. They include: DXD, REP, GEN, GNO, and OWL.

- DXD is a token which entitles holders to a percentage of the revenue of the ecosystem.

- REP is used to provide reputation and voting power on proposals.

- GEN is Daostack’s native token. It is used for boosting proposals and staking for or against them. (This filters out bad proposals.)

- GNO is a reward on proposals.

- OWL is a bounty reward token.

This vid explains what DxD is used for:

My Conclusion on DxDAO

DxDAO aims to keep the crypto economy decentralized, using DAO governance. Our current financial system is corrupted, by centralized powers. We need to carefully design our new system, in a way that isn’t susceptible to the same problems.

The DxDao project is in its infancy. BUT, it already has an active community, a suite of products, and revenue. I think its tokenomics and revenue distribution model could be improved. I think the community acknowledges this. It is a work in progress. The group seems to have good ethics, smart community members, and big goals. If they succeed in their mission, it will be a boon to the entire crypto community, and its token holders.

The DXD token supply of 100k, and diluted marketcap of 10 million is very LOW. Tokens are minted on an issuance curve, where the price goes up 1 ETH for every 50,000 tokens. Eventually the issuance will come to a halt, as the price becomes too high to mint. This gives it a high growth potential. I think this project may take a while to hit its strides, but could become essential infrastructure for the defi community.

If you liked this article follow me @defipicks