We need better decentralized stablecoins. USDC can be frozen. Dai could suffer from a price collapse of ETH. Tether is fractionally backed. Perfecting a synthetic stablecoin, is the key to making defi bullet-proof.

What is Dollar Protocol?

Dollar Protocol is an algorithmic stablecoin protocol. It’s based on a 2014 whitepaper, written by Robert Sams. It is very scalable, and will soon include many types of synthetic assets.

- The protocol separates value stability (USDx), and speculation (SHARE, xBOND) into three different coins.

Important Links:

- Whitepaper – by Robert Sams

- Dollar Protocol Docs

- Telegram

- Excellent article on seignorage and Dollar Protocol

- Article about algorithmic stablecoins

- Great video on Algorithmic Stablecoins

- Here is an ELI5 explaining the xBOND token.

What are Algorithmic Stablecoins?

Algorithmic stablecoins have a supply that can expand or contract. The supply changes, when the token price is off its peg. Incentives are given to create buying or selling pressure, to move the price up or down. This creates a resilient non-collateralized, stable asset.

Algo-stables like $ESD, $DSD, $DEBASE are getting alot of attention. I think the stabilization mechanics in these protocols will be widely adopted. Once they are perfected, they will become an important defi lego piece.

Dollar protocol’s first stablecoin is USDx. It will soon add assets, like the EUROx, YUANx, etc.

Dollar Protocol’s Three Token Economy

Dollar protocol consists of three tokens: USDx, SHARE, and xBOND.

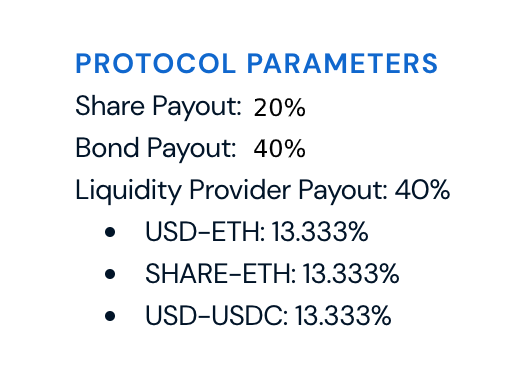

- $SHARE is a governance and rewards token. It earns 20% of the rebasing rewards on all stablecoins. $SHARE can be locked in the liquidity pool, to bump up rewards to 33%. It carries no risk of negative rebase. The supply is capped at 21 million.

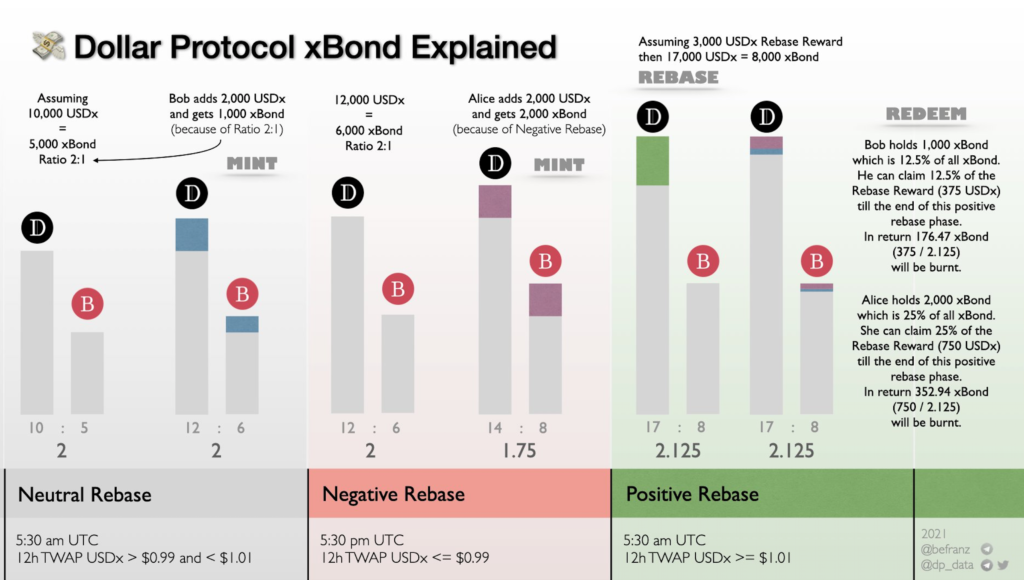

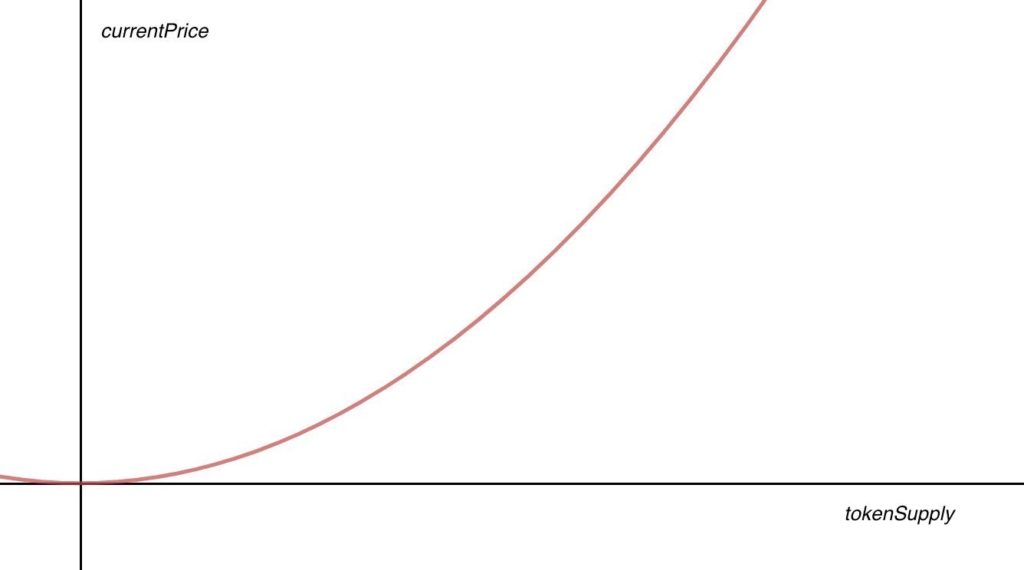

- xBOND receives 40% of rebase rewards. xUSD must be burned by the protocol to mint it. xBOND’s price goes up on a bonding curve when there is a positive rebase. Each time a negative rebase occurs, the bonding curve is reset 1:1 with xUSD. Users can move into xBOND if they feel there will be a series of positive rebases, after the negative rebase. xBOND allows holders to profit on the longterm growth of the protocol.

- USDx is a rebasing stablecoin, with a price target of 1 USD. Its supply fluctuates to maintain its price stability. It is one of many stable-assets that will be added to the protocol.

A deeper dive into xBOND. How it prevents negative rebasing.

If USDx is bonded, its supply doesn’t decrease during a negative rebase. Users can bond (burn) their USDx, to mint xBOND. Bonding it removes the USDx supply from circulation, and helps move the xBOND price upward.

xBOND is designed to reward users that believe in the long term growth of the protocol. If a user thinks a negative rebase will be followed by multiple positive rebases, they can move into xBOND to profit. The token will continue to gain value, if more positive rebases occur. xBOND’s price curve is reset 1:1 with USDx, whenever there is a negative rebase.

- The catch is that xBOND cannot be redeemed all at once. There is a limit to what you can redeem per positive rebase.

What happens when a positive rebase occurs?

Positive rebases inflate the USDx supply. The supply increase creates user rewards and selling pressure.

How is the Bonding Curve reset after a negative rebase?

When a negative rebase occurs, USDx is removed from circulation. Also, the price of xBOND is reset 1:1 with xUSD. This is an opportunity for users to flee into xBOND to protect their USDx, while making profits from gains on the bonding curve.

How are rewards distributed?

The protocol’s rebase rewards are split among 3 groups: Share token holders, Bond token holders, and Liquidity Providers in the following percentages.

The Seignorage and Share Mining Liquidity Pools

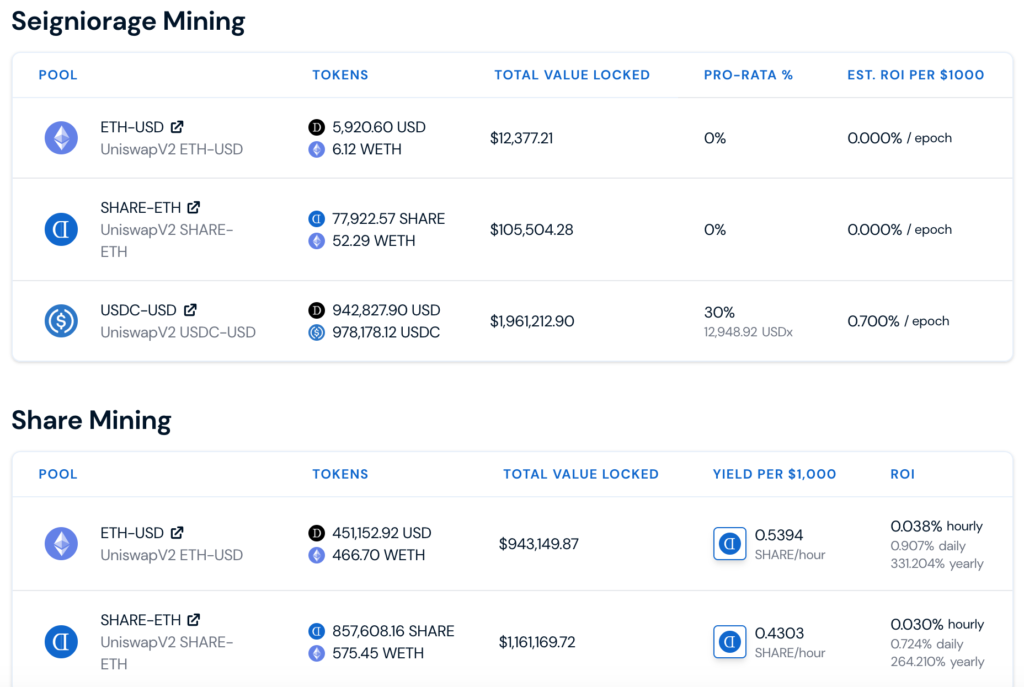

The protocol has two types of liquidity pools: The Seigniorage mining pool and the SHARE mining pool.

- Seigniorage mining allows you to earn stablecoin rebasing rewards on all stablecoins by providing liquidity. Rebase’s occur every 12 hours (at 12:30 EST am and pm).

- Share mining allows you to earn SHARE rewards by contributing to the liquidity pools.

In the future, their might be an xBOND mining pool.

Audits

Dollar Protocol is now being audited by market leaders Certik and Slowmist.

DAO Governance

Dollar Protocol’s DAO governance seems to be effective. It has passed multiple measures that benefit the project. The community recently voted to increase the rewards percentage on the $SHARE token. It also reduced the amount of votes needed to pass a resolution from 50% – 25%.

My Conclusion on the Dollar Protocol

Dollar protocol’s scalability, is its biggest strength. It could grow into a huge network of non-collateralized stablecoins. Each new coin will feed rebasing rewards to its token holders.

$SHARE holders will be the big winners, if this project scales. Rebasing rewards will scale, as the project grows.

Community participation is very strong. Governance is filled with devotees. Participants have fixed major flaws, like the reward split and voting threshold.

I think one of the main reasons Dollar Protocol isn’t more successful yet, is its complexity. It can be difficult to understand xBOND’s role, as well as seignorage coins in general. I hope that writing this article will trigger people to look at it more deeply. I hope they can see the potential that i see too.

If you liked this article, please follow me @defipicks