FRAX is a fifth generation algorithmic stablecoin. It is partially collateralized, and partially stabilized algorithmically. FRAX’s collateralization ratio (CR) increases or decreases, as supply and demand changes. The token can become more algorithmic, or more collateralized, as it seeks a stable value.

For example, if FRAX is over $1, it enters an expansion phase. In this phase, it becomes less collateralized. Less USDC is required to mint it. When the price is under $1, its collateralization rate increases. FRAX can even become fully collateralized, if demand is low! In this case, it would essentially be wrapped USDC.

- The algorithmic portion of FRAX is now 16 million. This value is very stable. FRAX’s algorithmic value is just as stable as the collateralized portion. Over time, the algorithmic portion will likely increase, as user trust increases.

Important Links:

Where will the collateralization ratio settle?

The developers don’t know where the collateral ratio will settle! It is fully determined by the market. It is possible that FRAX could become fully algorithmic. It is also possible, it could become entirely collateralized. Either way, FRAX will always be redeemable for $1.

FRAX’s two-token economy

The Frax.finance ecosystem consists of two tokens.

- FRAX is a fractionally-algorithmic stablecoin.

- Frax Shares Token (FXS) is a governance and incentives token.

Deeper into Frax Shares (FXS)

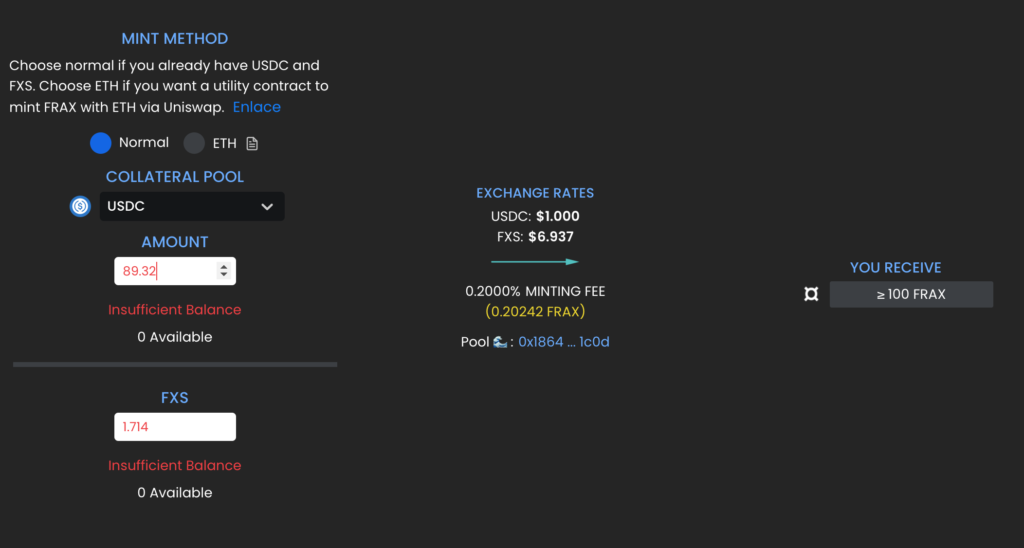

Frax Shares (FXS) is a volatile token. It is deflationary. It captures the seigniorage value that is created, when under-collateralized FRAX is minted. To mint FRAX (when under 100% CR), users must also supply FXS, which is burned during the minting process.

- For example, when a user mints 100 FRAX at an 89% CR, they would need 89 USDC and 1.7 FXS tokens. The 1.7 FXS is burned. The 1.7 FXS tokens captures the seigniorage value, by burning it and reducing the supply. (image below)

The FXS token captures value in four ways:

- It is burned when minting FRAX.

- It collects fees from the minting process.

- It collects fees from redemptions.

- It also collects fees from unused collateral.

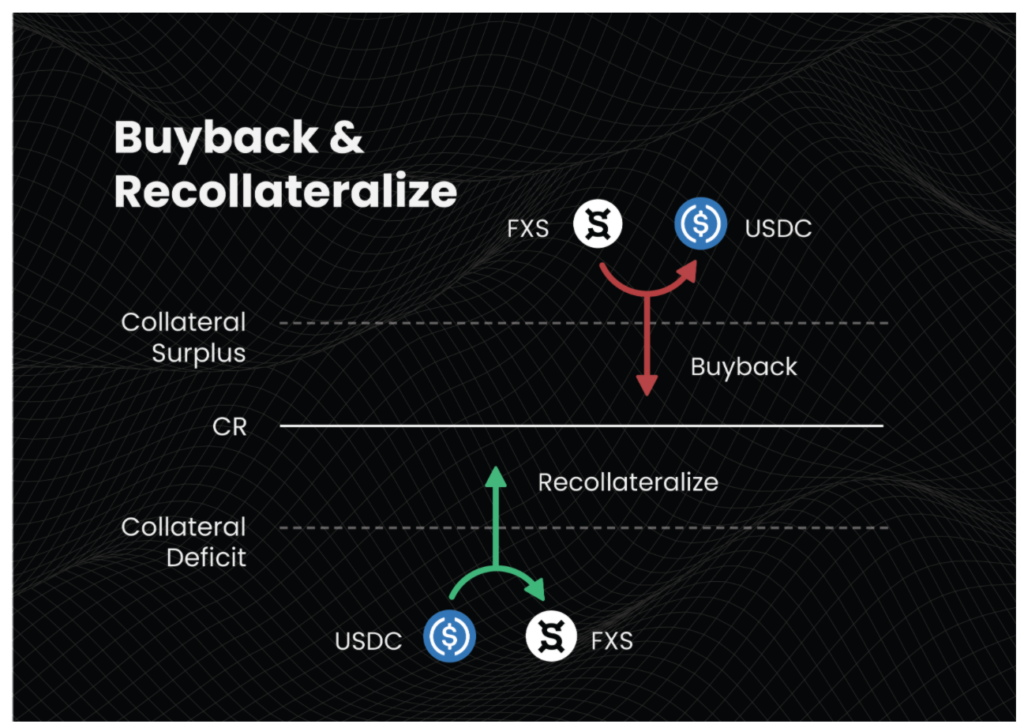

Recollateralization and Buybacks

Sometimes, FRAX needs more collateral. Sometimes, collateral needs to be reduced. In this case it, will undergo re-collateralization, or buybacks (more here).

- If FRAX is under $1, a user can deposit USDC to receive FXS, with a bonus of .75%. This helps to re-collateralize the protocol.

- When there is excess collateral, buybacks will happen. The FXS token will be bought and burned with extra funds.

New features for FRAX v2

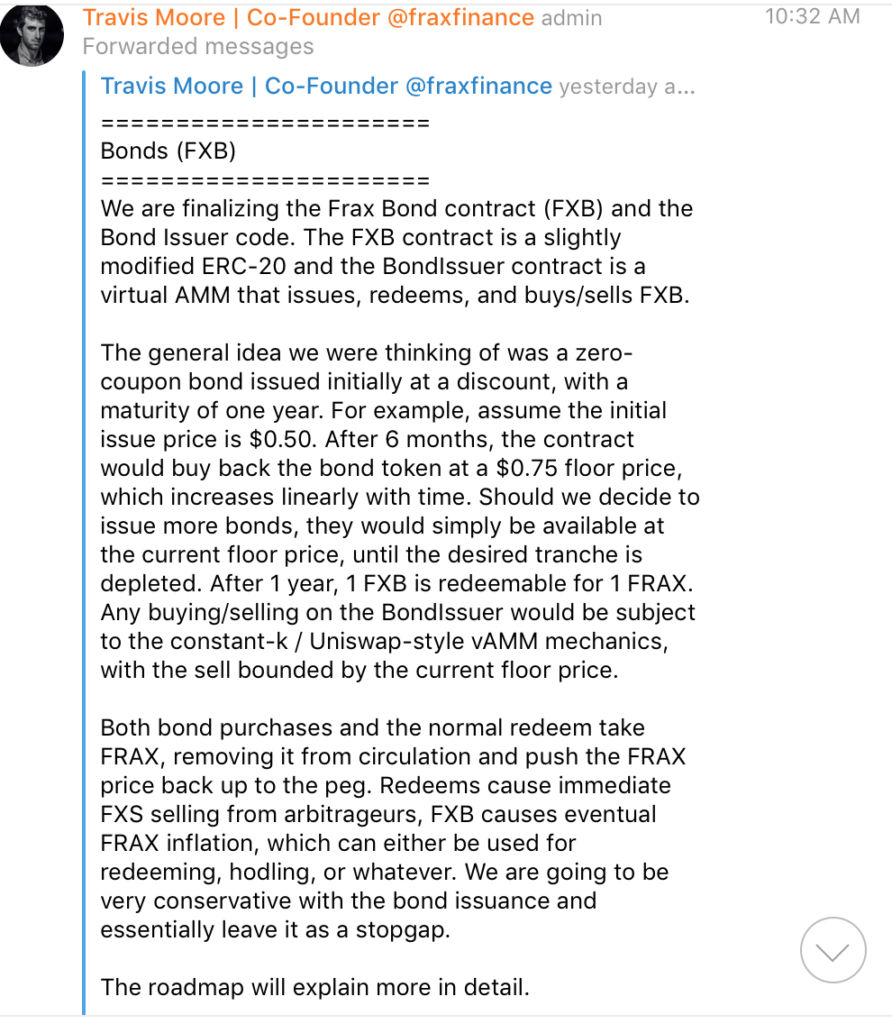

Improvements coming in v2 include: FRAX bonds, new collateral types, and a vAMM. Frax will soon be expanding to Binance Smart Chain.

FRAX Bonds

The community has voted to add FRAX bonds. These bonds will be tied to the collateral ratio.

Staking

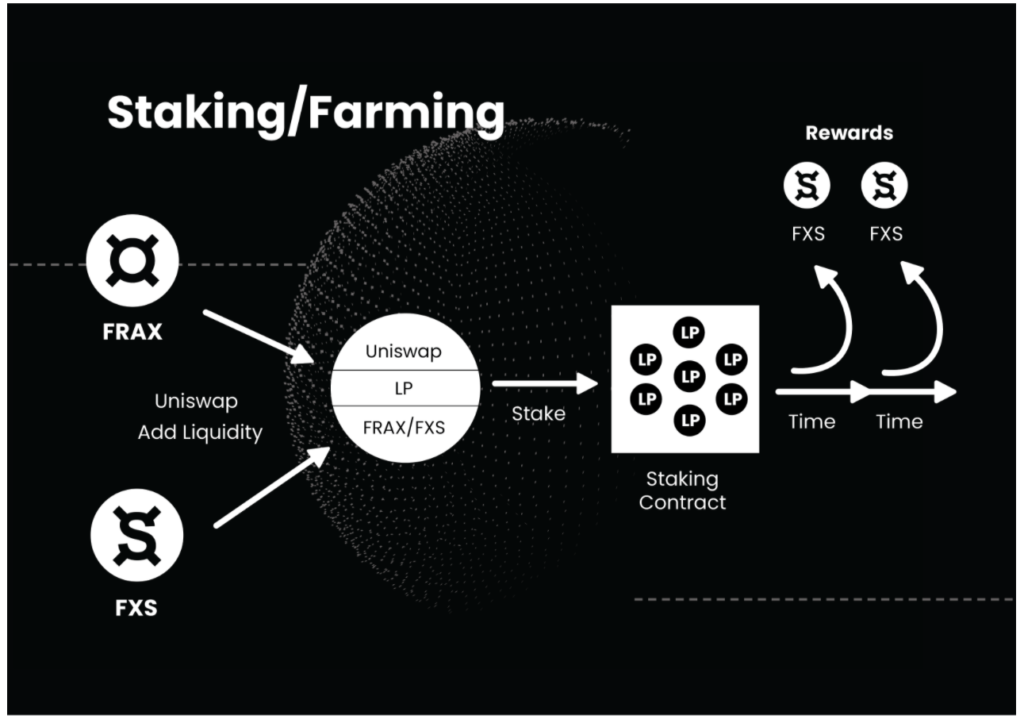

Users can stake in the liquidity pool, for FXS rewards. The more that FRAX becomes algorithmic, the more FXS will be emitted.

The staking rewards are high at a range of 35% – 100% on stablecoins. This is a very good reward for stables.

The problem with Algostables, like ESD and DSD

Unfortunately, most algorithmic stablecoins aren’t stable. They don’t do what they were designed to. They can get stuck under $1, when the price to buy bonds, doesn’t make sense. The mechanics of these coins aren’t effective.

I noticed another problem with algostables, when I was invested in DSD. It had an issue with whale manipulation. As price moved towards expansion, large DSD holders would dump on those seeking to move it into expansion. This stopped it from functioning as intended.

FRAX has very different mechanics, which hopefully will fix these issues. The adjustment of the collateralization ratio, has created stable value in a portion of the coin, without collateral backing. It maintains its peg, and doesn’t have a manipulation problem. The experiment seems to be working so far.

Conclusion on Frax Finance

I see enormous potential in algostables. But, they’re far from perfected. Coins like ESD, DSD, or Debase can’t maintain a stable value. They more or less function as a financial game. FRAX, on the other hand, maintains its $1 peg.

My biggest issue with FRAX, is that it uses USDC as collateral. USDC can be frozen, so this could present a problem if a large portion of the reserves was no longer backed. I think they should transition to a more decentralized stablecoin (or a basket of coins), which can’t be frozen.

As FRAX gains trust, I think it will become more algorithmic. Tether is not fully backed, but maintains a stable value. This shows me that user trust is a major factor in creating price stability for stablecoins.

FRAX v2 is also coming soon. It will be interesting to see if these bonds will further stabilize the price. The bonds will also add another method of profiting on this protocol.

I love to see innovation. FRAX is pushing algostable tech forward and creating a first of its kind product. The team seems competent, and intelligent. I’m looking forward to testing the features implemented in v2. We’ll see if the experiment succeeds, but so far it is looking very positive.

If you liked this article, please follow me @defipicks