Defi Money Market allows physical goods to be turned into interest generating assets. Users of the DMM platform can tap into the equity of cars, real estate, or planes, to earn a stable interest rate of 6.25%.

DMM is a two token economy. mTokens provide a stable 6.25% rate on ETH, DAI, or USDC deposits. DMG is a governance token, which entitles holders to about 5.5% of the earnings from ALL the assets on the ENTIRE platform! DMG holders can vote to receive the 5.5% income on mAssets, use it to grow the platform, or to purchase more income producing assets.

The DMG governance token is available for purchase here. (DMG was recently backed by investor Tim Draper.)

So, How does the DMM platform work?

DMM users start by depositing ETH, DAI, or USDC into the platform here. They receive interest generating mTokens (mETH, mDAI, mUSDC) in return. mTokens pay a stable interest rate of 6.25% APY. The mTokens represent a stake in $8.5 million dollars worth of income producing car liens (or other liens on real estate, airplanes, etc.). When the mTokens are returned, a user’s funds are paid back, along with any interest that is accrued. Cars are just the tip of the iceberg. Tokenizing assets like real estate, homes, and boats will suck trillions into defi. This is why I think a defi project will be the next 100x coin.

Tokenizing Trilllions in Real World Assets

The more i learn about the DMM protocol, the more I am excited about defi as a whole. Physical value is now being pulled directly into the digital world! 100s of asset types, in addition to cars, can and will be tokenized.

Transitioning to the DAO, the DMG Governance Token

The first stages of DMM, will launch under authority of the DMM Foundation. Later, it will transition to the DAO. The foundation includes members like Mathew Finestone, whom I respect highly, due to his work on Loopring. Once control is transitioned to the DAO, voting rights will be given to holders of the DMG governance token. Excess revenue of around 5.5% is generated by the system. This extra revenue will be paid to DMG token holders, used to buy more assets, or used to grow the protocol.

“The DMM DAO is unique in that it is one of the few DAOs that is already producing revenue and has a straightforward revenue model that grows as mAssets grow.“

How the DMG Token Generates 5.5% interest on ALL mAssets

DMM is a two token eco-system. mTokens pay a stable 6.25% interest rate, while DMG gives governance rights and a claim to excess revenue. So, how does DMM produce extra revenue?

The income producing liens generate 8% – 12% APR on assets, while mTokens pay 6.25% interest, SO there are excess funds. 5.5% APY is being earned from the mAssets right now, and is the right of DMG token holders.

DMG holders can even earn a 5% origination fee by introducing new assets into the DMME. This will grow revenues for all DMG holders.

Do I Consider Defi Money Market to be Decentralized?

Decentralization exists on a wide spectrum. Uniswap is at one extreme end. DMM is more on the centralized end, because it is dealing with the legacy financial system. It will work its way to the middle, when it implements its DAO. Some trust is needed, but will be lessened with on-chain transparency, regular audits, and DAO governance.

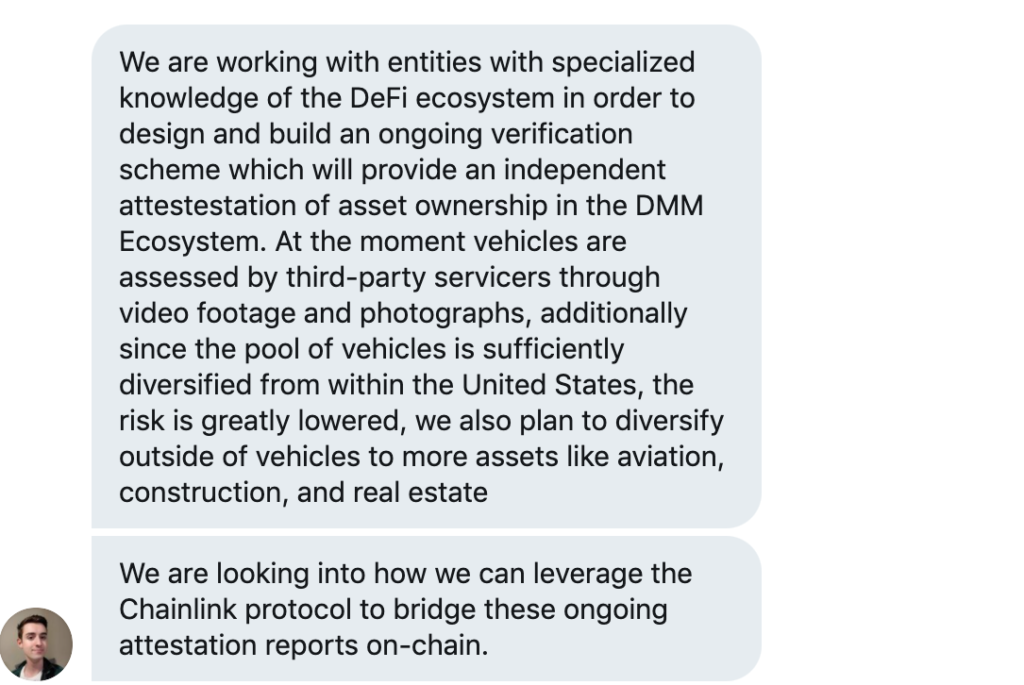

DMM’s car ownership data is currently on-chain. It can be viewed on the explorer here. We can see the ownership records now, but, I had concerns about the car appraisals. I think the cars values need to be verified by an independent auditor, in a scheduled manner. Users should to be able to verify that the car is worth as much as we are told it is.

Zachary addresses my concerns about the verification system below:

DMM’s goal is to create an automated system, which demonstrates ownership, accurate value appraisal, and verifies it all on-chain. I think adding automatic quarterly audit, would help as well.

Another issue I see, is the treasury management. It isn’t yet transparent. It is currently under the control of the DMM foundation, but isn’t yet on-chain. I assume it will be on-chain, when the DAO is implemented.

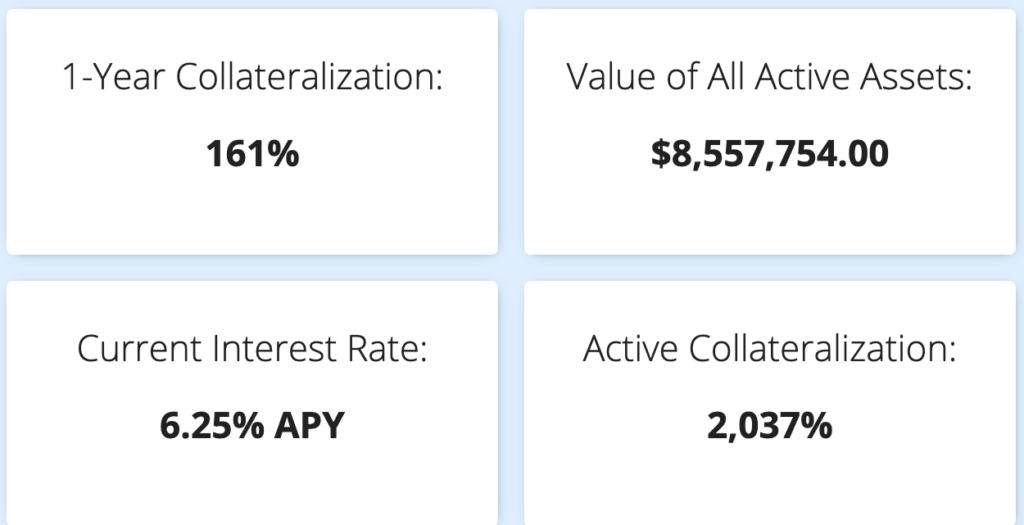

How to View Collateralization Levels on DMM

The DMM project is over-collateralized. This means the value in equity, is greater than the amount of mTokens paid out by the platform.

Currently, it is collateralized at 2037%. View collateralization levels on the explorer here.

Conclusion on DefiMoneyMarket

I believe that the tokenization of physical assets will provide huge growth for defi and the entire crypto eco-system. This influx of capital will power the success of many defi protocols.

Since the project is dealing with the legacy financial system, it is very difficult to make it fully decentralized. Trust can be brought to the project by providing transparency and data on-chain. One way that i feel the system could be abused, is by falsely valuating the cars. But, this can be addressed with independent audits to reassure users that the cars are actually as valuable as they are purported to be.

Overall, i really like this project. The governance and revenue provided by the DMG token, encourages holders to bring in new assets and further grow the system. I feel like DMM could reach a very high valuation, as there is alot of equity in physical assets that can be incorporated into the protocol. Tokenizing physical assets will lead to explosive growth in the entire defi and crypto markets.

If you liked this article, please follow me @defipicks

Other Useful links: