Stablecoins are cryptocurrencies which are designed to reduce price volatility. They can be pegged to real-world assets like: fiat currencies, baskets of fiat currencies, precious metals, or collections of assets with a stable value.

There are about 40 stablecoins in circulation, with a marketcap of around 5.7 billion. Another 50 stablecoin projects are either in development, or under review. 89 of these projects can be seen in the google doc file here.

4 “KEY” traits that i look for in a Stablecoin

The 2 types of stablecoins that i prefer include: crypto-collateralized (on-chain) and algorithmically stabilized coins. I like stablecoins that have 4 key traits including: censorship resistance, decentralization, no KYC, and are completely permissionless to use. I want as little risk to my funds as possible!

Most fiat-backed stablecoin issuers retain the ability to freeze a user’s funds. They say that it is to remain compliant with regulations, or in case of a hack. Although the intentions sound good, this has the opportunity to be used maliciously. Thats why my favorite is DAI! DAI operates through a decentralized DAO. It can never be frozen, because its immutable code prevents it!

Another reason that i like Dai, is because it is the centerpiece of a new defi ecosystem. This system is exploding with development!

<—The image (left) shows a cool Dai lending integration with Compound.Finance in the Argent wallet. You can start earning 7.75% interest with the Dai Saving Rate (DSR) easily from your wallet.

Developers have also created various flavors of Dai with unique attributes, including Chai and Cherry Dai. These variations of DAI are “wrapped” in protocols that can generate interest and fees via lending protocols, liquidity pools, and interest rate swaps.

Below, I’ve placed ALL stablecoins into 4 main-categories:

- NOT backed with assets:

- Non-Collateralized Stablecoins

- Directly backed with tangible assets:

- Crypto-Collateralized

- Commodity Collateralized

- Fiat backed

Crypto-Collateralized (On-Chain) Stablecoins

DAI – Dai is a ERC-20 stablecoin. It is pegged to USD. Users can mint DAI by creating a collateralized debt position (CDP) on Maker’s Oasis platform.

I like Dai because it’s decentralized, permissionless, and can never be frozen due to its immutable code. It has been able to maintain its stability throughout its short history, even though the price of Ethereum has been very volatile. The stability fee used to maintain its stable value is variable, and will fluctuate due to supply and demand in the market. Currently, the Dai Savings Rate (DSR) is 7.75%.

At the moment, DAI is the second highest marketcap stablecoin at about 97 million dollars. (as of Jan. 2020)

Reserve – The Reserve token is a new stablecoin, with a 2 token model. This project will start in a centralized manner with a goal of implementing 3 phases toward decentralization. It will be stabilized with a diverse portfolio of crypto collateral, and other asset classes.

It uses a two token model, with the Reserve Token (RSV) and the Reserve Rights Token (RSR). RSV is pegged to the US Dollar, while the Reserve Rights Token will fluctuate. RSR “plays a role in stabilizing RSV and confers the cryptographic right to purchase excess Reserve tokens.”

Bitshares – The Bitshares ecosystem uses a stablecoin called a Smartcoin.

SmartCoins are pegged to the value of another asset, such as the USD or precious metals like gold. A SmartCoin’s value is backed by the BitShares core currency, BTS. It is possible to convert smartcoins back to BTS at any time.

Their website states that “in all but the most extreme market conditions, SmartCoins are guaranteed to be worth at least their face value (and perhaps more, in some circumstances)”. Like any other cryptocurrency, SmartCoins are fungible, divisible, and free from any restrictions.

non- collateralized Stablecoins

Non-collateralized stablecoins, like Ampleforth and Carbon, are decentralized, and have no counterparty risk. They share similar stabilization strategies, but the mechanics of how they reduce their volatility are different.

Elastic Supply Stablecoins

Stablecoins with an “elastic supply” use smart contracts to automatically increase or decrease the supply using algorithms.

AmpleForth – This stablecoin reduces its price volatility by increasing and decreasing its supply.

It uses an “algorithmically enforced elastic supply policy, which allows it to adapt to economic shocks”, just like fiat currencies can. The supply changes are automatic and will never lead to inflation.

CarbonUSD (CUSD)- The Carbon protocol uses an algorithmic expansion/contraction of its supply via the issuance of additional tokens. Carbon started as a fiat-backed coin, transitioned to a hybrid model, but will soon be fully stabilized algorithmically.

The Carbon economy operates with a two token system including: CUSD, which is stable, and the Carbon Credit token, which has a variable price. Carbon Credits are issued for CUSD, when CUSD moves above its fixed price. This helps to reduce the value, when it moves above its peg.

Carbon also allows the trading of Carbon Shares to help in its contraction of the money supply.

COMMODITY-COLLATERALIZED STABLECOINS

Digix Gold (DGX) – DGX is a ERC-20 stablecoin that is backed by gold reserves. 1 DGX token is backed by 1 gram of physical gold. The gold reserves are audited every 3 months to ensure that the proper amount of reserves are in place.

Holders can even redeem DGX tokens for the physical gold, but they have to go the the vault in Singapore to do so.

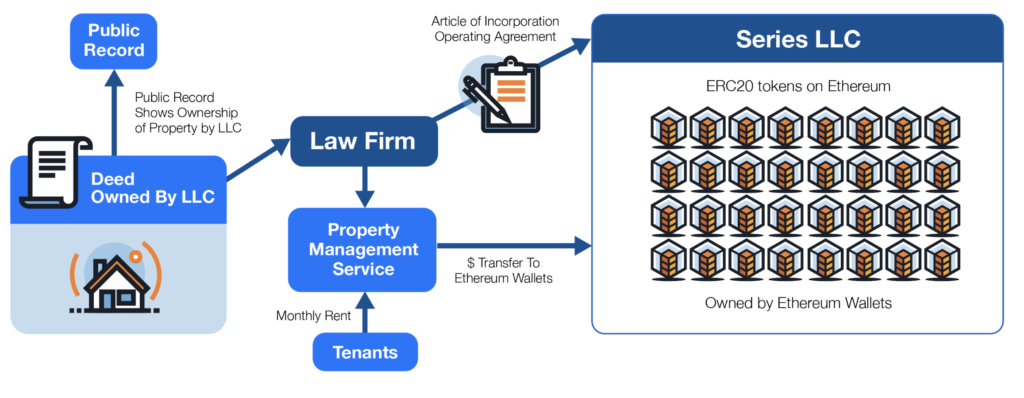

RealT (RET-[Property Address]) – RealT issues an ERC-20 token that represents a fractional ownership in rental property. While this might not typically be thought of as a stablecoin, its value would tend to be much less volatile than most coins in the crypto market.

A user must pass KYC in order to purchase a token. The value of the token will correspond to the value of the property address under which the coin was issued. Rental earnings will also be distributed, on a fractional basis to owners based on a user’s share of ownership.

3 US DOLLAR Backed Stablecoins

USDC – USDC is an ERC-20 stablecoin launched in 2018. It was created by the Center Consortium, which includes Coinbase and Circle. USDC is backed by a fiat currency reserve, which is independently audited to ensure that currencies actually back the coin.

Each USDC issuer maintains its own cash reserves to back up each USDC coin. Circle oversees third parties that issue USDC.

TUSD – TrueUSD is another fiat-backed ERC-20 stablecoin, issued by the company called Trust Token. True USD is backed by $1 U.S. held in an escrow account by a third party.

One benefit of TrueUSD is that it offers a 1 click redemption feature. This allows users to redeem TUSD for fiat with a single click. Trust token also offers TCAD, TAUD, TGPB, and THKD.

Gemini Dollar (GUSD) – GUSD is an ERC-20 stablecoin backed by USD. It was created by Cameron and Tyler Winklevoss. All backing funds are held at State Street Bank and Trust Company.

Gemini dollars are minted when fiat is deposited onto the Gemini platform, and GUSD is withdrawn. GUSD is destroyed when it is deposited and converted into USD.

- The negatives these fiat-back coins, is that they are centralized, can possibly be frozen, and rely on oversight of U.S. regulators.

Controversial Stablecoins – Are they fully backed or fractionally backed?

Tether – Tether has the largest marketcap of ANY stablecoin with over 4.5 billion. It is surrounded by controvery, due to the fact that users are unsure wether or not it is fully backed with USD.

Tether’s own lawyers have admitted that only 74% of Tether reserves are actually backed by fiat currency.

USDT requires KYC and AML in order to exchange to fiat currency.

Conclusion: what have i learned about stablecoins?

I think the stablecoin market will continue to grow in size and scope over 2020. I’m most interested in developments in algorithmically stabilized coins like Ampleforth, and variations built on the CDP backed model like DAI. I hope devs will continue to innovate, and build coins that improve the rate of returns for their holders (like Cherry Dai). Customers have lost faith in their banks and bankers have grown fat and happy. They likely have a rude awakening coming when users flock to defi for higher interest and innovation with their money!