Melon is an open-source protocol for on-chain crypto asset management. It gives individuals the ability to setup and manage an investment fund completely on the Ethereum blockchain, without any intermediaries. This makes fund creation cheap and simple, taking the power away from large institutional investment bankers, and putting it into the hands of anyone with a small amount of capital and the knowledge to do so. The Melon protocol lowers the barrier of entry for fund managers, as well as investors. Co-creator Mona El Isa refers to the Melon protocol as asset management 3.0.

Fund managers can use the Melon protocol to create an investment fund, which is defined by a set of rules or parameters, that are enforced by smart contracts. These rules can include: the fund’s risk profile, number of open positions, tradable assets, and investors which can contribute to the fund. Smart contracts ensure that a fund manager cannot deviate from their initial strategy and vision for the fund, as they are programmed directly into the contracts.

How did Melonport design a self-sustaining system?

Melonport created a company with the end-goal of shutting it down once the protocol was deployed to the mainnet. You can see evidence of this by checking out their current website. As soon as the protocol was deployed, developers began the process of handing it over to the community of token holders and the governance council. So, what attributes did developers design into the protocol to make it self-sustainable?

The Melonport developers goal was to create a decentralized autonomous network that can sustain itself without its creators. The devs hoped to accomplish this by maximizing its network effects, giving economic incentives to token holders for maintenance and improvement of the network, and providing a solution for its governance and maintenance.

Maximizing Network Effects

To maximize network effects, the MLN token was built with an inflation model that allows it to fund further development on the network. This lets projects who want to build applications on the protocol to make funding requests directly to the governance council, so they don’t have to run an ICO. If the governance council agrees, they can get funding through the melon inflation pool. The council can even approve the merger of tokens between two different projects and burn their existing ones.

Economic Incentives to Ensure Desirability of MLN

The Melon Council believed it was important to build in proper economic incentives to ensure desirability of the MLN token. To help facilitate use of the MLN token, users are required to pay asset management gas, in addition to Etheruem gas for certain transactions on the network. To create less friction and inconvenience for the user, asset management gas is paid in Eth. The Eth is then sent to the Melon Engine, which buys MLN through a decentralized exchange, then burns it. This decreases the MLN supply, and helps to align the token price along with network usage.

The Governance and Maintenance of the Protocol

The goal for governance after the transition is to improve the integrity and security of the network, maximize user adoption, and increase innovation on the network. The developers created a user centric and skill-based governance model. They wanted user voices to be heard, as well as supported by technically focused people who could implement their needs. This is done through the Melon Council. The council is composed of two sub-groups, which includes the Melon Technical Council (MTC) and the Melon Exposed Business Representatives (MEB). The MTC is composed of technically skilled people that have contributed to financial protocols or users who have contributed to the Melon protocol codebase. The MEB is a sub-group which is composed of users of the network that have a certain amount of assets under management of the protocol, or have used a certain amount of MLN gas. Council members will be compensated in MLN tokens from the inflation pool as an incentive. The responsibilities of the Melon Council will include: protocol upgrades, resource allocation, and network parameters.

The 2 Melon Protocol Layers

The Melon protocol consists two layers made up of components that interact to build the protocol. The two layers include the fund layer, and the infrastructure layer.

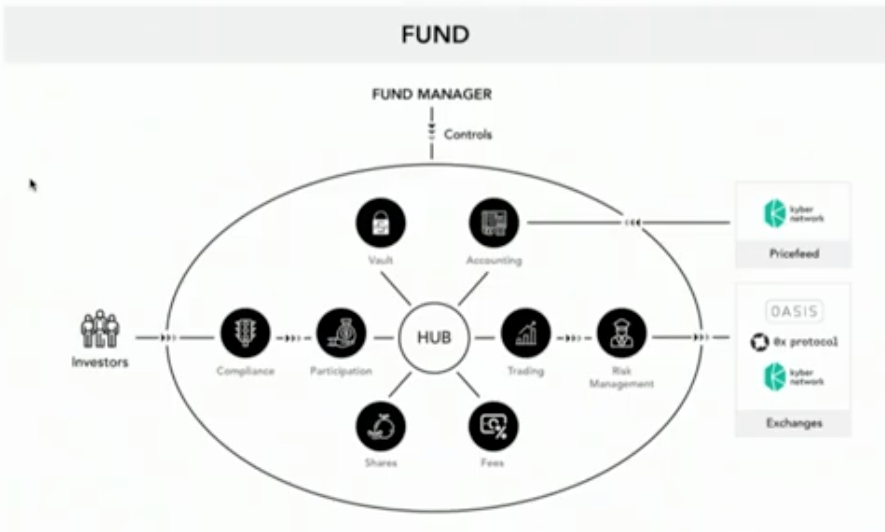

Layer 1 – The Fund

Each layer is composed of components which are connected like spokes from the Hub. The hub tracks each component and manages the permissions.

Layer 1: Components

The 8 components in the fund layer include: the vault, shares, participation component, accounting, fees, trading component, policies, and compliance. Below is a brief description of each of the components that build up the fund layer.

Vault – The vault is the component which stores tokens on behalf of the fund. The tokens are stored in a separate contract from all the other components in order to reduce the risk of attacks, and increase safety of funds.

Shares – Shares are a unit of account for fund ownership. The share component creates non-tradeable share units, which can be created and destroyed. Shares can be redeemed for assets at any time.

Participation – This module is where investors can enter and exit a fund. Managers pick which assets (like Eth or MLN) the investors can use to purchase shares from the fund. They can also redeem shares for the assets.

Accounting – This module provides the share price for the fund as well as tracks the amount of assets in the fund. Accounting errors are not possible because it is all done completely on-chain. This takes away the risk of loss associated with bookkeeping errors.

Fees – The fee component tracks how fees are awarded to the manager of the fund. All fees are paid in shares. There are two types of fees that a manager can be rewarded with: management fees and performance fees. There is also a fee manager component which tracks the fees. More fees can be added later if needed.

Trading – The fund manager can choose which DEXs they want to use with the trading component. The Dexs which are available at the moment include: Kyber, Omni Dex, 0x, and Melon Engine. The component then interacts with the exchanges from a unified interface within the Melon Protocol.

Policies – this component ensures that managers do what is in the interest of the investors and cannot alter their investment strategy, or embezzle money. One type of policy, for example, is risk management. Another ensures that a manager can only manage a certain number of assets at the same time.The policies are set when the fund is created and cannot be changed.

Compliance – Compliance controls who can participate in the purchasing of shares. Certain users can be whitelisted or black listed. This controls who is allowed to invest in the fund.

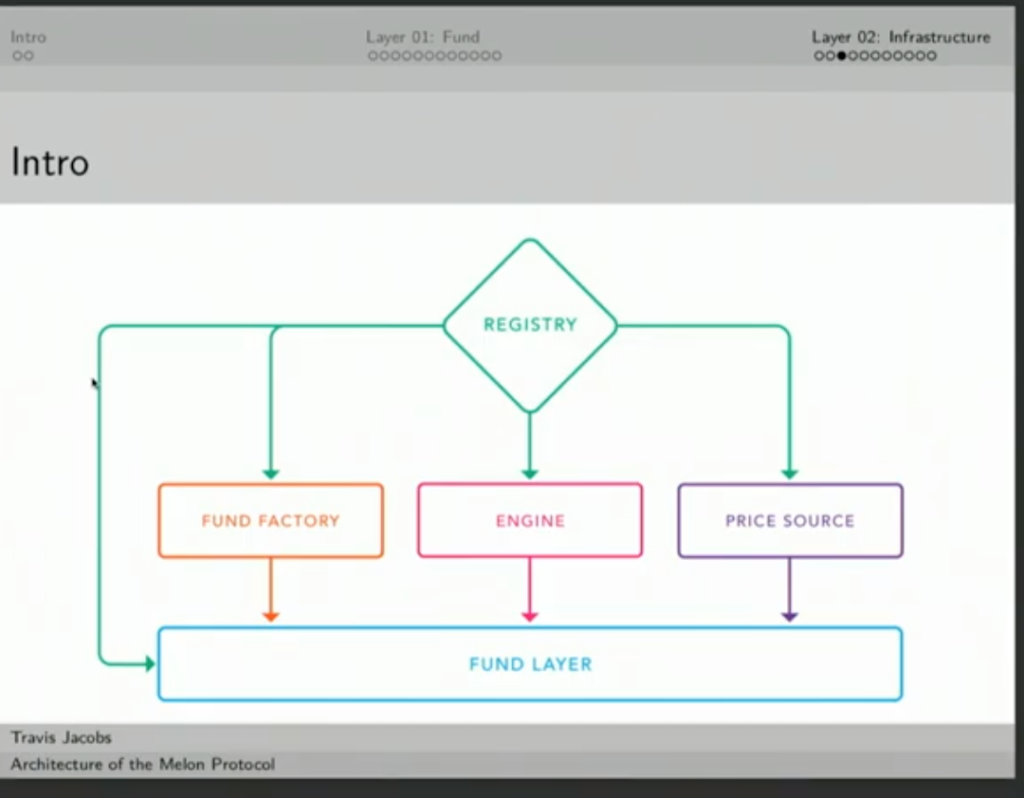

Layer 2 – Infrastructure Layer

Layer 2 contains the infrastructure layer contracts which are deployed by the Melon Council to make improvements. They are deployed once for each version, every time the council wants to do a protocol upgrade. Below are the components that build the infrastructure layer.

Fund Factory – this is used to create funds. It takes the pieces of the other components and assembles a fund to provide to the fund manager.

Exchange Adapters – each exchange has an adapter, which adapts component calls to different exchanges.

Registry – This contract tracks all infrastructure contracts and all the assets that are possible to use on the melon system. It provides an information hub for the entire protocol.

Engine – The engine collects ETH as funds to pay for certain transactions. Takes MLN out of circulation when it is purchased for ETH. The engine is always trying to buy MLN at a premium compared to market price. It uses a source like Kyber to get its prices.

Price Source – This is the source which informs the melon engine of the MLN price, so it can be purchased at a premium price through a DEX. Pricing information is used in the accounting, fees, trading for the policies, and the engine. Pricing data is on-chain, in order to have accurate accounting.

The Melon Monitoring Tool

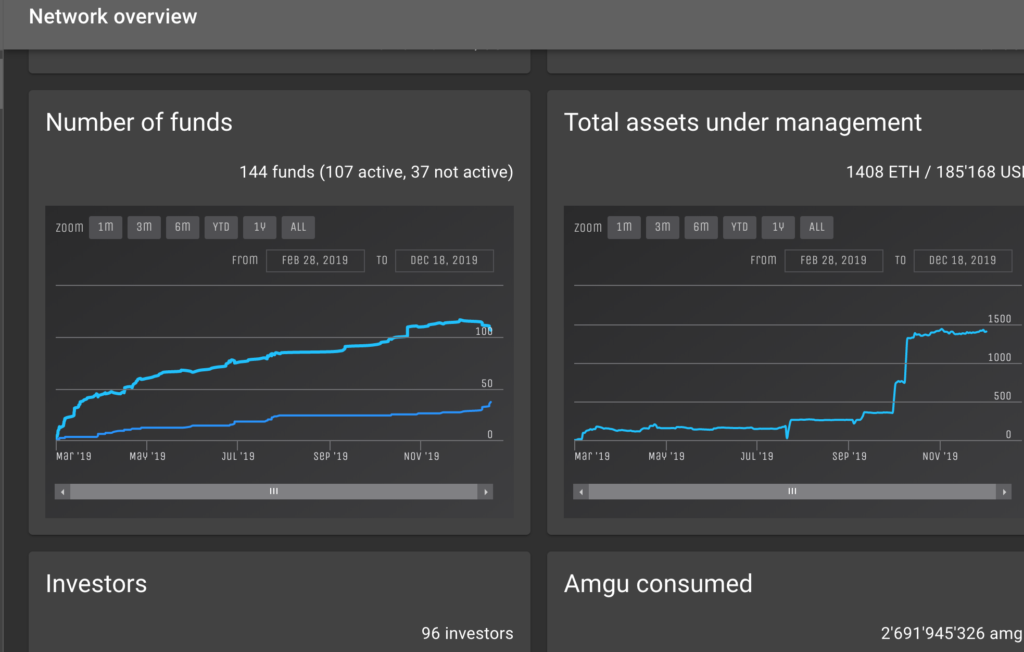

The Melon protocol has shown steady growth since its March 2019 inception. All protocol statistics are tracked on the blockchain and can be visualized using the monitoring tool. It has 144 active funds, and 1408 ETH under management.

The monitoring tool lets users sort by the best performing funds. All data and information about each fund is recorded on the blockchain including the annual volatility, number of trades, and all assets which are managed within the fund. This will help investors find the best fund managers, which can all be backed by hard data and statistics which are directly recorded on the blockchain.

Where The Melon Protocol Succeeds, and Where it Needs Work

My impression of the Melon protocol is that it excels in a variety of areas including: transparency, usability, cost cutting, security, and accessibility. But, it lacks in access to assets outside of crypto. At the present moment, it allows fund managers to invest in 11 crypto assets. It could benefit from the addition of assets which are pegged to the prices of stocks, indicies, commodities, precious metals (other than gold), and currencies. This would open up a world of options for fund managers, but I think this currently isn’t an option, due to the fact that these assets aren’t trading on the DEXs which it uses to purchase its assets, but this may change in the near future.

Melon is successful at removing many large expenses of investment funds like accounting, regulation, office space, and administrative. These expenses restrict fund creation to all but the largest investment banks.

Melon also succeeds in transparency, due to the fact that all transactions are recorded on the blockchain. This gives investors peace of mind, knowing that funds can be tracked in a way never before possible.

I think that once the UI is tweaked a bit, more assets are added, and a few dapps are developed to increase functionality, the protocol could change how investment funds are viewed and accessed. They will not just be seen as a tool for the super rich, but as a way the average everyday investor can grow their wealth.