Nexus Mutual is a blockchain based peer-to-peer insurance alternative. Its first product, Smart Contract Cover, covers financial losses due to smart contract failure. The company covers claims by spreading the risk of loss to a collective of its token holders. The capital pool, which goes to pay the claims made on the system, comes from a shared pool of its members funds. Its members also perform a variety of tasks needed to run the system in a decentralized manner.

Members are financially rewarded with tokens in exchange for validating claims by voting, assessing the risk of smart contracts, and voting for trusted underwriters. Nexus Mutual is working towards total decentralization, but still has some elements of centralization. These centralized elements include its capital model, claims assessment, and underwriting. The company is run as a decentralized autonomous organization (DAO), where its users can vote on proposals, upgrades, and even make changes to the system.

The company hopes to attract a group of independent smart contract auditors to search for bugs, or holes in the insured smart contracts. These auditors can stake their own funds, to win a percentage of the premium. If no claim is made, users get back their full stake, as well as additional tokens. The more funds that are staked against the smart contract go towards lowering the premium of the insured contract.

Why is Smart Contract Insurance Needed?

Over 500 million dollars worth of assets is already locked into potentially buggy smart contracts. A smart contract hack in 2016 on the Virtual Venture Capital Fund called the DAO project, led to the loss of over 150 million dollars worth of funds. All funds were lost to the hack and were NOT insured. Smart contract insurance could have recouped the loss of the funds for the claimants in this instance.

Dapps which Could Benefit from Smart Contract Insurance

Instadapp is a defi enabled wallet that allows users to borrow and lend funds backed by crypto-collateral.

It currently holds over 30 million dollars in funds, but has yet to recieve a smart contract audit to ensure their code is safe. This is potentially a risk to user funds.

Edgeware currently has over 200 million dollars worth of funds locked into its smart contracts. There was an audit done by Quantstamp and bugs were found in the code. This could have allowed hackers to steal funds. No funds were lost, and the bugs were fixed, but there was a significant risk to large amounts of funds for a period of time.

How to price the risk of smart contract failure?

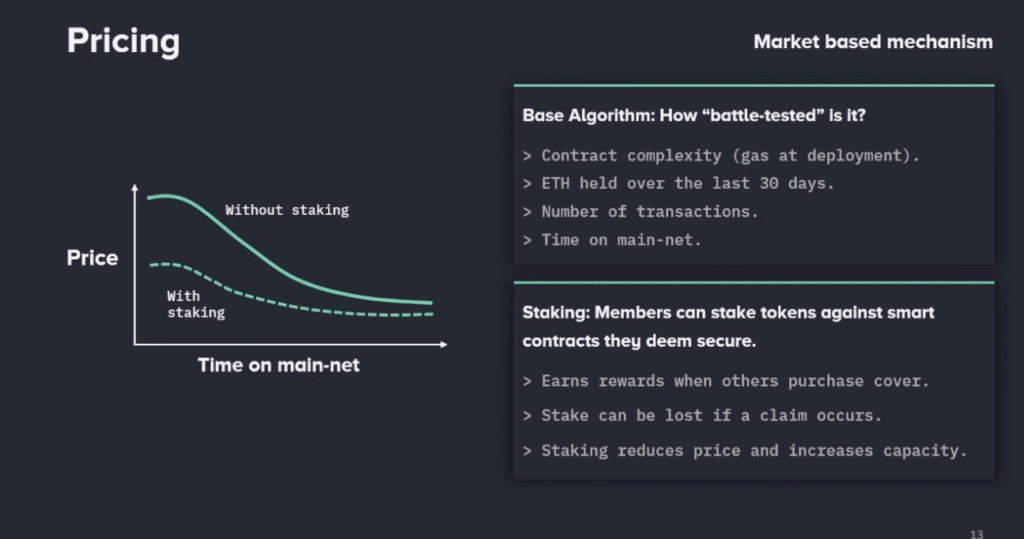

Nexus Mutual has created a market based mechanism for the pricing of smart contract insurance.

The premium is calculated based on a variety of factors which include the time without a loss of funds on mainnet. The price starts out very high for new, untested projects, then comes down as it has uptime, without being hacked.

Other factors that are considered when pricing the premium include the complexity of the smart contract, the number of transactions, and the amount of ETH held over the last 30 days.

Bonding Curve Model of NXM Token Pricing

The price of smart contract insurance is driven by the amount of funds required to pay claims, versus the amount of funds being held. A bonding curve is used so tokens can be purchased at a price that will rise based on the amount of funds locked. The price of the tokens will start low and rise as the fund gains momentum and more capital is put into the fund. This means that the more funds kept in the Mutual, the higher the price of the NXM token will be to purchase.

What can Blockchain do for the Insurance Industry?

Over 30% of fund spent by companies go to pay expenses, other than to pay claims made by policy holders. Blockchain tech could be used in the insurance industry, to cut out around 17% of these costs. This saved percentage would translate into billions of dollars.