Uniswap is a decentralized exchange which allows users to swap into any Erc20 token, or ETH. Users can also contribute to liquidity pools to earn a percentage of the trading fees. When a user contributes tokens or ETH to a liquidity pool, they will receive a proportional percentage of the 0.3% swap fees. Transactions are executed via smart contract always allowing users to retain full control of their money.

(follow me on Twitter here —> @defipicks)

Uniswap is ranked #43 on stateofthedapps. It has 250+ active daily users and 948 daily ETH volume. It also has 452 developer events in the last 30 days.

How much can you earn by contributing to Liquidity Pools?

Users will receive a percentage of the 0.3% swap fees, in exchange for contributing to the liquidity of the Uniswap protocol. The amount a user will earn is proportional to the amount that they contribute to the pool. For example, if you contribute 10% of the total Eth in the pool, you will receive 10% of the 0.3% fee. This is true for any token that you contribute.

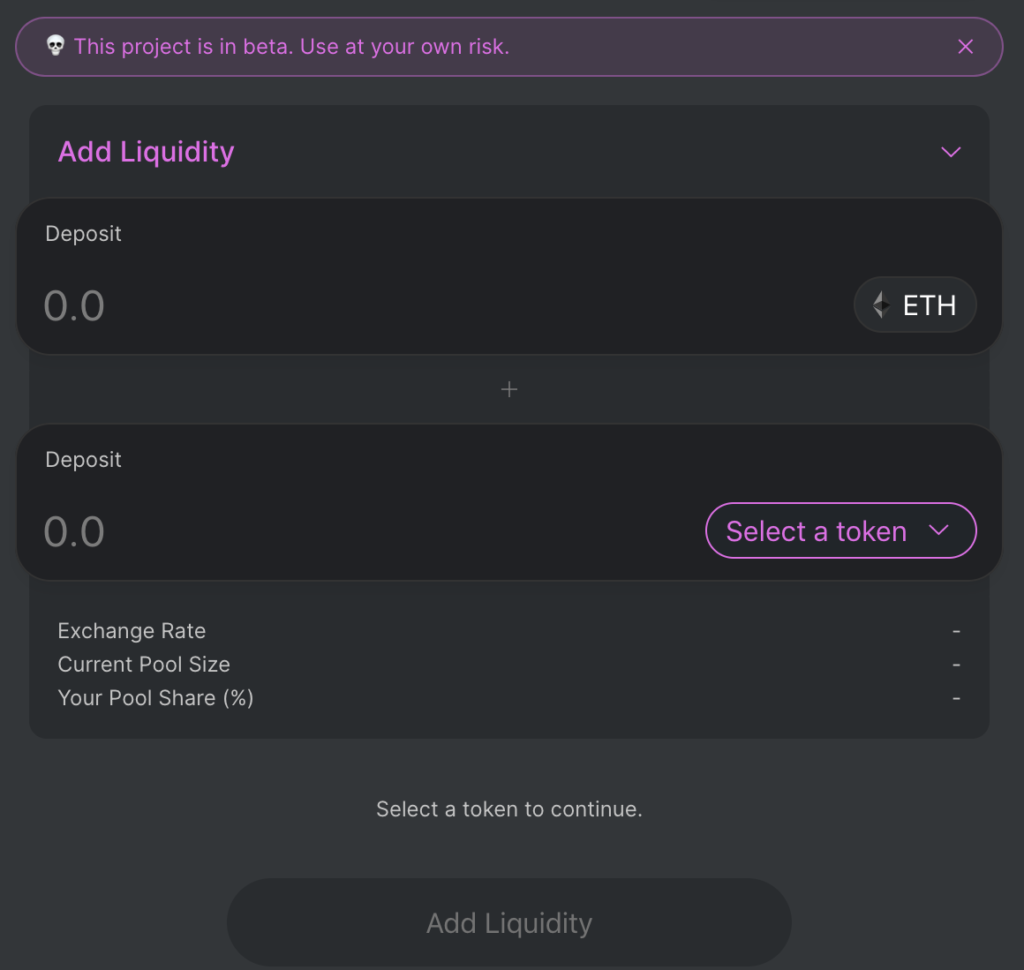

When you contribute to a pool, you will see your pool share (below).

The pool share is the percentage of the 0.3% transaction fee that you will recieve. The percentages can get pretty small if many users are contributing to the same pool.

How much can you make with Uniswap? check out the video below for an ROI calculator

Any user can create a liquidity pool to exchange any type of erc20 coin that they wish. When you contribute your tokens, you will receive a Uniswap token in exchange for the specific pool that you have contributed. The value of the Uniswap token changes as the fees are accrued. This can then be traded for ETH.

When a user withdrawals money that they have contributed to the pool, they will receive the fees that they have earned. You can withdrawal your funds by clicking the “remove liquidity” button.

For more defi content follow me here —>@defipicks