Defi creates new opportunities to earn passive income from interest and fees, but might come with certain drawbacks like wildly fluctuating rates, as well as some security risks. There are over 10 new defi protocols including Compound, Maker, DYDX, Nexo, Celcius, and Fulcrum that allow users to earn up to 14.0% interest in exchange for placing their cryptocurrency in a smart contract, where it can be lent out. The interest rates of these protocols will in most cases be variable (but in some cases can be fixed), depending on the provider. Defi allows holders to earn revenue, even in a bear market.

Which Defi Protocol Pays the Highest Interest Rate?

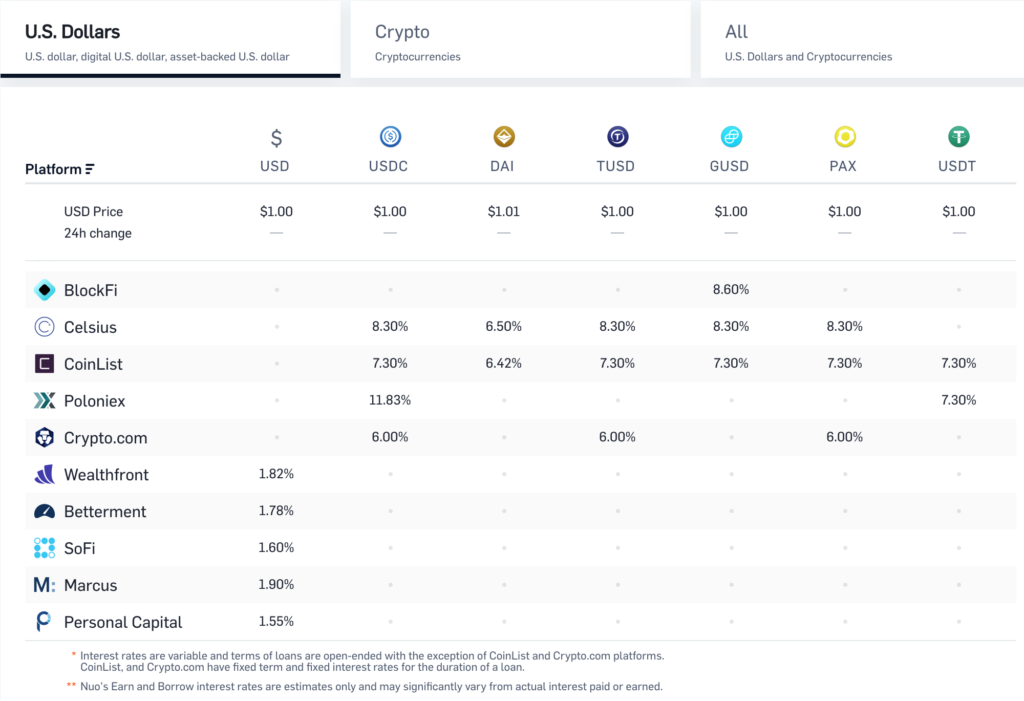

Decentralized lenders will pay different rates depending on the type of crypto you lend out, whether or not it is a stablecoin, the amount of crypto you place in the smart contract, and the defi lender that you use.

The interest rate for most defi lenders is NOT fixed in most cases, so expect it to change!

If you want to check out the current interest rates for each lender, as well as rates for the different types of currencies, you can find the rates at Loanscan.io

What is a Stablecoin? How does it generate interest?

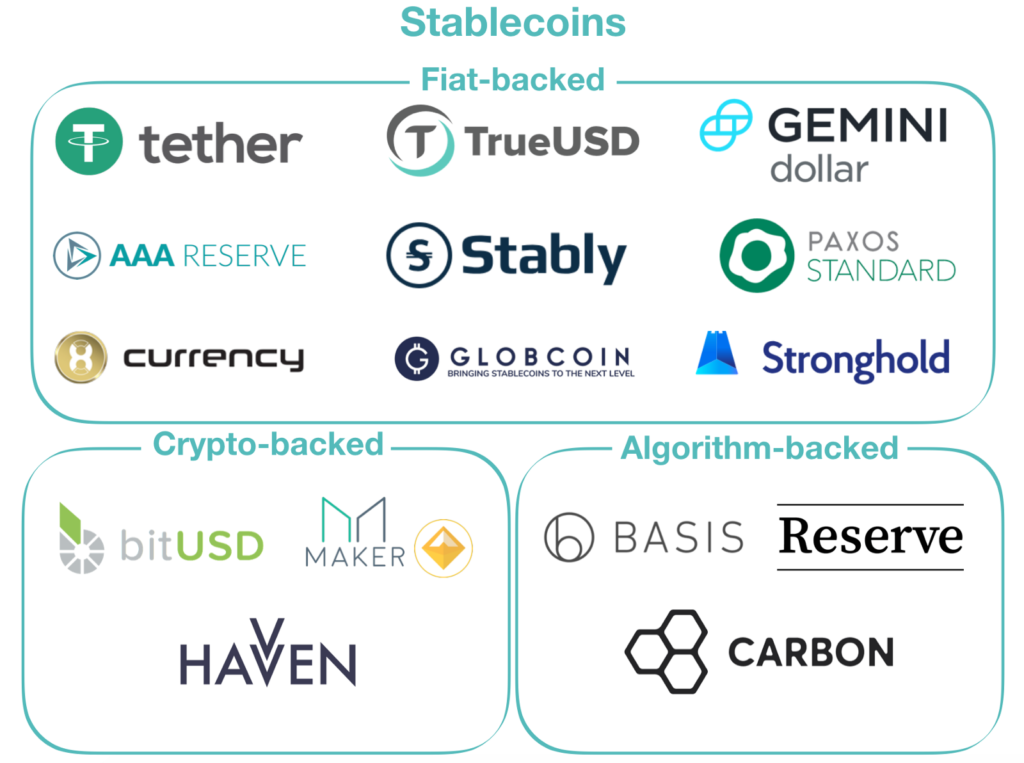

Stablecoins have a value that is fixed to fiat or an asset, usually USD. In addition, they can be collateralized to commodities like gold. Stablecoins can also have an algorithmically stabilized value.

Stablecoins also allow holders to earn passive interest. This can be done by locking them in a smart contract with a defi lender, where they can be lent out for interest. This is similar to how a money market account operates.

There are 3 types of stablecoins. Some coins are backed by fiat or an asset, some are algorithmically stabilized, and others offer a hybrid of fiat backed and algorithmic stabilization.

Interest rates of defi lenders range from around 0.03% – 14.00%. Most will fluctuate, and are variable. Defi lenders will accept different cryptocurrencies, but stablecoins tend to offer to best interest rates. Stablecoin issuers are highly competitive with each other, sometimes even subsidizing the interest rate.

Coin issuers like MakerDao or TrueUSD lend out funds, similarly to what is done in a traditional bank with a money market account. The fees which are generated by interest payments are shared with the holders of the coin. Each stablecoin will payout at a different rate. Sometimes the rates are variable, sometimes they are fixed.

Some stablecoin lenders require that holders lock up their tokens for a period of time. Other coin issuers like Nexo, allow holders to withdrawl their coins whenever they like, without any fees.

Variable Rate and Fixed Rate Loans with Defi

One of the potential risks with defi (as within any other type of loan), is that borrowers dont fully understand the terms they are accepting, so their monthly payment might unexpectedly change to one they cannot afford. Most protocols come with a variable rate, but some are fixed like crypto.com, which has two fixed rate loan options.

Recently borrowers on the MakerDao protocol were shocked when their interest rates rose up to 20%. Interest rates (refered to as the stability fee) in the Maker ecosystem are voted on by holders of the MKR governance token. The rate when the service began was just 0.05%, but has been dramatically risen up to 20%, returning to more normal level of 5% in recent months.

Lenders like CoinList and Crypto.com have a fixed term and fixed interest rates for the duration of the loan. They also require you to lock up your coins for a fixed period of time.

Are Defi Protocols Safe?

There are risks you need to understand before you lock your coins in a smart contract with a defi lender. These risks include a fluctuating interest rate, as well as some security risks, and smart contract failure risk. The security risk can be mitigated by choosing an insured lender like Nexo, who insures their clients funds up to 100 million dollars. There are also other companies like Nexus Mutual that provide insurance in case of smart contract failure.

Another aspect that you need to understand is whether the loan rate will fluctuate. Borrowers on the MakerDao protocol were surprised when the stability fee (or interest rate) suddenly spiked to almost 20%. It has since come down to around 5%. You can view the stability fee live here.

Another risk that you might face in defi is security. There was a highly publicized hack of the funds from a defi lender. This was done to a decentralized autonomous organization (DAO), so funds were not insured from the theft.

A way to mitigate the risks are to fully research your loan terms, your defi lenders, and go with a defi platform that is insured. You can also work with a company that offers smart contract insurance. This type of service is desperately needed in order to defi to properly take off.