Instadapp.io is a crypto wallet that gives users access to defi protocols, directly within the app, essentially making them their own bank! These defi services include lending, borrowing, and even porting loans between protocols like Maker and Compound.Finance. Instadapp is also non-custodial, which means that a user retains complete control of their capital while they loan or borrow on their funds. They can earn interest, as well as generate income from fees by contributing to a liquidity pool.

Defi is an exploding sector for blockchain. Many believe it will be the killer app to drive mainstream adoption on the Ethereum blockchain. Recently, Instadapp has taken on a 2.4 million dollar round of seed investing from corporate investors like Pantera Capital and Coinbase.

Managing your CDP

One function that Instadapp allows users, is take out a “collateralized debt position” or CDP, on Ethereum collateral directly within their wallet. Users can borrow up to 66% on the value of their Ethereum. If the value of the Ethereum collateral becomes lower than 2/3 of the cost borrowed, the position will be liquidated. Liquidation also comes with a penalty of 13%. Capital can currently be borrowed on 2 different protocols, including MakerDao and Compound. There are plans to soon add other protocols including: Fulcrum, Nuo, and Dharma.

In exchange for borrowing on the MakerDao protocol, users will pay interest, which is referred to as a stability fee. Fees are incurred, the longer the debt position is left open. The stability fee will fluctuate and is voted on by owners of the Maker governance token. Initially the stability fee for MakerDao began at 0.05%, but in recent months has risen to 18%. In this instance, the option to port over to another protocol would be very beneficial for borrowers. Although the interest rate is rising, it isn’t deterring borrowers. Recently, a loan of over 1 million dollars was taken out with no paperwork and cost of only $0.73.

Lending to Earn Interest on your crypto in Instadapp

In addition to taking on a collateralized debt position (CDP) in instadapp, users are also able to lend their cryptocurrency in order to earn interest.

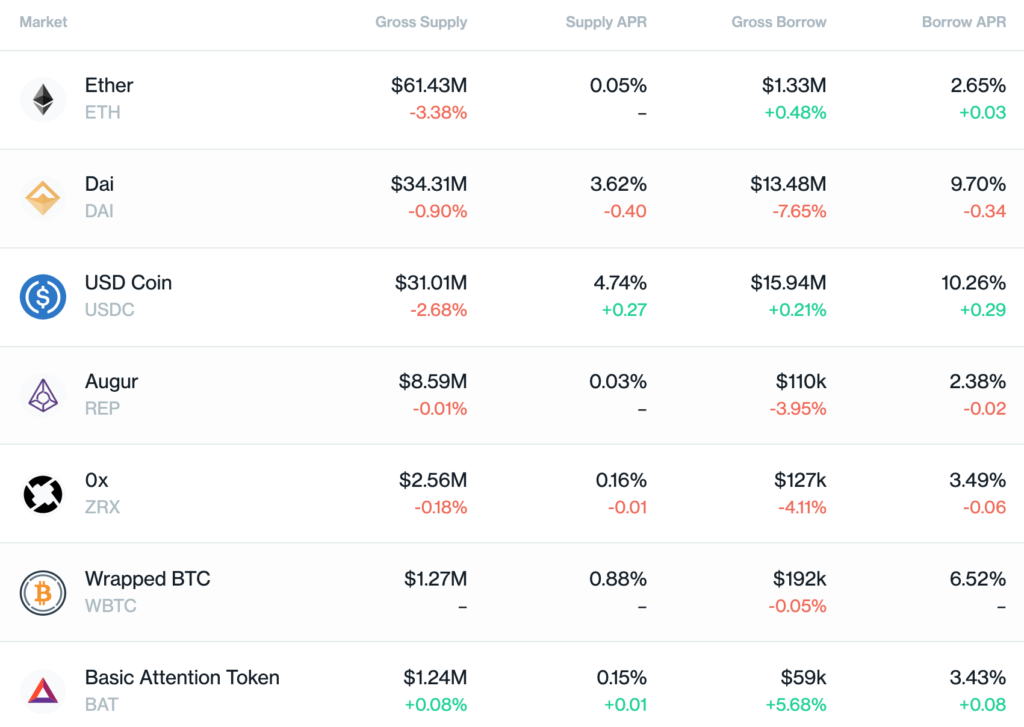

Interest rates on lending vary based on factors including the type of cryptocurrency you lend/borrow, the protocol you use, and the amount that you lock up in a smart contract. When you “deposit tokens into the Compound smart contract, you get cTokens, which are ERC20 tokens that represent your lending or supply balance and the interest it has accrued.” The cTokens grow proportionally with the interest rate, which you can then redeem. You can even place your cDai in the Uniswap protocol to earn additional fees for adding it to a liquidity pool, while you are earning interest.

Rates for borrowing and lending are variable, they can be found here.

Here is a video that explains the Instadapp Lend and Earn feature:

Porting Loans Between Protocols

I believe one of the most powerful features that Instadapp offers, is the ability to port a loan between protocols like Maker or Compound. This ensures that a user can always port away from a bad interest rate.

Porting a loan between protocols is referred to an “instabridge“. This allows users to retain the best interest rates by moving their loans over to another protocol if rates are better. This results in increased interest for lenders, and savings for borrowers. Users can easily refinance their loans to obtain a better rate.

Liquidity Pools

Another feature offered within the Instadapp interface is the Uniswap Protocol. This protocol gives users the ability to trade between a variety of cryptocurrencies, directly within the wallet. Users can earn 0.3% of the fees by pooling their tokens fees in exchange for providing liquidity.

Multiple currencies that can be swapped within this protocol including: BAT, USDC, AUG, OX, and wrapped BTC.

Loop and Save

Instadapp also allows users to “long” the value of ETH, directly within the wallet. This can be done by getting a loan on the value of the ETH collateral with DAI, then purchasing more ETH to deposit in your CDP. You have just increased your collateral and can thus draw out even more DAI. This allows you to long the price of ETH with 3x leverage.

If you believe the value of ETH will rise, this is a way that you can go long on its price directly within your wallet.

The Beginning of a Bankless Defi Future

Instadapp is one of the first applications that bring powerful defi functions of cryptocurrency to a mass audience. The ability to get a large loan with no paperwork, a nominal fee, while the user retains complete control of their capital, will give users opportunities that have never existed.

Ethereum looks like it will be the first blockchain poised for mass adoption with impressive applications in lending, payments, derivatives, insurance, prediction markets, staking, and more.