MakerDao is currently the market leader in the defi lending space, with almost $350 million locked up in its smart contracts currently. There are two tokens in the MakerDao ecosystem including the MKR token, and the DAI stablecoin.

MakerDao is built on the Ethereum blockchain, and has gained quick traction in the defi lending space which also includes projects like: Compound.Finance, DharmaLeverage, Nexo, Celcius, and Blockfi.

How does Maker Dao work?

MakerDAO is a protocol that provides loans backed, using a borrowers crypto as collateral. Users can generate DAI stablecoins by locking their crypto in a smart contract, which can be repayed in MKR tokens or DAI to free up your crypto collateral with interest. Each DAI coin is backed by an amount of Ethereum. Users can take out a debt position on their ETH by up to 150%.

The value of DAI is pegged to USD, using a CDP, or collateralized debt position to maintain an equal value. CDPs work by altering “the total supply of outstanding Dai, creating Dai when new assets are leveraged and destroying existing Dai when it is repaid to the position.” This ensures that 1 DAI is equal to 1 USD.

DAI is a stablecoin that addresses the major problem of price volatility in the crypto market. It provides an alternative to other stablecoins which are supposed to be directly backed with USD. In some case, it cannot be verified wether they are or not actually backed with fiat money or assets.

MKR on the other hand, is a governance token which was designed to fluctuate in value. MKR holders are allowed to vote on the governance of the ecosystem including stability fees and polls.

MKR is needed to repay the fees accrued on collateralized debt positions (CDPs) which are been used to create Dai in the Maker ecosystem.

Is DAI better than other Stablecoins?

Currently there are over 50 stablecoins, which achieve their stability in different ways. One of the problems with other types of stablecoins like Tether and TrueUSD, is that they might not actually be backed 1:1 in USD.

The big fear is that the coins are not properly audited and are being used as a money printer. DAI addresses this by creating its stability in a differently than many of the other coins. They are backed directly with crypto assets that are placed in a smart contract by the borrowers. DAI is generated when crypto is placed in a smart contract.

Are Loan Rates on Maker Dao fixed?

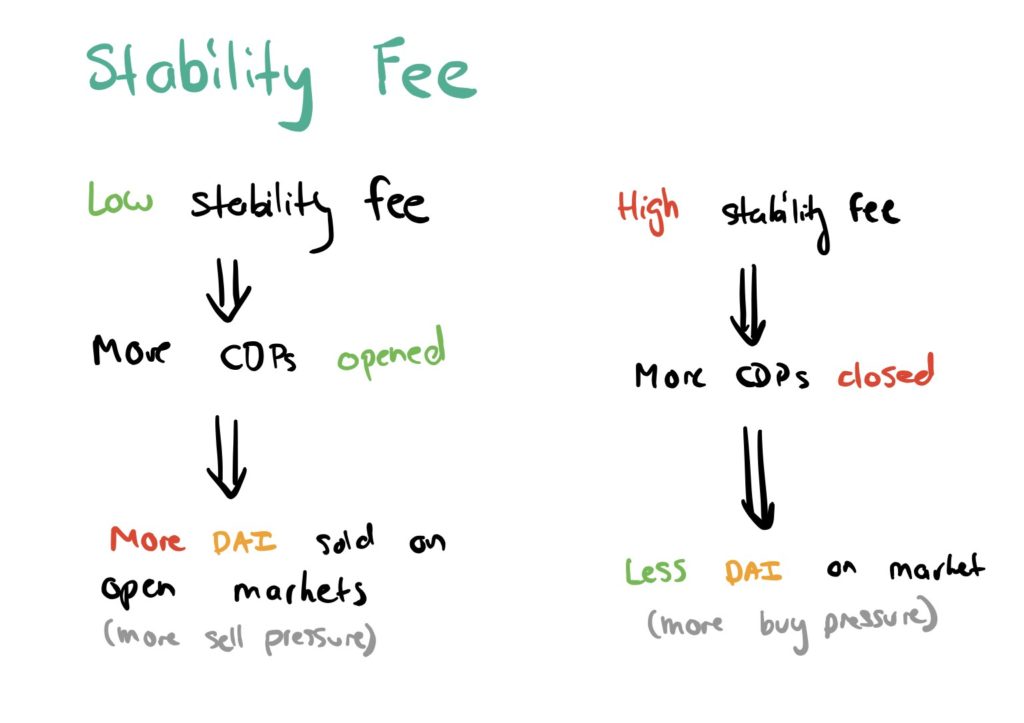

One problem with MakerDao, is that the loan rates on the MakerDao protocol are not fixed. Rate changes are voted on by owners of the governance token, MKR. The interest rates of the protocol will vary as they are voted on by the community to maintain the stability of DAI, based on changing market conditions. The owners of the Maker governance token, vote on stability fee changes.

It is important for a borrower to maintain a healthy debt to collateral ratio. Your position will be liquidated if your collateral falls to less than 150% of the amount you owe.

Since the interest rates of a loan on MakerDao fluctuates as a part of the way it creates its stability for DAI, it has led to many borrowers being left with dramatically increasing rates. In Feb of 2019, the stability rates rose up to 19.5%, from a starting rate of .5% when it first began offering loans. This left many borrowers with a bad taste in their mouth.

You will be charged a stability fee, when you repay your debt. Interest rates change due to a fluctuating stability fee. This fee accrues on your debt over time, and can be repaid in both MKR and DAI.

MakerDao is the most successful defi project on the ETH blockchain

MakerDao has had 20% growth each month, with most of its borrowers making real life purchases with this new stablecoin. DAI has over 100 million dollars worth of stablecoins in circulation.

Even though there might be some issues with fluctuating interest rates, the success of MakerDao proves that there is a huge market for defi lending as well as new ways to borrow and generate interest.