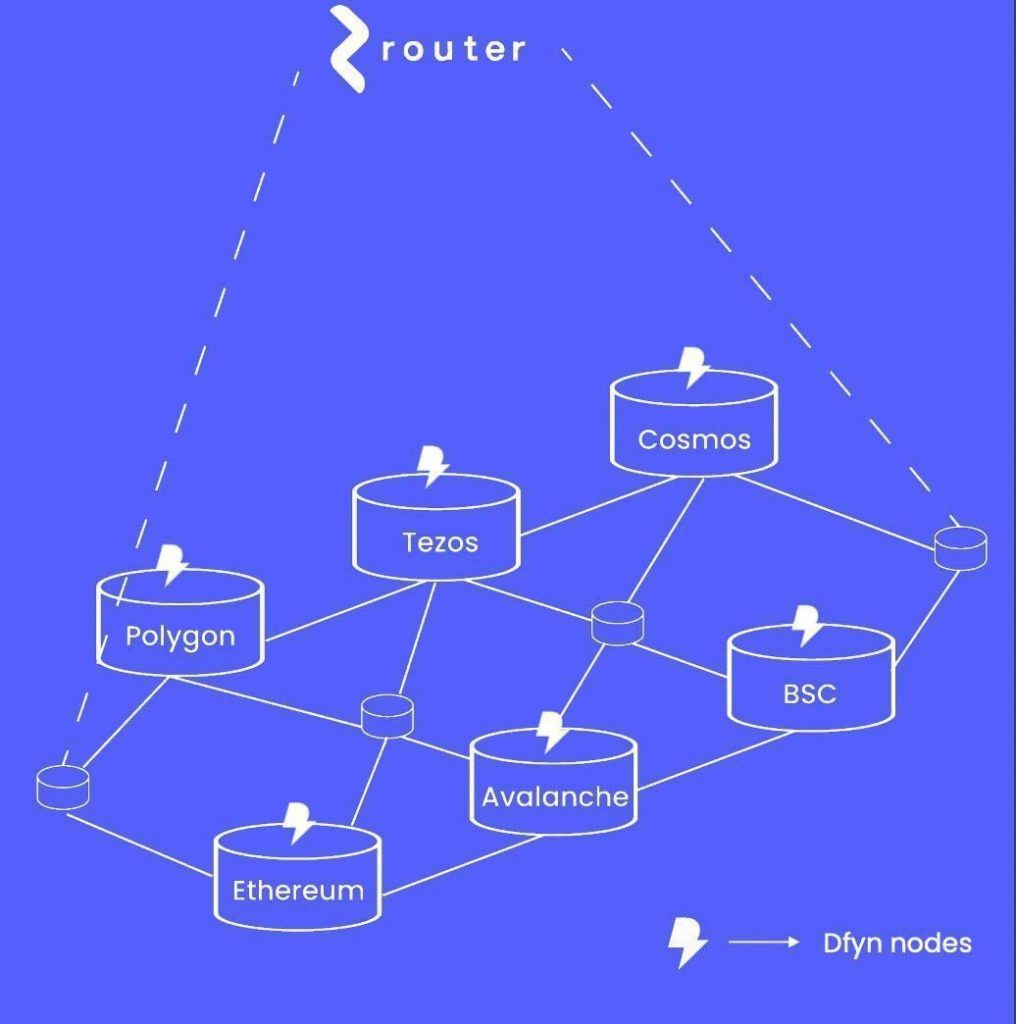

Router is a blockchain agnostic protocol, that aggregates liquidity into “islands”. These liquidity islands are used to connect various Layer 1 and Layer 2 protocols (image left). This prevents liquidity from being fragmented. It enables swapping, lending, farming, arbitrage, the use of flash loans, and governance across chains!

The Router protocol can route orders through DEXs on various L1/L2 protocols. This allows users to get the lowest price between chains. The team is adding chains including: Matic, BSC, HECO, Avalanche, Cell, LUNA, and Ethereum. (More will be added.)

The $ROUTE token is used as the protocol’s gas fee. It’s the cost to access the liquidity. The $ROUTE token is used, so users don’t need to hold gas tokens for each chain.

Upcoming Events:

- Router’s mainnet will be live in Q2 of 2021.

- It’s white paper should be arriving in just a couple weeks.

- Cross-chain swaps are now live on the testnet, here.

Important Links:

- Telegram

- Medium

- Whitepaper (the white paper is not released yet)

- Github for Router. Github for DFYN.

Beyond Swaps: Applications of Cross-Chain Liquidity

Router’s tech is very exciting. The liquidity islands will enable cross-chain arbitrage, lending, farming, launchpads, and even governance. Users will be able to borrow against their assets on the ETH chain, for degen farming on Matic. They’ll even be able to do x-chain flash loans, with new partner Unilend!

Router brings us a step closer to a unified system of liquidity. I think that in the near future, users won’t even know which chain they’re using. An app will seemlessly route a transaction between multiple coins and chains, without the user paying much mind to it.

The Team’s Three Products: DFYN Exchange, Spacefarm, and Galaxy Farm

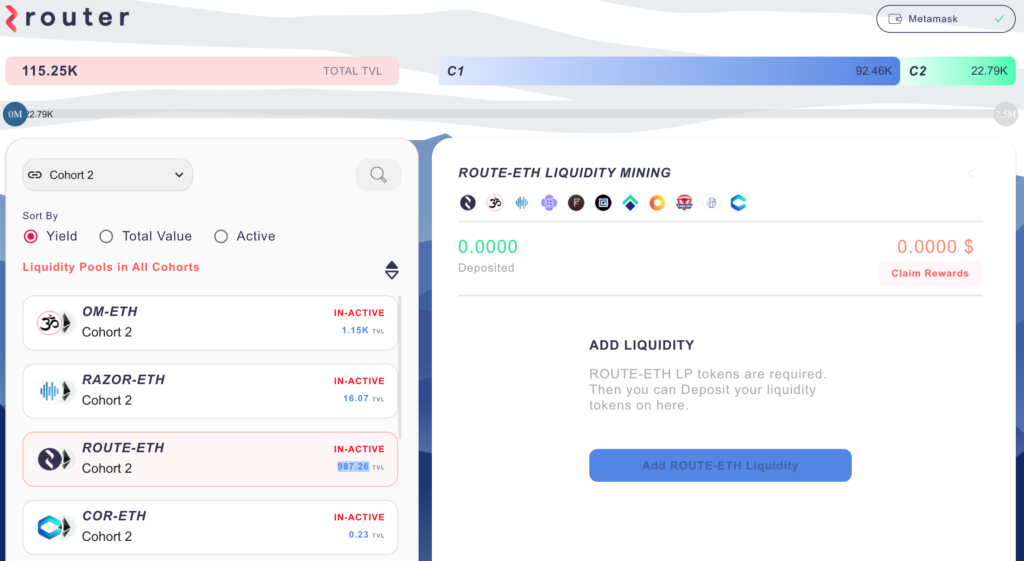

The team has built 3 products using the Router technology: The DFYN Exchange, Spacefarm, and Galaxy Farm.

- The DFYN Exchange

DFYN is an exchange (built by the same team) that uses the Router protocol for gasless, cross-chain swaps. DFYN accesses liquidity through Router’s nodes across layer 1 and 2 chains. It will source assets from DEXs on multiple chains, to give the best price, with the lowest slippage. This is DFYN’s competitive advantage!

- Here is an overview of the DFYN tokenomics.

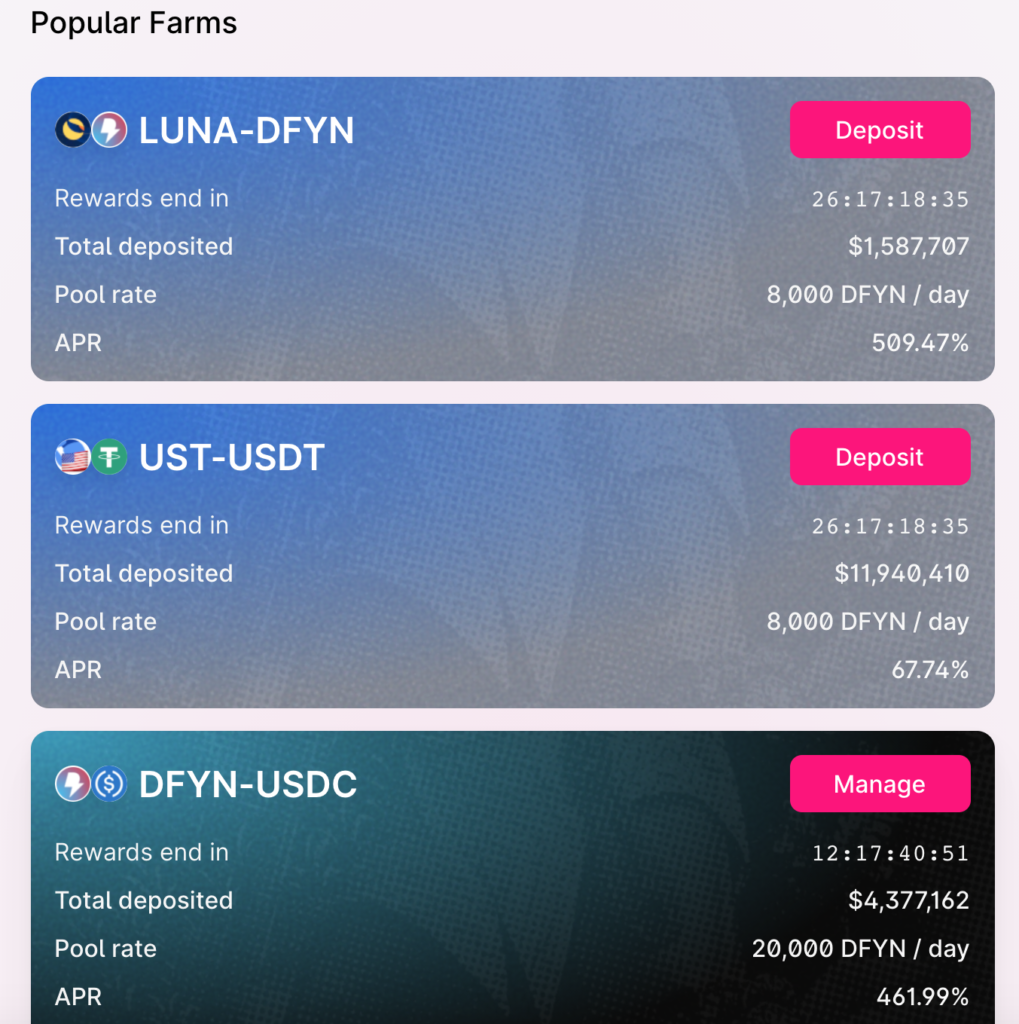

DFYN has a great farming program. Its APYs are as high as 600%. Farming and swapping is gasless. Over 400k transactions have been done on DFYN, saving over 12 million in fees, as compared to transactions on ETH.

- DFYN will have a launchpad capable of simultaneously releasing tokens on multiple L1 and L2 chains.

- DFYN will also have prediction markets soon.

2. GalaxyFarm and SpaceFarm

GalaxyFarm and Space Farm incentivize liquidity for the DFYN ecosystem. The farming is completely gasless. All transaction fees are subsidized by the project.

$ROUTE Tokenomics

The $ROUTE token is used as a gas fee for the protocol.

It has a max supply of 20 million, with a circulating supply of 3.8 million.

- Here is an article explaining the tokenomics of $ROUTE.

Investors in Router Protocol

The Router team has high profile investors, including: Polygon, Avalanche, and MantraDao.

They’re adding high quality partners at a rapid pace, see here. I think many teams are seeing the potential in this project, and the importance of the cross-chain eco-system as well.

Governance and the Cross Chain DAO

The Router DAO will enable users across multiple blockchains to participate in governance. This makes governance easier, cheaper, and more accessible. The future of governance is multi-chain.

The Router Team

The team is composed of nine members based in India.

I feel the team might be getting additional support from Polygon. I think Polygon could be cultivating other Indian teams to build key products in the their ecosystem.

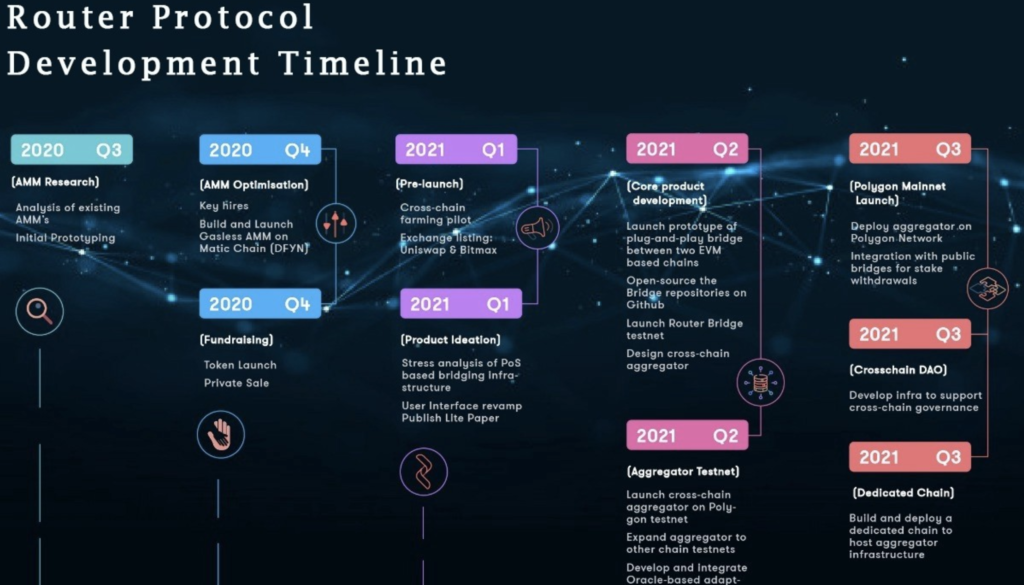

Router Protocol Roadmap

Conclusion on Router, Dfyn, and the Ecosystem of Products

Blockchains in their current form, are walled gardens. Router can help turn them into an unified system of liquidity. It can help remove much of the friction in a multi-chain environment. Users will be able to move value from chain to chain, with minimal effort.

I see the cross-chain narrative building over the second half of 2021. I think the Router team is positioned correctly to experience the growth in this area. Current cross-chain bridges leave room for improvement. Router will make the experience of moving value between chains better, faster, and cheaper.

The team is pumping out new products rapidly, but have yet to complete their whitepaper. I’m ok with this. It gives them more time to plan their strategy and get feedback on the products they are releasing. They are are letting their work speak for itself, and I look forward to see how these projects develop over this year.

If you liked this article, please follow me @defipicks