Dynamic Set Dollar is an algorithmic stablecoin, with a fluctuating supply. It is NOT a rebase coin. Its balance does not change within a users wallet. DSD reaches stability by giving its users financial incentives, that encourage them to sell or burn tokens. This helps the $DSD price move towards its goal of $1. Devs call this mechanism, Voluntary Elastic Supply.

How the DSD supply changes:

- If the price of DSD is above a dollar: new DSD tokens are minted. These new coins go to reward the stakers of the DAO, and providers to the liquidity pools. These new coins create sell pressure, moving the price downwards.

- If the price of DSD is under $1: users are encouraged to burn their tokens in exchange for coupons. These coupons can be exchanged for a higher percentage of coins, once the price crosses back above $1.

The devs felt incentives were a better method of price control, compared to rebasing. Reducing a user’s balance, can give users a bad feeling. Rebasing also breaks the composability of defi, and the ERC-20 standard.

What is the difference between Empty Set Dollar (ESD) and Dynamic Set Dollar?

Dynamic Set Dollar is a fork of Empty Set Dollar (ESD). DSD fixes the issue of bot manipulation of the coupon and redemption system. It also shortens the epoch to 2 hours, making it more reactive to price fluctuations. The DSD changes include: epoch duration, rebase amount, supply/reward mechanisms, and coupon expiry.

Reaching Equilibrium: The 2 Phases of Dynamic Set Dollar

Dynamic Set Dollar goes through 2 different phases in order to reach its one dollar peg: Expansion and Contraction

The Expansion Phase

When the price of DSD is over a dollar, it enters an expansion phase. During this phase, the supply expands by a maximum of 10% each epoch (An epoch is 2 hours). The increased supply adds selling pressure to DSD, which coaxes the price downwards. The maximum amount the supply can expand is 35%.

The expanding supply goes to reward liquidity providers, and DAO stakers. 60% of rewards go to pay DAO stakers, 40% goes to liquidity providers. DAO bonders earn compounding rewards, liquidity providers rewards are non-compounding.

The Contraction Phase

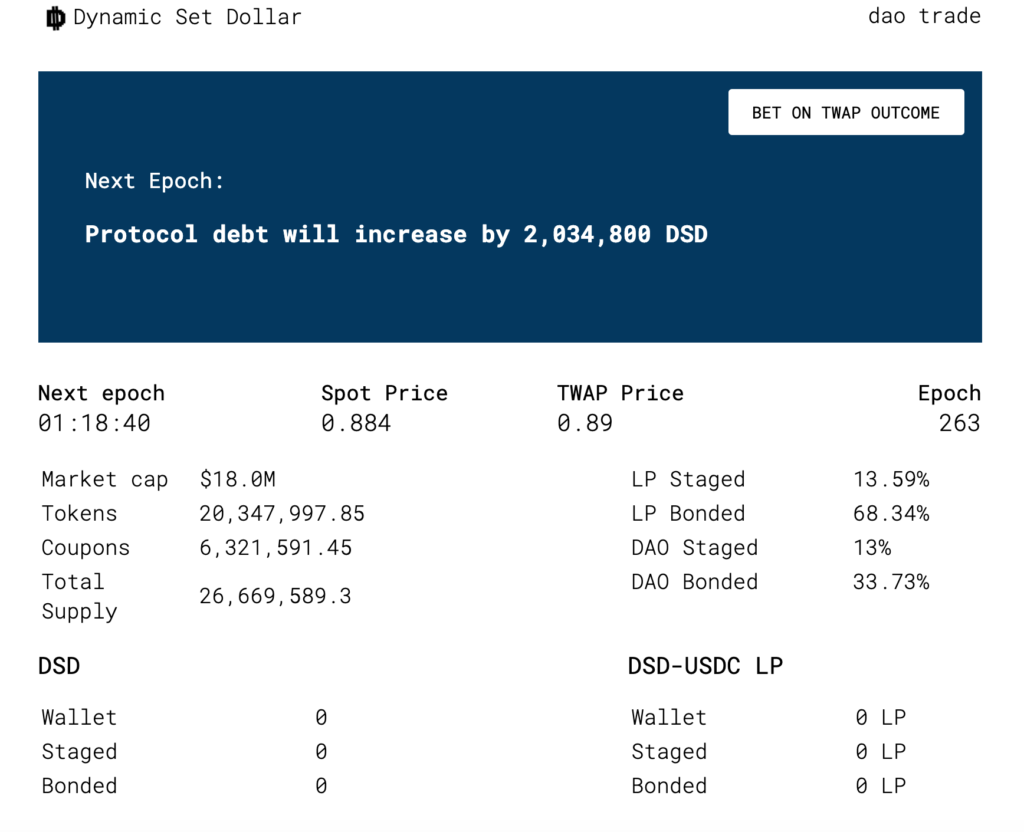

When the price of DSD is under $1, it enters a contraction phase. During this phase, users are incentivized to burn their tokens. Reducing the DSD supply will move the price upward.

During the contraction phase, users can burn DSD tokens in exchange for coupons. These coupons guarantee premiums (currently 45%) on tokens. The coupons can be redeemed when the price crosses back over $1. The coupons expire after 360 epochs, which is around 30 days.

- Once the price goes under $1, the Liquidity Provider rewards and DAO rewards stop.

How are Coupons Redeemed for a Premium?

The coupon system encourages users to burn DSD tokens, in exchange for coupons. This reduces the supply, leading to a price increase. The coupons can be redeemed for a premium when $DSD breaks $1. Currently coupons are worth 1.45 times the amount of tokens burned.

How DSD’s coupon system is different from ESD’s

The DSD fork altered the ESD coupon system. These changes help to reduce bot manipulation of coupon redemptions. It gives user incentives to buy coupons early, by creating a redemption penalty on coupons which are bought late. Users can still redeem coupons early, if they are willing to accept this penalty.

The chart below demonstrates the penalty:

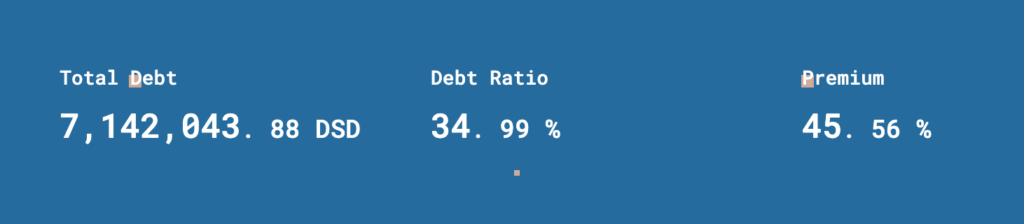

DSD Statistics

Live statistics for the protocol can be found here.

Rewards: Liquidity Provider and DAO

Users can earn DSD rewards by staking. They can bond tokens to the DAO, or stake their liquidity pool tokens to earn rewards. Compounding interest is earned when bonding to the DAO, at a rate of 60%. Non-compounding rewards are earned by staking LP tokens. In both instances, the tokens are locked for 36 epochs.

My Conclusion on Dynamic Set Dollar

The Dynamic Set Dollar protocol offers two core features. First, it creates a price reactive algorithmic stablecoin that will hopefully maintain a stable value, in a very volatile market. Secondly, it provides financial opportunities for speculators, as $DSD fluctuates between its expansion and contraction phases.

I think DSD’s incentive system is more fair, than a rebasing system. An incentive system allows users to hold DSD, without taking on the risk of a negative rebase. Users can speculate with the coupon system to earn incentives, or choose not to. There is risk and reward in the incentive system, but it is totally voluntary.

The staking and coupon system offers ample opportunity for gains. But, users should have a strong grasp on DSD’s fundamentals before utilizing it. Holders can only earn rewards, when its price is above $1. This means its price will always be retreating towards its peg, as rewards are earned. They need to sure that their staking rewards will be greater than the loss of the coins value, as DSDs price descends. They also need to be wary of the unbonding period. They will not immediately dump their coins!

DSD offers important improvements to the Empty Set Dollar’s protocol. Its addition of a coupon redemption penalty, fixes the issue of front-running by bots. Its epoch time changes, make it more reactive to price fluctuations. The DSD and ESD protocols offer a new type of stablecoin. If the price of these coins eventually settle firmly at their $1 peg, it will make a nice addition to the current selection of non-collateralized stablecoins. But, it will take time to see if it can hit its target, and maintain a stable value.

If you liked this article, please follow me @defipicks