Linear Finance is a cross-chain synthetic assets exchange, with DAO governance. It will allow users to trade delta-one synthetic assets like gold, oil, and index funds. Linear’s devs hope to improve on design flaws that they perceived in the Synthetix project. They saw problems in areas like: the oracle price update speed, pledge ratio, tokenomics, transaction costs, rewards, speed, and multi-chain accessibility.

I think the standout feature for Linear will be interoperability. The team will start out by building on ETH and EVM compatible chains, like Binance Smart Chain (BSC). Then, it’ll expand to non-ETH compatible chains. These alternate chains can offer higher speeds, lower transaction costs, and greater accessibility.

Linear Finance is backed by noteable investors like: Alameda Research, Kinetic, and Hashed. (See the image below)

Important Links:

How Does Linear.Finance Work?

Linear Finance allows the minting and trading of synthetic assets. Each synthetic asset is over-collateralized, by lUSD stablecoins. This over-collateralization ensures the system will not break, even in times of heavy volatility or a black swan event.

To encourage users to maintain the proper collateral for their synthetics, the project offers rewards. Exchange and inflation rewards can be earned, by maintaining a certain ratio of lUSD collateral to synths. This ratio is known as the p-ratio or pledge ratio. This helps to maintain the overall health of the system.

Within this system, Linear’s liquidity pool acts as the counter-party. This allows for almost unlimited liquidity, with zero slippage. Users can also earn $LINA rewards for contributing to the pool.

The project is now in its testing phase. Currently, users can only mint lUSD and stake. Soon, they will be able to buy synthetic assets, and trade them.

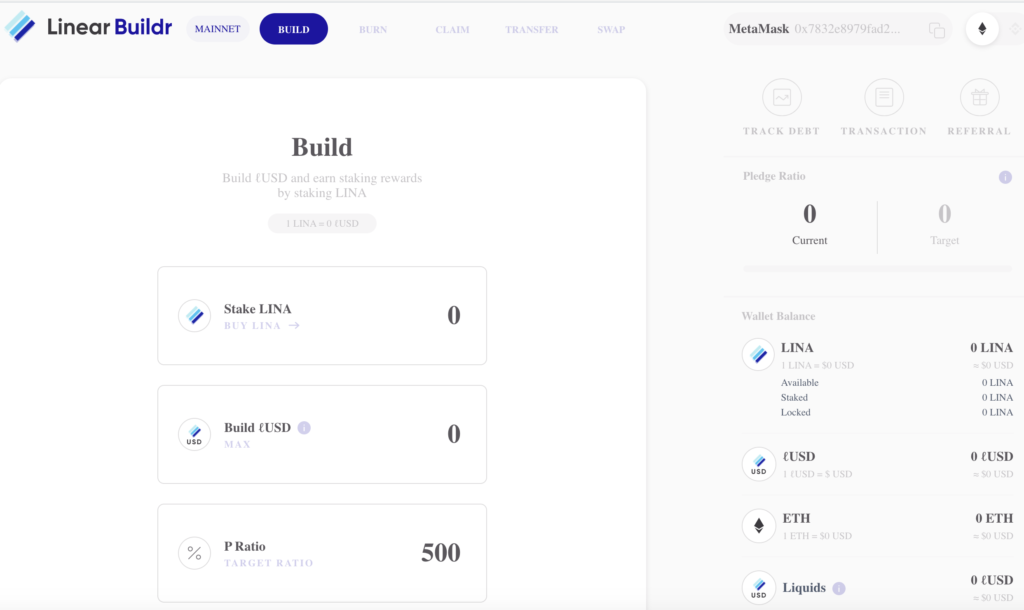

What is a Pledge Ratio?

The Pledge ratio (p-ratio) is the ratio between a user’s lUSD collateral, and their synthetic asset holdings. Over-pledging ensures that even in high volatility, the system will work. In order to receive $LINA exchange rewards, a user must have a p-ratio that hits a certain threshold. The starting p-ratio will be 600%, but this can be changed by the DAO.

How to Mint lUSD Stablecoins on the Buildr App

Users can mint lUSD stablecoins from $LINA tokens. This is done on the Buildr app. Soon, other collateral types will be accepted to mint lUSD. This will be in a ratio decided by users of the DAO (possibly a 80:20 ratio).

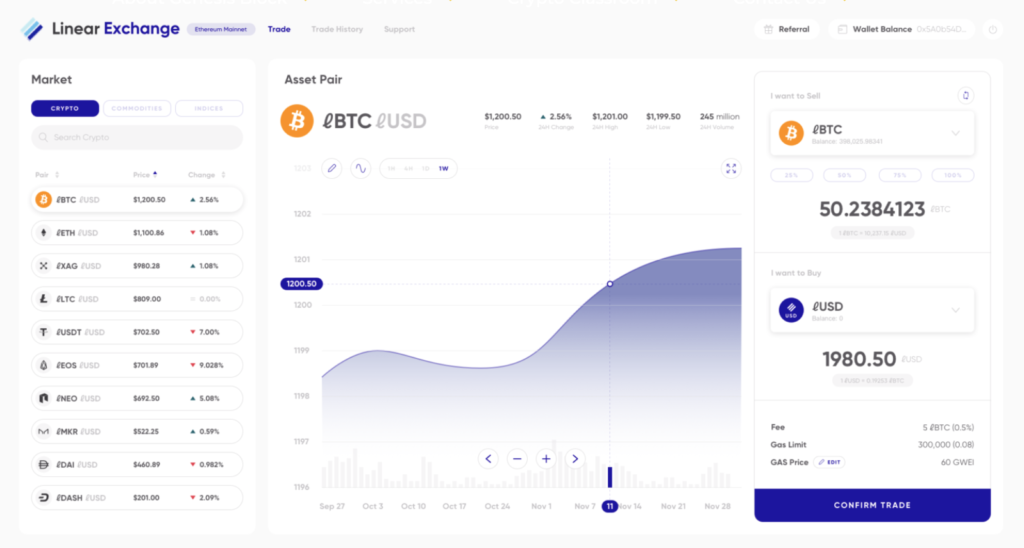

The Synthetic Assets Exchange

The exchange will allow the trading of liquids, aka synthetic assets. This includes: precious metals, stocks, cryptos, and commodities like gold. Any asset with a price feed can be added. The fee on every trade, is 0.25%. Fees are rewarded to users, if they have a pledge ratio above the set threshold. Rewarding users to maintain a certain p-ratio, helps ensure that the overall system wont fail due to insufficient collateral backing.

Using BAND Protocol to solve oracle front running

The project chose BAND as its oracle provider. It was chosen because of its near instant finality, and 2-3 sec block times. Devs believe that this will help to solve the oracle front-running problem, which is a type of arbitrage on the price feed delays.

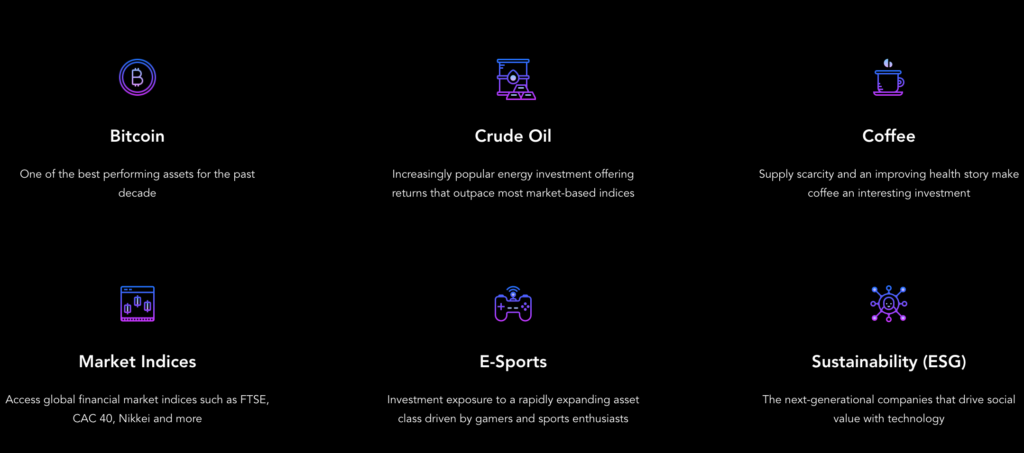

Which Assets can be Traded?

Tradeable asset types will include: cryptocurrencies, commodities, and indicies. Users will vote in the DAO on the types of assets that will be included.

Staking and Rewards on the Platform

Users can earn three types of $LINA rewards on the platform: Transaction Fees, Inflationary Rewards, and Yield Farming Rewards.

- The transaction fee of 0.25% is distributed to LINA stakers that have a pledge ratio above the threshold.

- The inflation rate of the LINA token is set to 75%. It will reduce each week at a rate of 1.5%. Stakers can get these inflation rewards if their pledge ratio is above the threshold determined by the governance.

- Users can yield farm by providing liquidity to the debt pools. Rewards are currently about 1% interest per day. This liquidity will help bootstrap the project.

- Users can also earn $LINA rewards by creating and burning liquids.

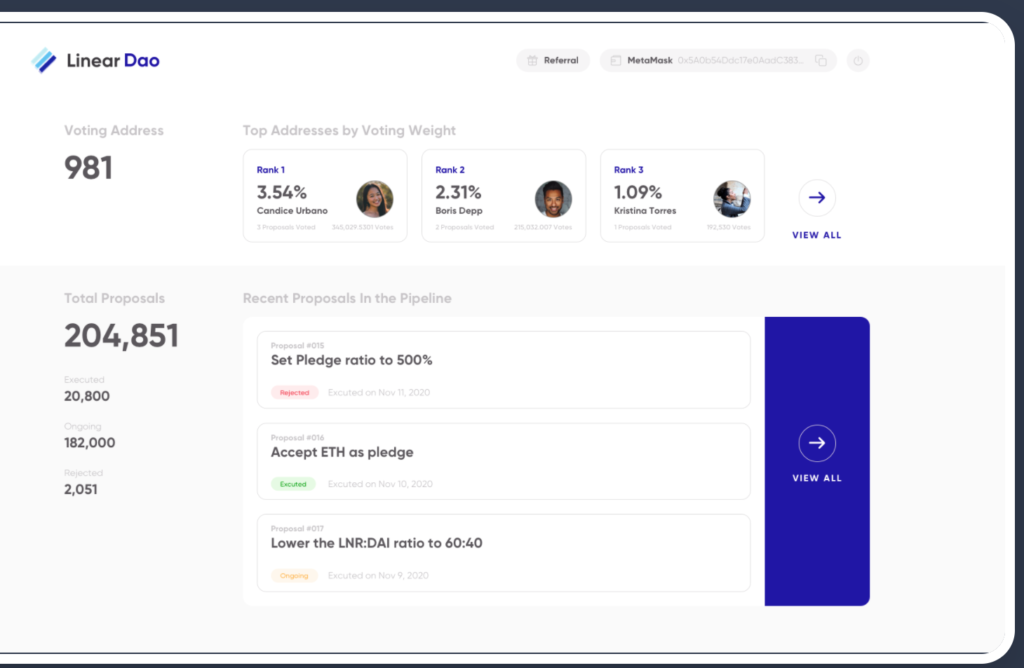

DAO governance

Linear Finance uses DAO governance. $LINA holders can vote on variables like: pledge ratio, asset types, and the insurance fund. Any token holder can create proposals and vote.

$LINA Tokenomics

LINA has a max supply of 10 billion. Its circulating supply is 475 million. It has 75% inflation built-in to enhance user rewards. This will decrease by 1.5% weekly. This can be changed by the DAO.

The $LINA token is used for: staking, minting of synthetic assets, governance, and payments.

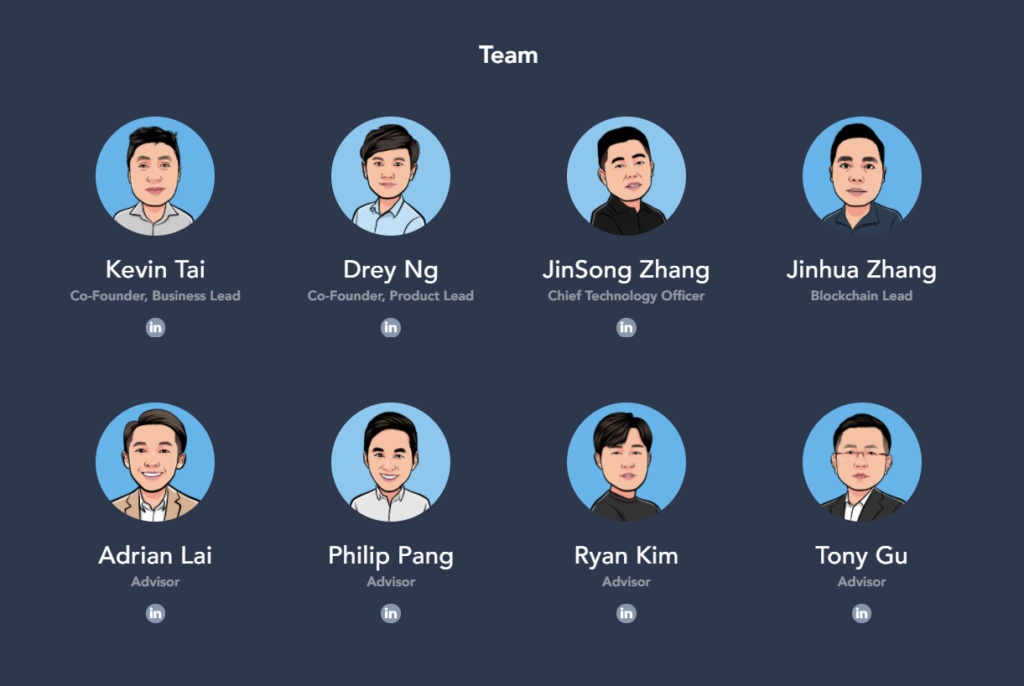

The Team

Linear’s team is well rounded. They have experience in crypto, exotic assets, and structured financial assets. Check out their Linkedin here.

My Conclusion on Linear Finance

I think Linear Finance is a solid, under-valued project. It has a strong team and noteable investors like Alameda Research. It will provide an avenue to trade synthetic assets on chains other than ETH, which is needed in crypto. It also seeks to improve on perceived flaws in the Synthetix design. The project’s tokenomics, low marketcap, high rewards, and current interest rate of about 1% daily, make it very enticing.

On the other hand, Synthetix is stiff competition. Its is very innovative. It will soon upgrade to V2, with layer 2 implementation. This will improve its speed, costs, and feature set. This might make some of Linear’s improvements, less dramatic. BUT, i feel that just bringing synths to BSC and other chains, is enough of a selling point. Its exchange will be utilized just due to this. It’s rewards, tokenomics, and growth potential are a bonus.

After launch, i hope that Linear Finance will differentiate itself. Offering a cross-chain product with design improvements, is great, but I would also like to see uniqueness after it is up and running. I want exotic assets, a multitude of inverse assets, traditional assets, and things i cant find elsewhere. Maybe diversity of assets is where Linear can begin to set itself apart. It would also be nice to see leveraged trading on the exchange.

The rewards and tokenomics are great. If Linear can fix certain pain-points, and offer interoperability, i think users will become active on the exchange. The project wouldn’t have high profile backers, if they didn’t think this was possible as well.