BarnBridge tokenizes market fluctuations and risk exposure. It’s a new type of defi lego to create tradable tokens, that expose a user to more or less volatility in a market. It can reduce volatility for conservative investors, or increase it for traders. Its tokens open up new opportunities for risk management, speculation, and hedging.

There is over 200 trillion in global debt. Bonds on corporate debt are now earning below 2% interest for the first time ever! This corporate debt might be coaxed into defi, if the yield and price fluctuations were less volatile. Barnbridge can reduce this volatility. It can even offer a stable yield rate, by consolidating the return from multiple protocols.

Important Barnbridge Links:

What are Tokenized Fluctuation Derivatives?

Barnbridge creates tokenized derivatives on market fluctuations. Examples of these markets could include: yield rates, price, prediction market odds, mortgage default rates, etc. These ERC-20 derivative tokens are separated into high, medium, and low risk/reward baskets, called tranches.

Barnbridge’s first derivative TOKENs

Barnbridge’s first two derivative tokens: Smart Yield Bonds and Smart Alpha Bonds.

Smart Yield Bonds

Smart yield bonds consolidate and tokenize yield from multiple defi protocols. The ERC-20 tokens can offer high risk/high yield, lower risk/lower yield, or stabilized yields.

The yield bonds are structured according to the image below:

Smart Alpha Bonds

Smart Alpha Bonds tokenize price exposure. They can expose users to a high, medium, or low amount of price fluctuation. Higher risk price exposure gives higher returns, but also higher losses.

- Each token doesn’t have to be flat on the price exposure curve! For example, the first 10% of price exposure can have a different exposure curve than the second 10%. The second 10% can move the price up more/less up or down, than the first 10%.

Barnbridge also plans to develop more derivative products including: SMART Prediction Hedge, SMART Swaps, and a Market Driven Ratings Oracle.

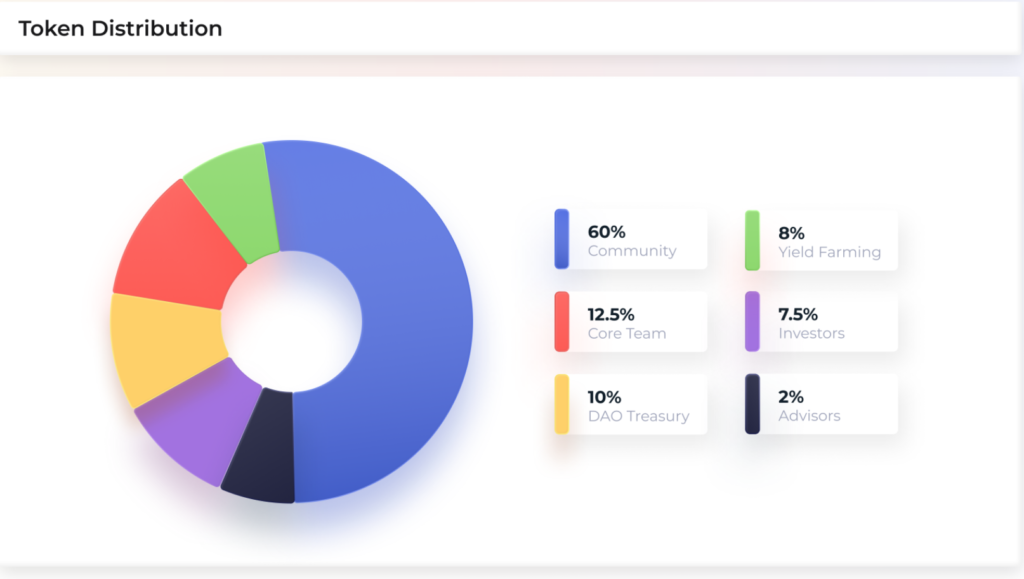

$BOND Tokenomics

$BOND is the native ERC-20 token of the protocol. Its total supply is 10,000,000. It is used for staking, governance, and incentives. $BOND’s fair release model was inspired by yEarn. It is distributed to the community by yield farming.

The 2.2 million $BOND tokens allocated to founders, seed investors, and advisors are vested, then released on a weekly basis over a two year period.

$BOND Yield Farming

The team will distribute the $BOND token fairly. It uses a Proof of Capital model to release the token as yield for liquidity providers. Barnbridge needed this liquidity to “structure”, then release its product.

Below are the 2 liquidity pools available for farming:

- USDC/DAI/sUSD Pool (#1) – Pool 1 is composed of stablecoins, so impermanent loss is not possible.

- USDC/BOND Uniswap Pool (#2) – Pool 2 may be less vulnerable to smart contract failure, as Uniswap smart contracts have been deployed and tested longer.

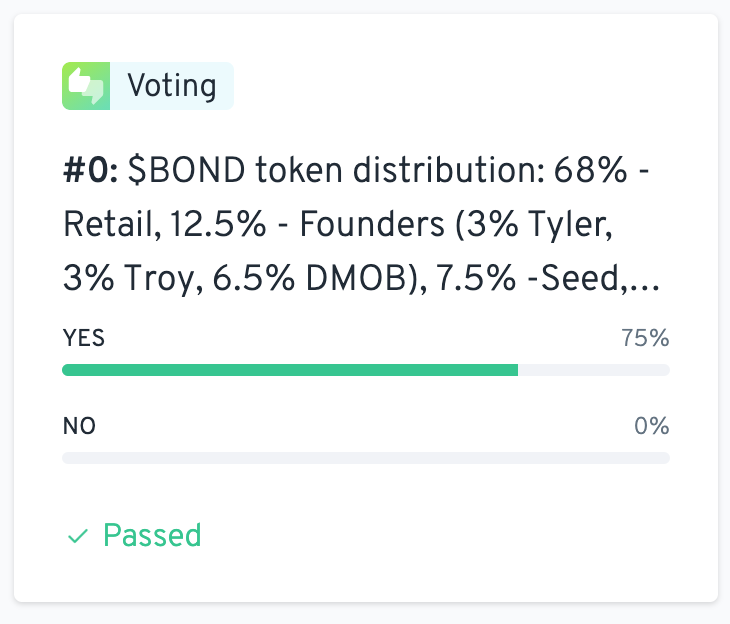

DAO Governance

Barnbridge started under a “launch DAO”, using the Aragon platform. (Access it here.) Soon it will soon be transitioned to the final Barnbridge DAO.

The Barnbridge Team

The founders of Barnbridge have a history with crypto startups including: SingularDTV, Dharma Capital, and Gnosis. Its devs are part of the web 3 development company in Bucharest called Digital Mob.

Conclusion on Barnbridge

I think the risk management tools offered by Barnbridge, will encourage new types of debt to enter our space. Defi can give exceptional APY’s on mortgage and corporate debt, but institutional investors might afraid of a risky, unproven protocol. Barnbridge can spreadout and stabilize this risk. Tools to mitigate the exposure, and steady interest rates, will allow conservative investors to slowly dip their toes in.

Barnbridge is a very unique product. There’s no comparable protocol in defi. Its derivative tokens offer new ways to speculate, manage risk, and hedge. The ERC-20 tokens will be used by both conservative and aggressive investors to give stability, or maximize gains.

I also think the team made a smart decision by going with DAO governance from the very start. The market highly values fairly run projects, like yEarn! Barnbridge has enthusiastic community support, with $400 million locked in now. I’m very curious to see which market types Barnbridge will tokenize next.

If you liked this article, please follow me @defipicks