Thorchain is a permissionless, decentralized marketplace of liquidity, with the goal of connecting all blockchains. It is a proof-of-stake network, allowing its users to supply and swap assets in continuous liquidity pools (CPLs). It’s similar to Uniswap, but for ALL digital assets. Stakers provide liquidity to pools, so they can receive rewards on swap fees. The swap fees are based on the slippage. It’s not a flat fee, like with Uniswap. Thorchain’s tech allows users profit from their unproductive assets.

Thorchain’s RUNE token

RUNE serves four purposes: Security, Liquidity, Governance, and Rewards.

- The token is staked by validators to secure the network – Nodes must bond RUNE, in order to be given the chance to be churned in as a validator. Bonding creates Sybil resistance, preventing a malicious user from harming the network. 1,000,000 RUNE is the minimum bond to run a validator node.

- It is used for liquidity to perform swaps – In the liquidity pools, all tokens are bonded to RUNE. Swaps are done over two pools (Asset1–> RUNE –> Asset2). Bonding assets to RUNE lowers the amount of connections needed between tokens.

- It is used for governance – It is a signal for new assets to be listed. New asset pools with the highest amount of RUNE allocated by users are added first.

- It provides rewards for liquidity providers and validators – Liquidity providers earn swap fees as a reward. Rewards are also given to validators that secure the network.

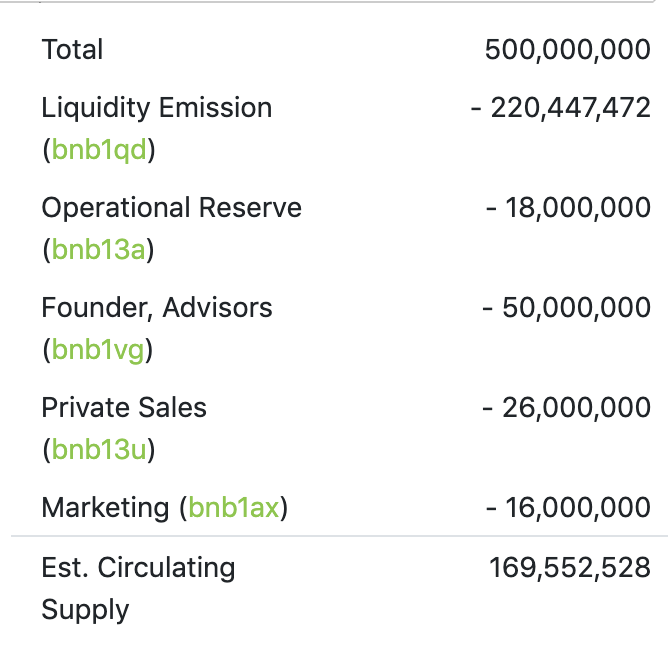

Supply and Allocation

RUNE’s total supply started at 1 billion tokens. 500 million were burned by the team, bringing the new total supply to 500 million. 44% of its supply will be emitted over 6 years. All transaction fees on the protocol are burned, making RUNE a deflationary token.

Below, is the RUNE’s token allocation:

Thorchain Team and Project Info

The Thorchain project started in 2018. It operates as a semi-anonymous team, for better decentralization. Here is the whitepaper, the Economic Paper, and their medium blog.

The project is built on an eco-system of 5 protocols: BiFrost, Yggdrasil, Aesir, Asgardex, and the Flash Network.

Its BiFrost Protocol builds cross-chain bridges to bring interoperability that is secure. It’s Yggdrasil Protocol addresses scalability, using a vertical sharding technique. Its Aesir protocol is for governance, and its Asgardex protocol is the liquidity interface. Soon, it will add a layer 2 payment network called the Flash Network.

What is BEPswap?

BepSwap is a non-custodial DEX for Binancechain tokens. It’s built on Thorchain’s tech. It’s in alpha now. It operates using continuous liquidity pools (CLPs) supplied by stakers. Stakers give the liquidity, in exchange for rewards.

Bepswap has no oracle supplying its price feeds. Prices are created via user arbitrage. The price is determined by the “ratio of the depths of both assets”.

RUNE Staking: How much can stakers earn?

Stakers earn RUNE tokens by providing liquidity, or as block rewards. Stakers can currently earn between 20 – 30% APY. Pools with low liquidity and high demand, earn the most for liquidity providers.

Can Stakers Lose Money in Liquidity Pools?

There is a risk of impermanent loss in liquidity pools. This occurs due to volatility in the market, when one asset in a pool gains against its paired asset.

Here is a website and video below showing the profitability of liquidity pools on different protocols.

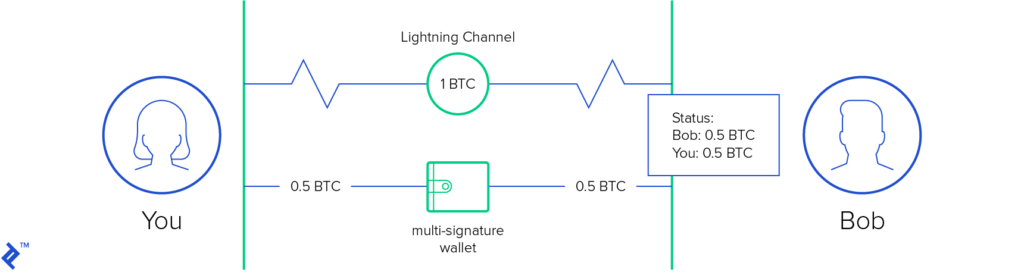

Thorchain’s Layer 2 “Flash Network”

Thorchain plans on creating its own 2nd layer scaling solution. It is called the “Flash Network”. The team is planning to work on this in 2021.

With the Flash Network, the team is trying to fix a problem with lightning to lightning swaps. With this type of swap, there is no way to prove that a recipient has received the funds. Recipient’s might not redeem an invoice, in certain situations. Thorchain will use the price feeds from its liquidity pools, to power their layer 2 Flash Network.

Governance

Thorchain has minimal governance. The devs want to create tools to allow validators to create their own cross-chain bridges. New chains can also be added through community and node participation. A higher amount of staked capital, leads new assets to be added.

Users create new pools on their own. They can list new assets by “making staking transactions with the asset in the transaction memo”. The new pool is then bootstrapped, with swapping disabled. Every few days, the new assets with the deepest liquidity are enabled. The highest amount of liquidity is what triggers the protocol to list the new assets.

Goals for Thorchain in 2020 and Beyond

Thor’s mainnet was launched in June 2020. The goals for this year are to add more BEP tokens, create a bridge to Binance Chain, then add 5-6 more chains. The team wants to build developer tools, so validators can build bridges to other chains, if the community demands them.

Goals for 2021 and beyond include: adding a layer 2 scaling network, called the Flash Network. After it’s built, they will connect it to other lightning networks.

My Conclusion on Thorchain (RUNE)

Thorchain is an excellent project, with big potential to gain marketshare. Uniswap is its model, so it is built on proven fundamentals. Its goal of adding assets from ALL chains, gives RUNE potential to grow to a large marketcap.

RUNE has excellent tokenomics. Demand and value of the RUNE token will increase, as the protocol grows. RUNE tokens are needed to stake in liquidity pools, as well as to bond to validators. Transaction fees are burned, so the token is deflationary! Stakers of RUNE are currently earning around 20 – 30%! I love seeing teams learn from the token models of their peers. Good tokenomics are important to help a project gain traction, fund the team’s development, and bring in new investors.

The marketcap of Thorchain is already 81 million. This is significant, but leaves some room to grow. The project is blockchain agnostic, so it has potential to expand further, as more chains are added.

If you liked this article, please follow me @defipicks