Loopring 3.0, is a massive update to the non-custodial, decentralized, order-based exchange protocol. The 3.0 version provides enhancements like higher throughput, lower gas costs, as well as reduced costs for exchange owners. It also introduces 3 types of LRC staking including: protocol pool staking, exchange owner staking, and exchange protocol fee reduction staking.

Speed and cost improvements, have been employed using a second layer scaling solution called ZKsnarks. The use of ZKSnarks allows many operations to be done off-chain, while maintaining the same level of security as the Ethereum blockchain. With On-Chain Data Availability, the Loopring 3.0 protocol can now settle up to 2000+ trades per second, with costs as low a $.0001 per trade!

Below, I ask Loopring COO, Jay Zhou a few questions. After that i’ll breakdown the new Loopring 3.0 tech in-depth.

Interview with Jay Zhou, Loopring COO

ME: Do you see DEXs taking over the volume from CEXs? OR, will they operate concurrently, serving different needs for different types of users?

JAY: Yes, it’s happening now. DEX volume has increased ALOT since 2020. Dydx, Uniswap, Kyber, and IDEX have been contributing alot of volume. In Feb. 2020, we launched the first zkRollup dex on the Ethereum blockchain Loopring.io. We believe zkRollup can bring the DEX to a new level. Yes, I agree that CEXs and DEXs will concurrently operate and serve different needs for different types of users for a very long term. But, younger generations prefer DEXs and decentralization more.

ME: What points do you think DEXs excel? Where do you think DEXs need improvement?

JAY: (Where DEXs excel) Safety and ownership of assets are the keys to make DEXs excel. We’ve seen too many bad things happening on CEXs, whether it’s an accident or theft. With DEXs, the people have 100% control of their assets. Users don’t need to worry about hacking, manipulation, or account suspension.

(Where DEXs need improvement) All the DEXs are facing liquidity problems. Particularly, if you compare them to top tier CEXs… But, it’s improving. We now see more people are starting to trade on DEXs, and more market makers are moving to DEXs.

ME: What Defi Projects (other than Looping) are you excited about?

JAY: Keep Protocol is on my radar. I really like the tBTC idea and design. The Ethereum community has been looking for a BTC alternative on Ethereum for a very long time. I think tBTC will have a good chance of success. I’ve even started talking about tBTC in the loopring community.

ME: Plans to add Derivatives Trading? or a Fiat Gateway?

JAY: We talk alot about derivatives/options at our monthly meetings. But, we think our focus should be on the upcoming Wallet+DEX APP. We will launch a smart wallet + DEX APP in May. A combination of layer 1 plus layer 2 UX. Yes, we want to provide a fiat on-ramp solution to users. But due to different regulations in different countries, we will add this function carefully.

ME: What is your Vision for the Future of Looping?

Loopring will focus on two things; zkRollup and Smart Wallet. Loopring.io is the first DEX using zero-knowledge proofs to scale the thoughtput, and do low-cost trades on Ethereum. The Loopring protocol can settle more than 2,000 trades per second ($0.0001 / per trade) with Ethereum. I think Loopring zkRollup will be an example for future layer two projects on Ethereum. Another big goal for our team is the Smart Wallet. I come from a sorta traditional finance background. I understand people’s mindset there. In order to have mass crypto adoption, we have to make our product more user friendly. Smart wallet can ease the layer 1 and layer 2 on blockchain. Think about smoothly trading between wallet and Dex WITHOUT Metamask or other wallet login. Your wallet is your dex account!

- Thanks for the Interview Jay! Follow him on Twitter —> here.

MY Loopring 3.0 Protocol Breakdown

- In the rest of the article below, i’ll discuss: ZKSnarks, On-Chain Data Availability, Loopring 3.0’s performance improvements, Staking, Fees, and it’s oracle solution Chainlink.

What is ZKSnarks? How does it increase speed and lower gas costs in Loopring 3.0?

ZKsnarks is a type of zero-knowledge proof which can provide proof-on-chain (POC), that an operation has occurred off-chain. It gives proof that an operation has been executed, using a much smaller amount of on-chain data. This reduces gas costs, lowers latency, and dramatically improves the speed. Exchange operators can maintain high security levels, and provide better performance, by taking many operations off-chain.

On-Chain Data Availability

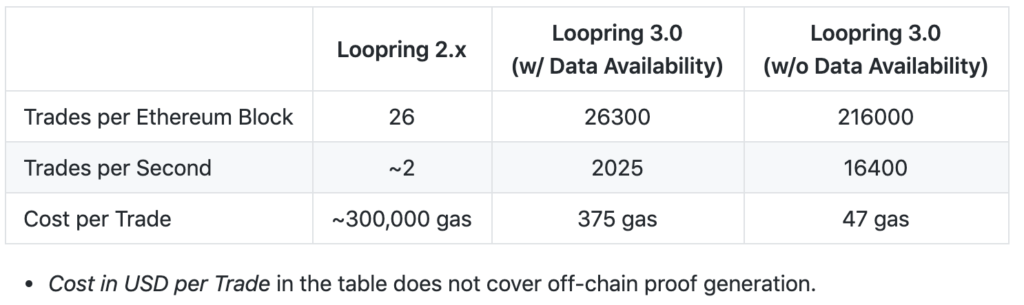

The Loopring 3.0 update has increased its potential throughput up to 2025 transactions per second with On-Chain Data Availability (OCDA), offering the same level of security as the ETH blockchain. If On-Chain Data Availability (OCDA) is turned off, the throughput can be as high as 16,400 trades per second! But, this does come at some cost to the level of security.

- On-Chain Data Availability (OCDA) means that Merkle proofs can be generated to claim a users funds, from data that is stored on the Ethereum chain, even if servers go down. This keeps funds safe and accessible at all times, even if the exchange is offline.

@loopringorg is doing a SNARK zk rollup DEX; they have a theoretical cap of ~2500 TPS (300 gas per trade, 300k SNARK verification cost, (10m – 300k) / 300 = 32333 tx/block -> 2487 per sec)

— vitalik.eth (@VitalikButerin) January 7, 2020

Loopring 3.0 performance improvements include:

Lower Cost Per Trade: With Loopring 3.0, the cost per trade has been reduced to $0.000124/trade with OCDA. Without OCDA it is 60% cheaper, at just $0.0000048 per trade!

More Trades Per Block: The trades per block has increased up to 26,300 with On Chain Data Availability (OCDA), and 216,000 without OCDA.

staking on Loopring 3.0

Loopring 3.0 has also introduced LRC staking. LRC Staking is used for the economic security of the protocol, rewards, and to reduce trading fees. There are 3 types of staking which include: protocol pool staking, exchange owner staking, and exchange protocol fee reduction staking. Here is a link which further discusses the utility of the LRC token.

Why is Staking Needed?

Staking helps to ensure that a block is valid. With staking, block producers can be penalized financially if they try to cheat. If an operator commits a block that is invalid, they lose a percentage of their staked funds. LRC is also staked by DEX operators “as a bond for service-level guarantees”.

- Go here to learn how to stake your LRC, under “how to stake”.

What are the LRC Staking Rewards?

Users can stake their LRC tokens to earn 70% of the Loopring protocol fees. An additional 20% will go to fund the Loopring DAO, and 10% will be burned making it a deflationary currency. Protocol fees of .06% are taken from each trade, which go to pay LRC stakers.

The amount of staking rewards a user receives, is proportional to the amount staked, and how long the LRC is staked. In order to receive staking rewards, users must stake for 90 days.

Reducing Trading Fees with LRC Staking:

Stakers of LRC, as well as high volume traders, will have their trading fees reduced. The taker fees are reduced in 4 tiers seen below:

the Fees on Loopring

In addition to trading fees, fees on Loopring 3.0 are also taken for: account registrations, password-resets, deposits, and withdrawals. These fees are necessary to prevent Sybil attacks. In this instance, attackers could create many accounts, or small deposit/withdrawl requests to use resources. These fees are essential for the security of the protocol.

The Trading Fee Structure on Loopring 3.0

- The trading fees for maker orders across all trading pairs is 0%

- The trading fee for takers is between 0.3%-0.5% for normal trading pairs, and 0.06%-0.10% for stablecoin trading pairs

- The protocol fee is .06%, which is paid to LRC holders who have staked for at least 90 days.

Anonymity and Data collection

Privacy, anonymity, and data collection are a major concern for defi users. I like how i can trade on a Loopring DEX without giving any personal info, just an ETH address. NO KYC is needed, and NO personal data is collected.

I believe providing permissionless access with no data collection is an integral part of building a decentralized eco-system. The Loopring team seems to understand this as well!

Loopring’s Price Oracle

Loopring 3.0 uses Chainlink as its oracle. An accurate oracle ensures that price feeds cannot be manipulated by bad actors. At the moment, Chainlink is seen as the gold standard of oracle middleware. Chainlink has a bright team (see video below) and a multitude of high profile partnerships, including: Google, Swift, Microsoft, and Intel.

Below is a talk between Chainlink and Loopring devs:

Conclusion

It’s exciting to see how quickly DEX technology has progressed in such a short period. I encourage users to migrate towards DEXs. DEXs can reduce risk to funds, improve privacy, and reduce the power of centralized entities that have too much control in the market. (Read my previous DEX guide here.)

Loopring 3.0 is an impressive technology, which will bring DEXs closer to the standards of centralized exchanges. Off-chain processing tech that makes use of zero-knowledge proofs, allow for transaction speeds to hit numbers NOT seen in ANY other DEX protocol. The On-Chain Data Availability feature provides security matching the Ethereum blockchain, giving users peace of mind that their funds are safe and accessible. The team is very intelligent, as you can see from the videos above. I am impressed with this project, and I personally just made a small investment in LRC, after writing this article. As DEX tech continues to advance, users will be struggling to find a reason to justify using a centralized exchange.

If you liked this article, please follow me @defipicks