Dforce is building a full-stack of permissionless, composable, DEFI protocols focused on the Chinese market. The Dforce ecosystem currently includes: a stablecoin called USDx, a decentralized lending protocol, a liquidity protocol for stablecoins (x-swap), a yield token wrapper, and a yield enhancement protocol (called DIP001). It will soon add a derivatives platform (called Infinity X), a prediction market, and more.

Dforce got my attention when i noticed it had climbed to #7 on defipulse. It has over 21.8 million of locked in funds on its lending protocol, Lendf.me! Lendf.me operates similarly to Compound.finance, where funds can be lent or borrowed from a reserve pool at a variable interest rate.

dforce aims to be the Defi Solution for the Chinese market

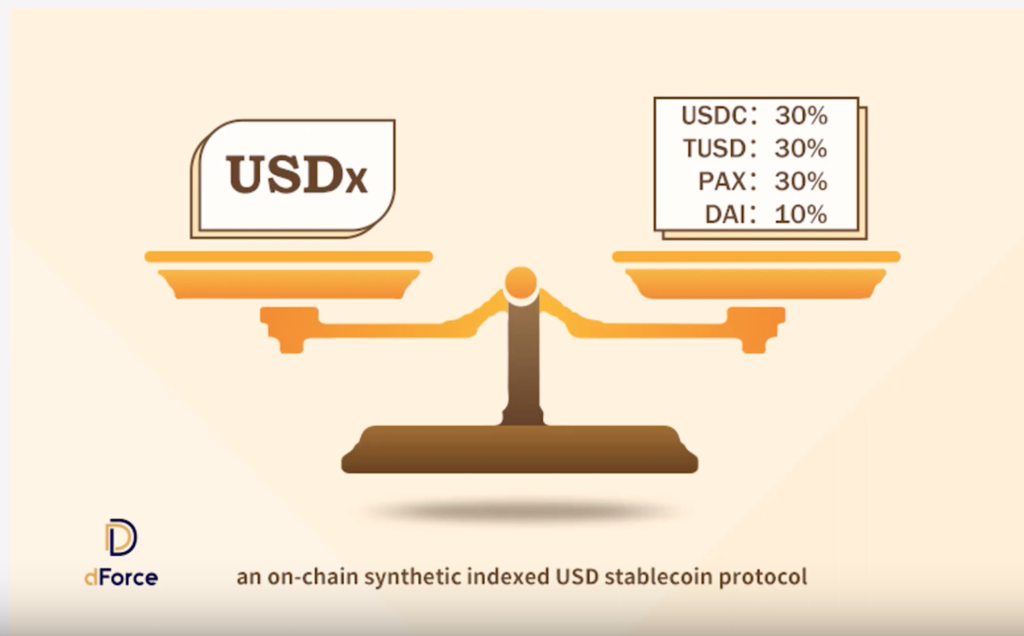

According to Dforce co-founder Mindao Yang, DEFI really hasn’t gotten as much attention in China, as it has in the States. Dforce aims to change that by creating a fully-fleshed out eco-system of DEFI protocols for the Chinese market, based around its USDx stablecoin. The USDx token is minted from a weighted basket of stablecoins which includes: USDC, TUSD, PAX, and DAI.

USDx aims to be an alternative to USDT, which has the largest stablecoin volume in China. Since USDT is known to be only 74% backed with fiat reserves, some users are understandably wary of it.

Most Chinese blockchain projects like NEO, Vechain, and Tron, are focused on building public smart contract platforms. There is currently a lack of defi services marketed to the China. Dforce aims to fill this gap.

Dforce’s WEIGHTED BASKET Stablecoin: USDx

USDx is composed of a weighted basket of stablecoins which includes: USDC (30%), TUSD (30%), PAX (30%), DAI (10%). USDx comes pre-weighted in the ratios above. This weighting can be adjusted on-chain. The goal with USDx was to create stability, fungibility, and scalability. They believe this can be achieved using USDx’s combination of fiat-backed and over-collateralized tokens.

The USDx stablecoin also entitles users to a say in governance. It provides diversification as well as reduction of risk with its mixed basket of coins. New types of stablecoins like USDx are needed in the crypto market, especially after recent issues with DAI and USDT.

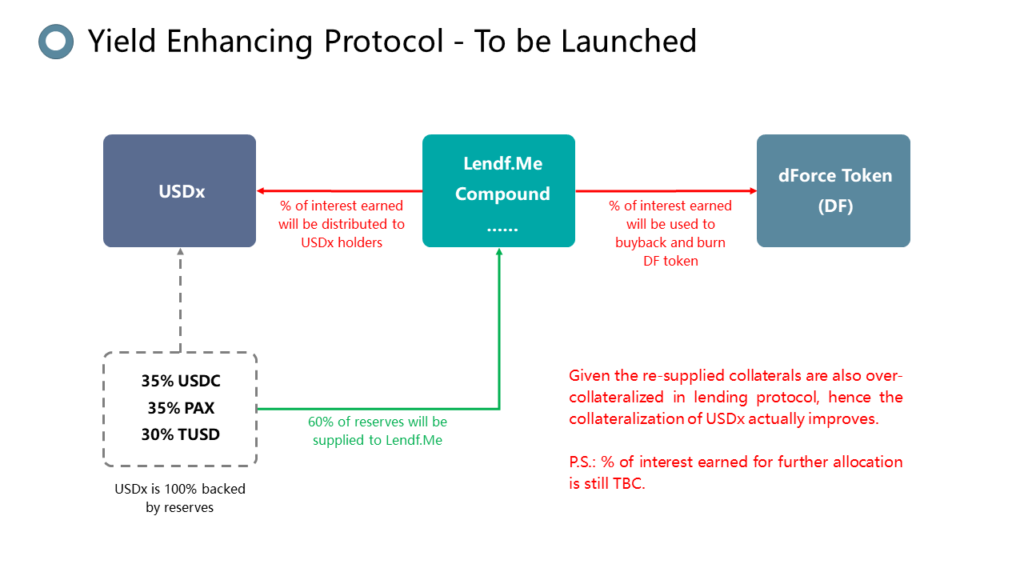

dforce’s yield enhancing Protocol

Current lending protocols require a borrower’s position to be over-collateralized. Some by up to 300%. Dforce’s yield enhancing protocol (DIP001) can optimize this collateralization ratio (CR) and improve the yield of a CDP. It unlocks a user’s collateral pool, then re-supplies it to a designated lending protocol to maximize yield generation. If the reserve becomes too low, a user can rebalance it by paying a gas fee.

Dforce’s Lendf.me Lending Protocol

Lendf.me allows users to borrow or lend their crypto assets to a reserve pool. Interest rates are variable, depending on the supply and demand on the protocol. The protocol has a collateralization ratio of 125%, allowing you to borrow up to 80% on the collateral which you contribute. The USDx token can generate interest at a current rate of 3.6% for lenders.

Lendf.me supports the following tokens: USDx, USDT, DAI, USDC, PAX, TUSD, WETH, imBTC, HBTC, and WBTC.

Xswap Liquidity Protocol

The Dforce project is working on a liquidity protocol called xSwap. xSwap will be similar to Uniswap, but soley focused on stablecoins. Here is the github for xSwap. It will allow the swapping of USDx, USDt, USDC,PAX, and TUSD tokens.

The DF TOKEN

Dforce has its own native token called the DF token. The DF token will be used for transactions, payments, community governance, incentives, and an insurance pool.

DF tokens give holders a say in governance which includes: voting on proposals like reserve adjustments on the USDx token, as well as protocol improvements. The total supply of DF token is 1,000,000,000. Small amounts of DF token are burned with some transactions, reducing the supply, making it a deflationary currency.

The DF token is not trading on an exchange at the moment, but can be purchase by putting the contract address (0x431ad2ff6a9c365805ebad47ee021148d6f7dbe0) into Uniswap.

Conclusion on Dforce

Dforce’s full-suite of DEFI products looks promising, but needs more development to build-out the ecosystem envisioned by Mindao Yang and Xin Xu. Stablecoin alternatives like USDx are needed in China due to its dependance on USDT. USDT, which has the highest volume in China, is known to hold only 74% of its reserves, making it very risky. Adoption of USDx, could be a way to reduce this risk.

I think Dforce’s focus on the Chinese DEFI market is a good angle for the project to take. I also like how Dforce incorporates its own native DF token, making it a project that investors can also participate in.

If you want to learn more about Dforce, here are some links to their social networks: medium blog, twitter account, and their sub-reddit.

If you liked this article, follow me @defipicks