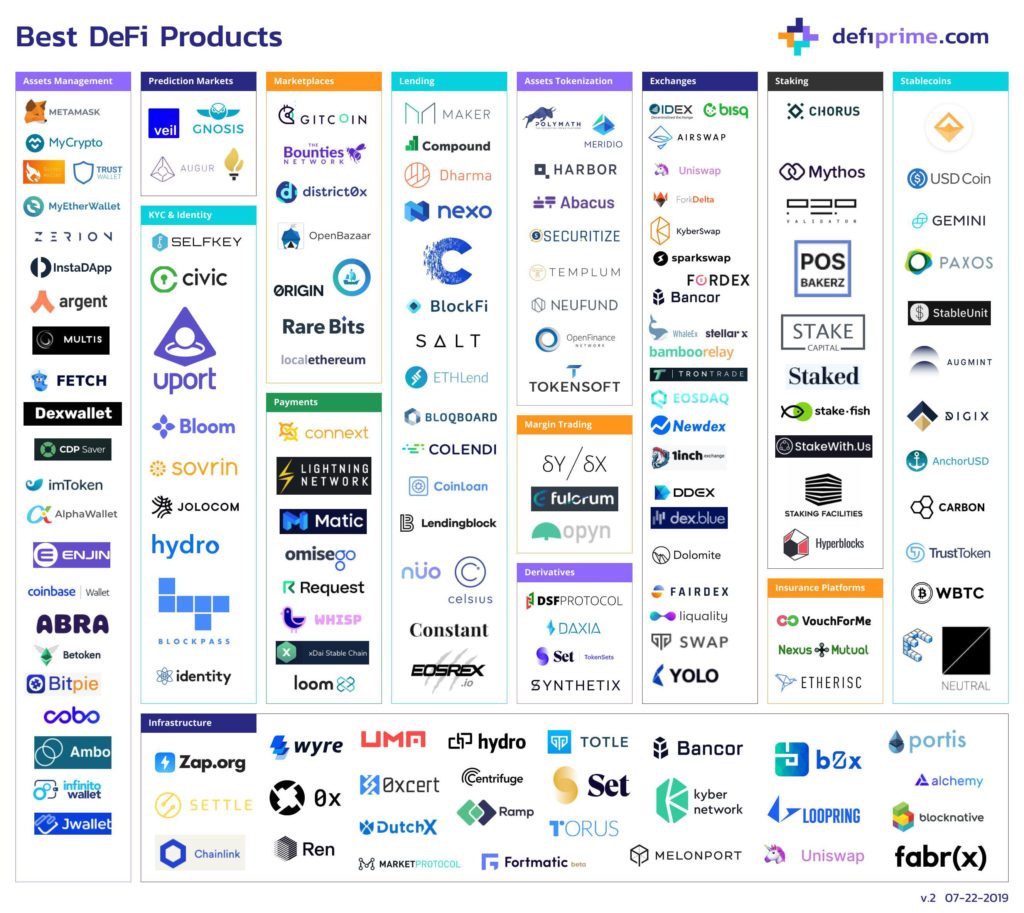

A core framework of over 200 projects is forming the backbone of a new decentralized system of finance. Projects like Chai, DefiZaps, and Instadapp are constructed from key pieces of defi infrastructure which include: Maker’s Dai, Uniswap, Lending Protocols like Compound, and Margin Protocols like BZX. These core pieces are forming a base layer that can be used to construct more complex financial products.

I believe 2020 is the year that the base layers of defi will begin to form a strong foundation. A working defi ecosystem will emerge from this to eventually do to institutional banking, what Uber did to the Taxi industry.

Below I’ll talk about how “core elements of defi” are being used to construct a new permissionless financial system. I’ll discuss: 1) smart contracts as money legos 2) stablecoins and lending protocols, 3) defi zaps, 4) types of interest bearing tokens and 5) interest rate optimizers and porting.

Smart Contract Money Legos

Smart contracts, are “components” that can be linked together to create financial products and services for the defi ecosystem. The video below provides an in-depth explanation of what smart contracts are, and how they can be used together to perform complex tasks (4:26 and 17:39).

Here is great article on the Totle blog that also illustrates the concept of Ethereum smart contracts, as “money legos”. It discusses how protocols like Maker, BZX, and Uniswap are being combined to create unique financial services.

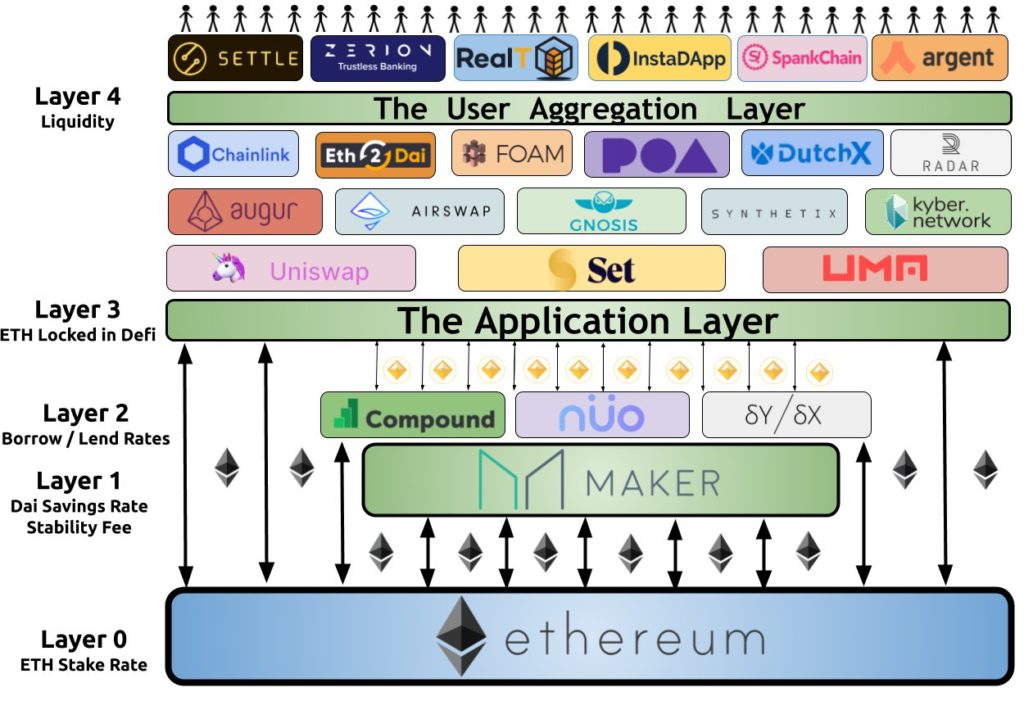

The graphic below shows how key applications are building up the core layers of the system and how other projects are created from these core pieces. The layers of Ethereum’s defi ecosystem are still being defined, but might include: a base layer, application layer, and user aggregation layer. (image found via @trustlessstate)

LENDING PROTOCOLs + STABLECOINs = interest Bearing Tokens

Stablecoins are cryptocurrencies which have a price that is fixed to an asset, like the US Dollar.

Interest bearing stablecoins are constructed by combining a stablecoin like Dai, USDC, or TUSD with a lending protocol like: Aave, BZX, Compound, or Maker

Interest bearing tokens like Aave’s aToken, BZX’s iToken, Compound’s cDai, and Chai all function a bit differently. They generate a return for a user by either growing in value along with the interest rate, or growing in number with the rate.

Defi Zaps combines protocols to build complex financial products

DefiZaps is a project which clearly illustrates the concept of inter-locking smart contracts, as “money legos“.

A ZAP can combine various protocols from lending, margin trading, and liquidity providing to form a much more complex financial product.

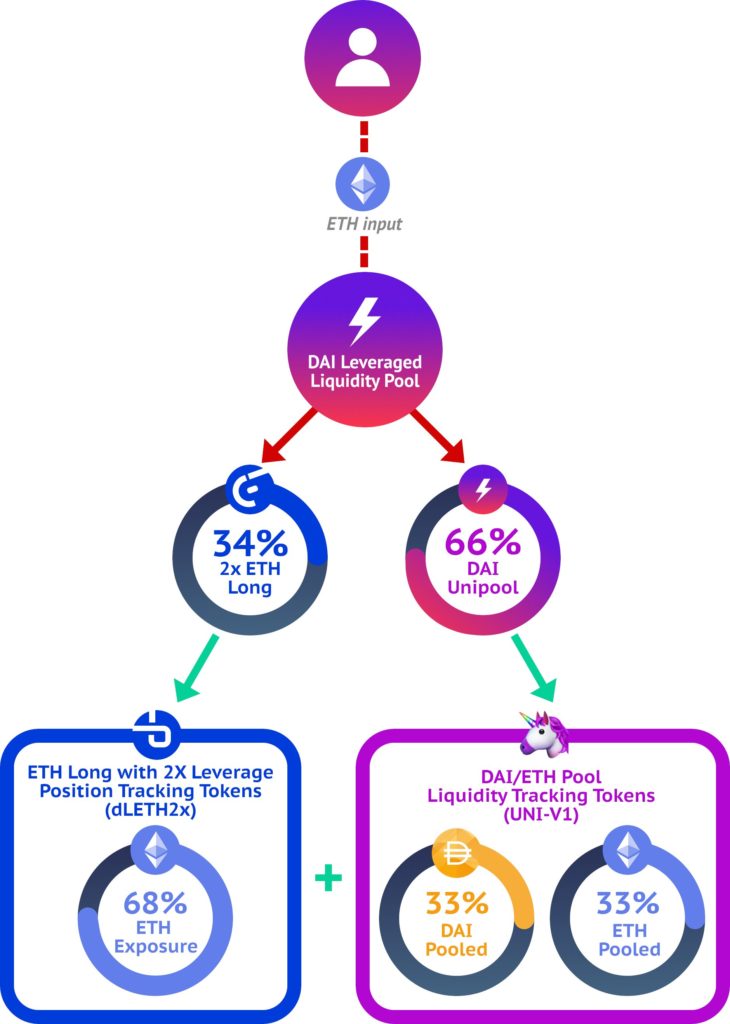

<— The diagram (left) shows how how the Dai LLP zap gives a user exposure to upward Eth price movements, while still allowing them to collect transaction fees by contributing funds to a Dai/Eth liquidity pool on Uniswap.

The Dai LLP zap was created by combining the BZX and Uniswap protocols into a token which a user might use if they were bullish on Ethereum, but also wanted to collect liquidity pool transaction fees.

Currently their are 14 Zaps to choose from here. You can pick a zap that best fits your investment goals.

Types of Interest Bearing Tokens

Below i’ll give a more in-depth explanation of the types of interest bearing tokens, and how they function:

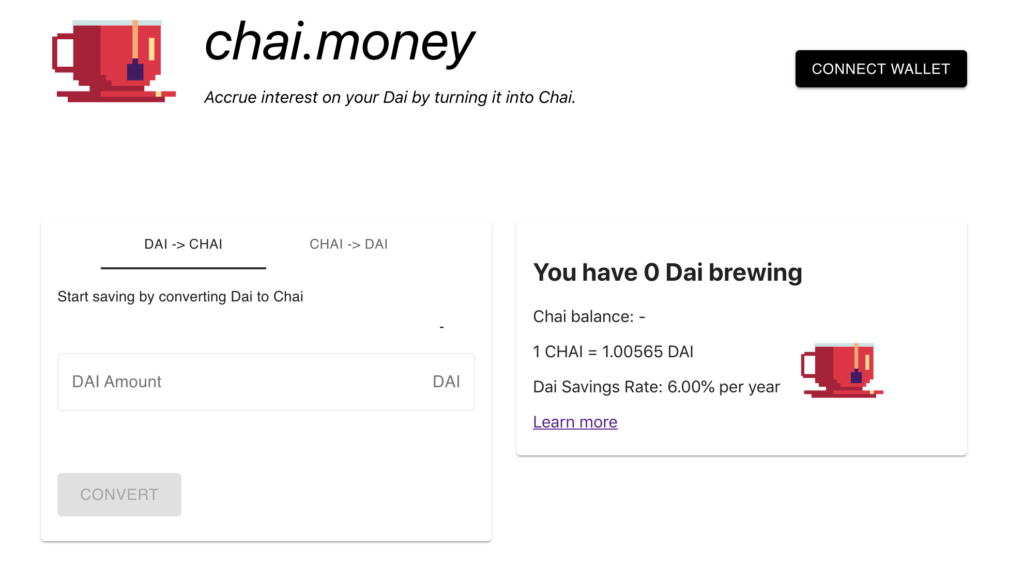

Chai Tokens and the Dai Saving Rate

The Chai project is an app which allows its users to convert ERC-20 Dai stablecoins, into “wrapped” Chai tokens.

Chai is simply Dai, “wrapped” in the Dai Savings Rate. Wrapping the Dai tokens preserves its liquidity. Chai can be traded freely and no longer has to be locked up in a smart contract to generate interest!

One negative possibility that i read about Chai in a blog post was that, it might be lent out to other lending protocols, while already earning the DSR (Dai Saving Rate).

aTokens and The Aave Protocol

Aave’s protocol went live on Jan. 2020 and already has over $2.5M USD deposited into it. Aave offers a pool-based lending strategy. It allows lenders to provide liquidity into the pool, in exchange for interest payments as aTokens.

A user’s balance of aTokens increases as interest is generated according to the current rate. This interest rate changes algorithmically, depending on the amount of funds being lent to the pool, as well as the amount which is being borrowed.

iTokens and the BZX protocol

The BZX protocol allows users to borrow, lend, and trade with leverage. Users lend their funds to the protocol, in exchange for iTokens. iTokens generate interest by constantly increasing in value.

iTokens are a real-time reflection of supply and demand on their lending pools.

cDai and the Compound Finance Protocol

cDai is an interest bearing token that is generated when Dai is locked in the Compound.Finance protocol. It is a redemption token that will always increase in value according to the interest rate. cDai’s value increases with every block and can be freely transferred or sold on an exchange.

Interest rate Optimizers and Porting

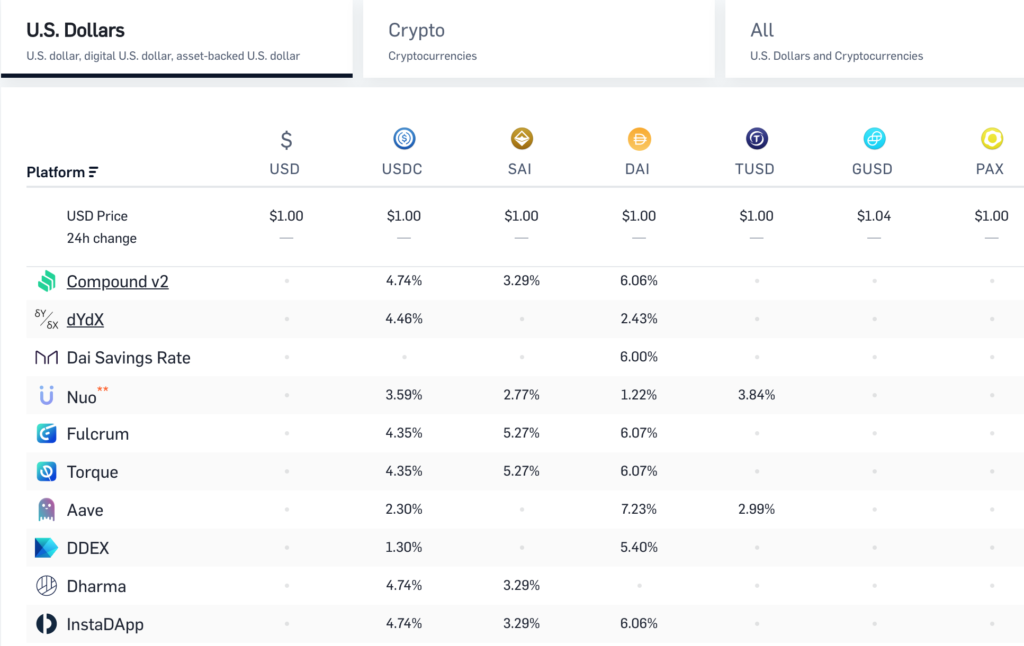

The current available interest rates can be found on Loanscan.io. Users are not locked in to any rate. They can freely port their loans from one protocol to another via a dapp like: Instadapp or Idle.

Using Instadapp to port your loans to a better interest rate

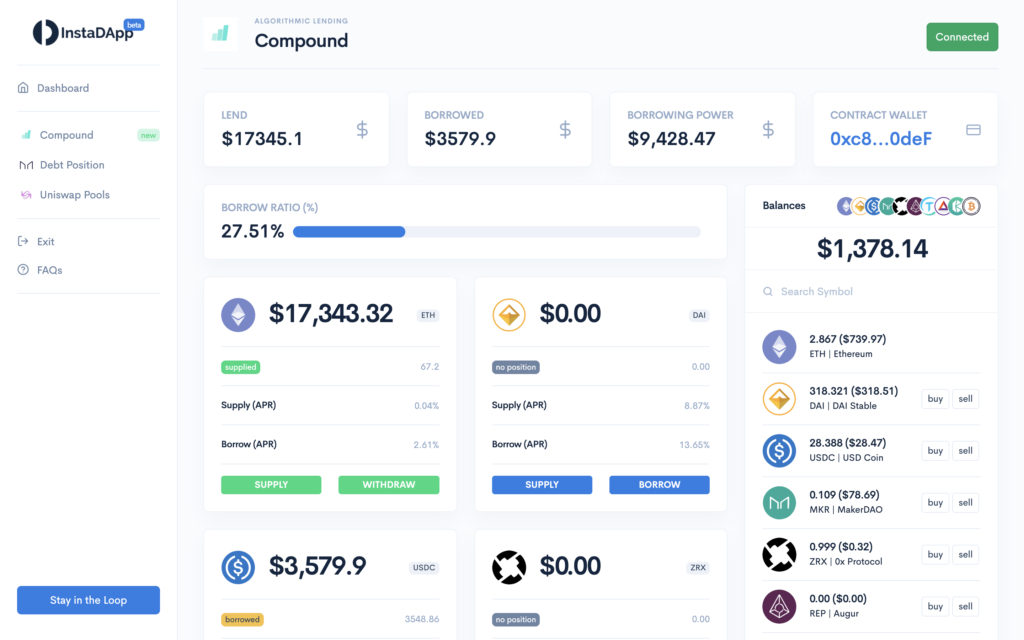

Instadapp is a smart wallet with an interface that allows users to borrow, lend, and port between 2 lending protocols which include: MakerDao and Compound.finance.

The porting ability lets users switch to the best interest rate, as stability fees fluctuate up and down. This is an essential feature, as Makers borrowing rates are variable and spiked up to 20% from Jul. through Aug.

Idle: the interest rate optimizer

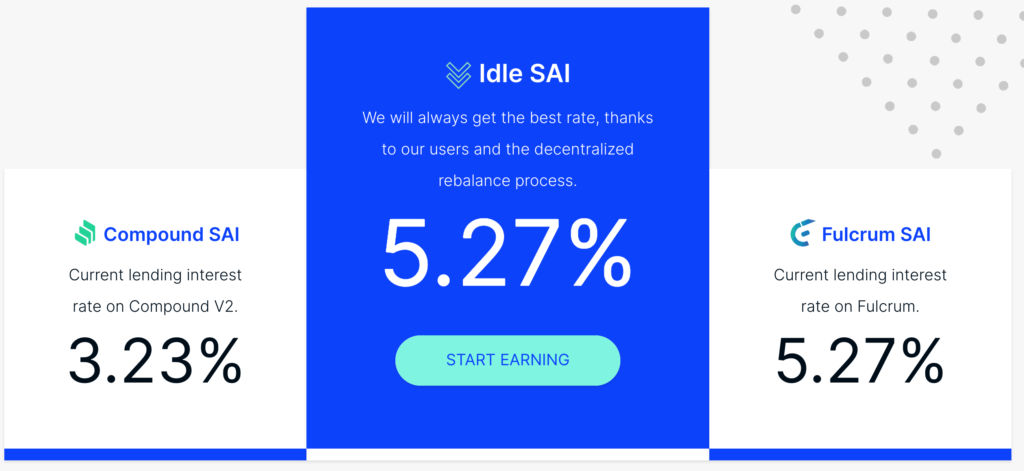

Idle is a protocol that lets you buy a token which automatically rebalances between 2 lending protocols, Compound and Fulcrum. This token will automatically deliver the best interest rate to its users.

Conclusion

As more key pieces of Ethereum’s defi ecosystem are developed, an explosion of ideas, development, wealth, and opportunity will be produced in the space. Defi may very well be the first case for mass user adoption in blockchain. About 3% of all Ethereum (over 300 million dollars) are already locked up in defi applications. 2020 will be a defining year for defi, which will produce more key infrastructure that will go on to create interesting and useful products for users.