I strongly believe 2020 will be the YEAR OF THE DEX… because if you have to execute a simple ERC-20 swap, there is NO reason to take on the added risk that a centralized exchange brings to the trade. A few limited issues may drive you to use a CEX including: access to a fiat gateway, reductions in slippage, and cross chain trading, but these issues are now being addressed by exciting new projects that i will highlight below.

In this article I will cover: 1) DEXs v. CEXs, 2) Fiat Gateways for U.S. and Non U.S. Residents, 3) Using Dex Aggregators to Find the Ultimate Trade, 4) Cross Chain DEX Swaps, 5) Liquidity Pools, DEXs, and how to earn fees.

Feeling Risky? …Why DEXs ARE Better Than CEXs

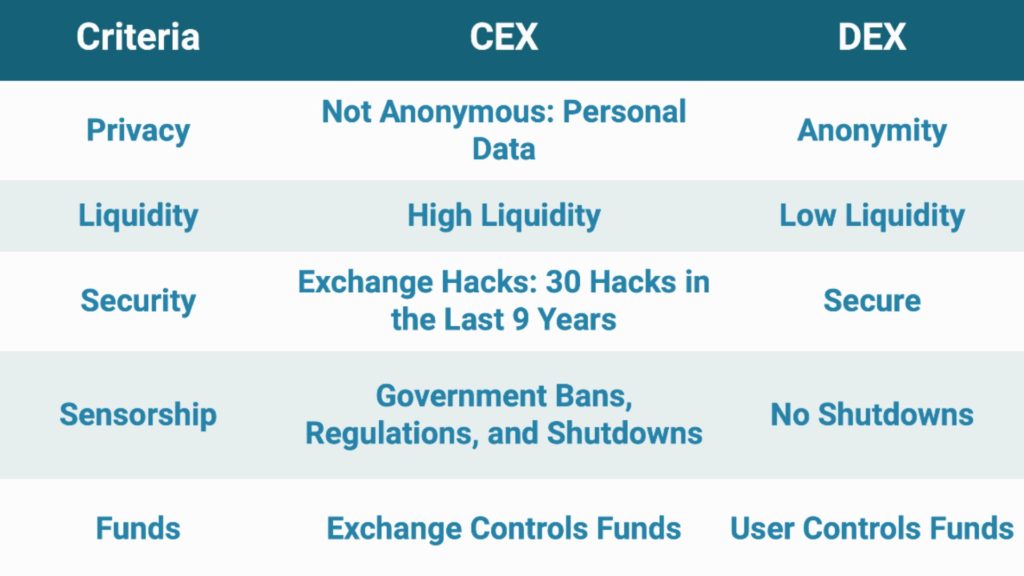

The added risk of using a CEX is very significant and can include: 1) the loss of custody of your funds, 2) security vulnerabilities/hacking, 3) deposit/withdrawal and trading fees, 4) censorship, 5) KYC, and 6) restrictions on trading pairs. So, why would you EVER take unnecessary, increased risk to your valuable funds, when you can trustlessly swap your coins out for the cost of a gas fee??? WHY???

DEXs solve the issues in the graphic above, but aren’t completely flawless. They add a few problems like: increased slippage and reduced access to cross-chain trading (which is being addressed). In my opinion, the advantages of a DEX far outweigh the negatives.

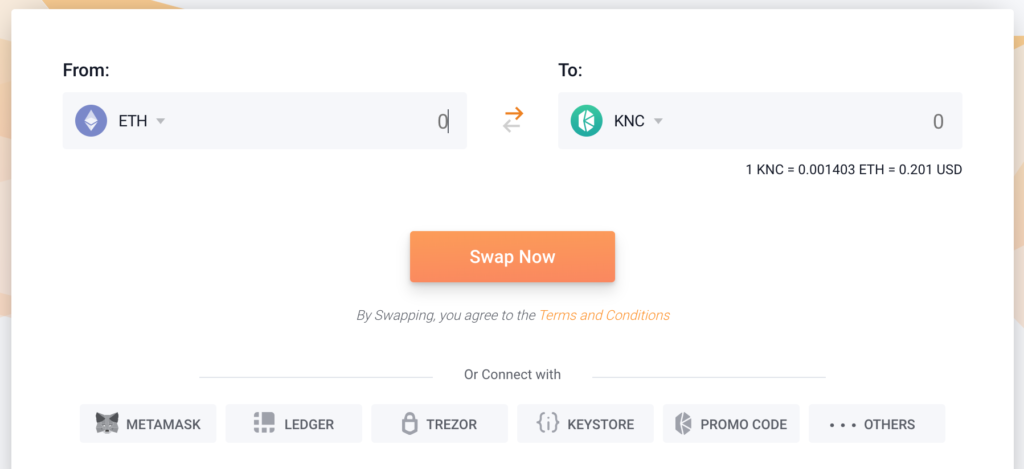

Please, Give it a TEST! Visit Kyberswap, 1inch.exchange, Dex.ag, or JellySwap (offers cross-chain trades), and Bancor so you can see how frictionless, simple, and user-friendly an interface can get.

Fiat Gateways for U.S. and Non- U.S. Residents are a missing piece of the puzzle

Fiat gateways have become a pain-point in crypto! (especially for U.S. users.) Limited entry points prevent new users from gaining access, reduces competition, and results in raised fees. We need better options NOW.

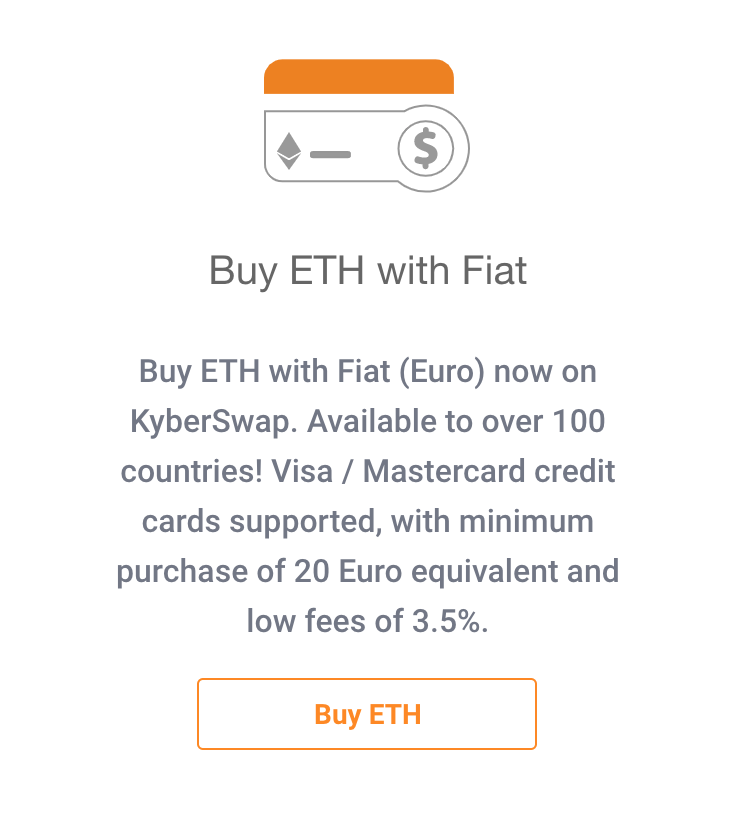

Kyberswap recently partnered with Coindirect to allow users to buy fiat for crypto with a credit card. Users can buy ETH for Euros from over 100 countries, BUT U.S. users are OUT OF LUCK!

As far as i know, the ONLY DEX with fiat gateways for U.S. residents was Bancor. The fee to fund an account with a credit card was a bit steep at i think 5%. I recently found a cool alternative, if your looking for a more decentralized gateway.

Direct to Wallet Crypto Purchases via SendWyre

One company that is working on a fix for this is Sendwyre.

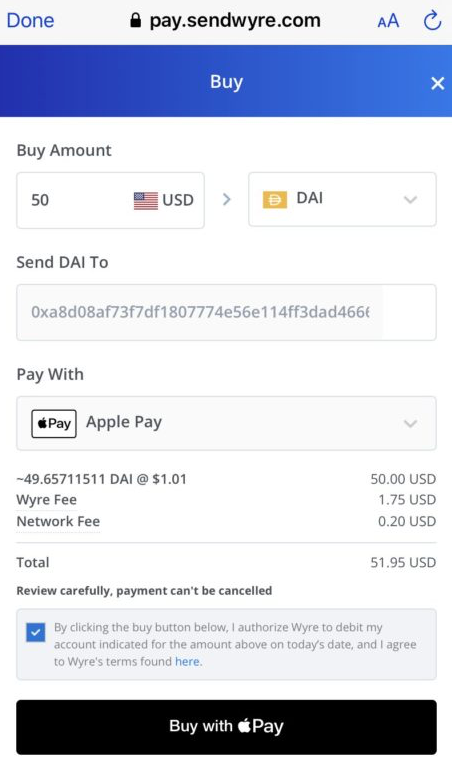

They’ve created an integration for the Argent crypto wallet that allows you fund fiat to crypto purchases directly into your wallet via Applepay.

I learned about this integration via @trustlessState.

Here is his screenshot purchasing DAI through ApplePay. It looks to be about a 3% fee, which is o.k., but i’m hoping for a gateway that can beat coinbase’s fees.

The added competition is great, and it could definitely bring the fees down if more options were on the table.

(*NOTE) I did read reports of some users having declined transactions with their credit cards with this method of funding.

Using Dex Aggregators to Find the Ultimate Trade

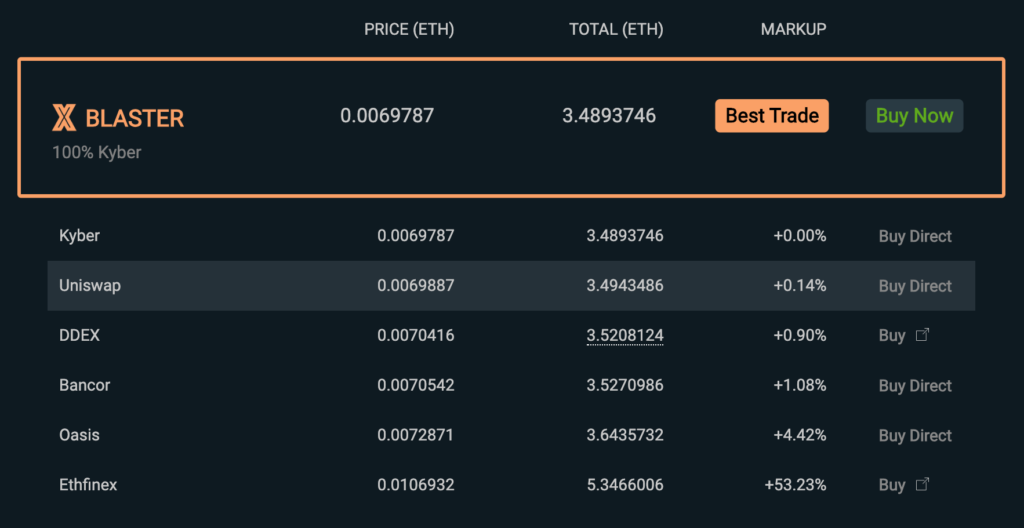

Dex aggregators scan and consolidate open orders across multiple DEXs and liquidity providers, in order to present the user with the best trading opportunity.

1inch.exchange, states it achieves the “best rates by splitting orders among multiple DEXes in one single transaction”. I believe aggregators will be an emerging trend in defi for the year 2020, as they offer users the best option.

Other Dex aggregators of note include: ParaSwap, Totle, and Dex.ag (screenshot below)

The transaction fees will vary between aggregators. Currently, many of them are not charging additional fees. You will have to pay fees to the liquidity provider or the exchange that the order was executed on.

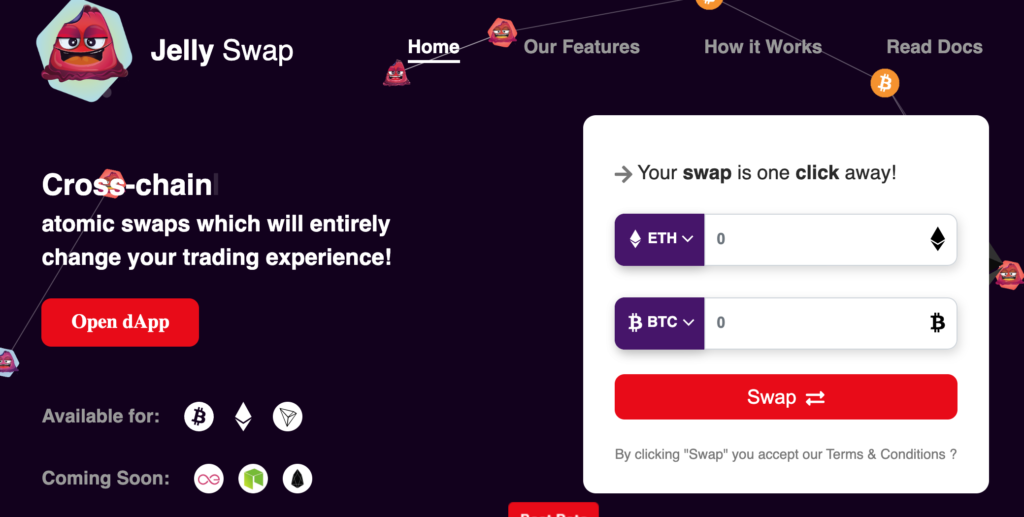

DEXs like Jelly Swap are now providing Cross Chain Swaps

One problem that you are going to run into with many DEXs is the lack interoperability between blockchains at the current moment. I would personally like better access to cross-chain swaps, as i often want to adjust my ETH/BTC ratio. There are other options including WrappedBTC, or tBTC, which is coming soon. But Jellyswap is offering cross-chain swaps NOW!

JellySwap allows cross-chain atomic swaps between the BTC, ETH, AE, and TRX blockchains. The team soon has plans to add atomic swaps on more blockchains like EOS, and NEO.

The video below shows a user connecting two wallets to the DEX in order to do a cross-chain trade.

The Problem with Slippage

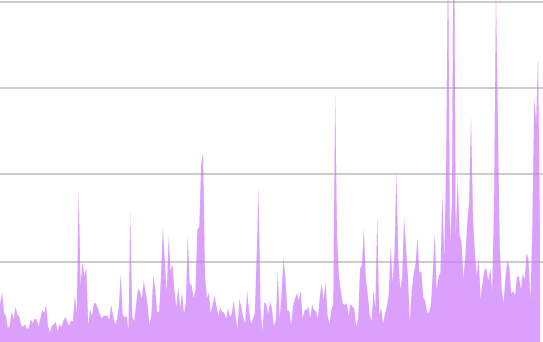

A problem you may experience with decentralized exchanges is slippage. Slippage occurs during periods of high volatility. The difference between your expected price and the price you received in your executed order is called slippage.

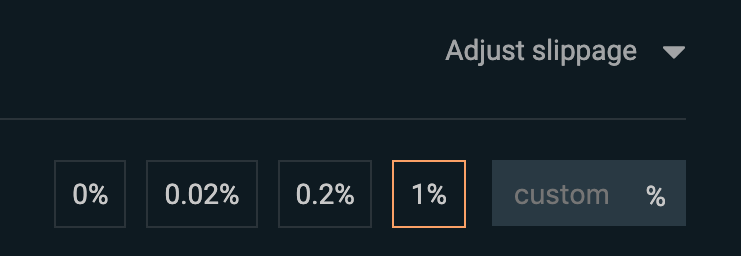

The slippage issue is being addressed by aggregators which allow you to define what is an acceptable amount of slippage, before you make a trade.

Maximum slippage – certain aggregators like Dex.ag allow users to define what is an acceptable amount of slippage, BEFORE a trade executes. Dex.ag is the only DEX out of the four i was looking at that allows you to define what is an acceptable amount of slippage on your trade. 0x protocol now proports to have the lowest amount of slippage of decentralized exchanges.

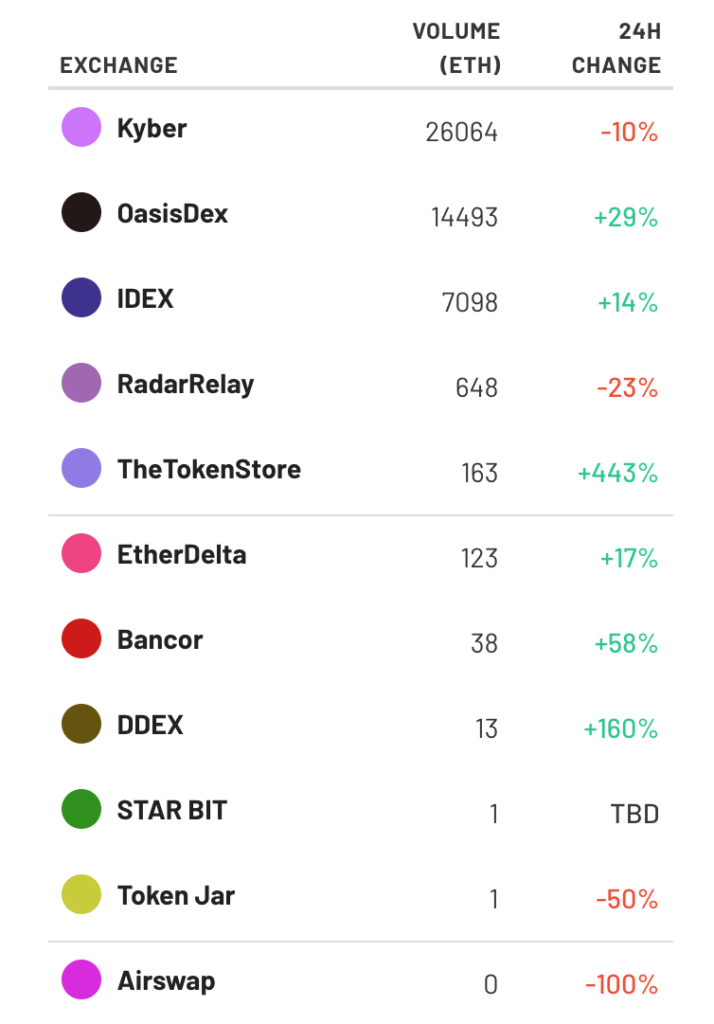

What are the Trading Volumes of the top DEXs?

The majority of DEX trade volume takes place on Kyberswap, followed by OasisDex, and IDEX.

I personally think the majority of users will congregate to the aggregators.

Users want trades with the lowest fees, slippage, and greatest number of assets, with a simple/easy UI. I think the AGs offer this in the most user-friendly manner.

Liquidity Pools, DEXs, and Transaction Fees

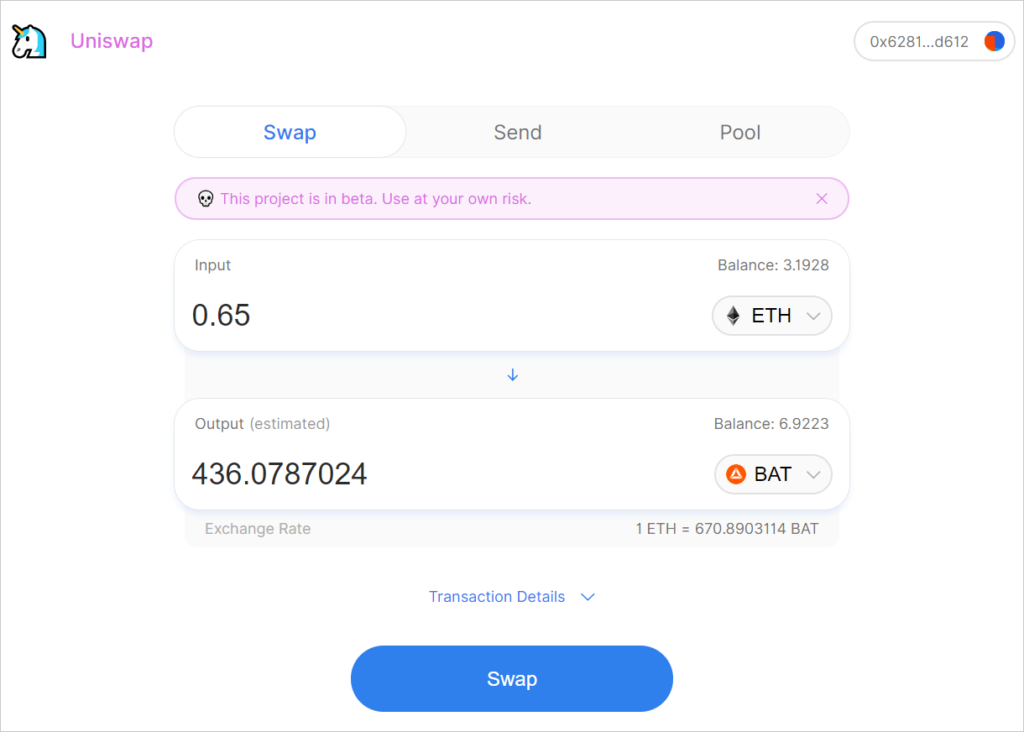

Uniswap is a decentralized exchange protocol that allows users to contribute the liquidity of their own tokens to a pool, in order to earn a percentage of the transaction fees in that pool. Uniswap is a major contributor of liquidity for the DEXs and DEX aggregators i spoke about above.

Uniswap recently hit a milestone at $1,000,000 in fees being earned by providers of the liquidity on the network. Users can create their own trading pairs. They must contribute an equal amount of ETH to start a new pair.

With every Uniswap trade, a 0.03% fee is deducted in order to split up among the pool of trading providers. In order to setup a new trading pair, providers must contribute a token, as well as an equal amount of ETH.

Bancor Liquidity Provider Token

On June 9-10, Bancor began doing an airdrop of ETHBNT to holders of its BNT token. This new token allows users to share in the transaction fees of the ETHBNT liquidity pool.

Bancor states that this new airdropped ETHBNT token “will instantly turn all BNT holders into liquidity providers who can immediately collect fees from every ETH conversion on the Bancor Network.” Here is an article that better explains how holders of the BNT token have been transformed into liquidity provider for the Bancor network.

This new ETHBNT token will help with:

- Decentralize liquidity sources across thousands of unaffiliated users

- Shift BNT from a dynamic supply to a fixed supply token

- Allow BNT to evolve into an inflationary token that supports liquidity provider rewards

Conclusionary Statement:

I did alot of deep research about DEXs and as a result of what i learned, i think i will never use a centralized exchange again. Why would you ever put your funds at risk, expose yourself to additional trading fees, and reduce your privacy, if you don’t have to. The conclusion to my research is that DEXs have progressed rapidly and will continue to do so in the coming years. If you haven’t looked into them for a while, you will be blown away by the progress that has been made in just a couple years time. 🙂

Please follow me @defipicks