TokenSets is a protocol designed to strategically manage your cryptocurrency assets. This unique protocol makes automated trades according to 17 different strategies, or “sets“, which are chosen by the user.

The protocol automatically shifts a user’s assets between Eth and a stablecoin according to the movements of technical indicators.

The trading strategies of the protocol are tokenized. Users purchase tokens, which represent assets traded according to a particular “strategy” that a user chooses. The user can then cash out SetTokens into ETH. The total losses and gains of each strategy are represented and tracked by the SetTokens.

TokenSets is currently ranked #14 on Defipulse, with over 876 Eth locked in its contracts. The project was co-Founded by Inje Yeo, who originally coined the word “defi”. The TokenSet protocol is completely transparent, so users know exactly how their funds are being traded.

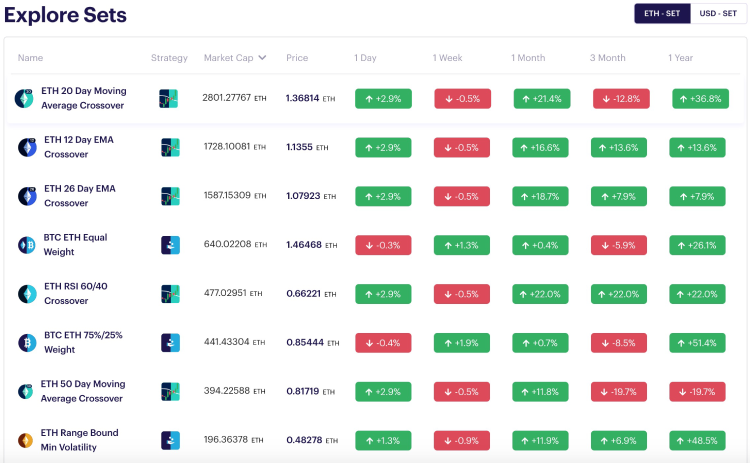

Types of Sets and Strategies Available

Tokensets automatically rebalances a portfolio according to trends, statistics, and indicators used by many experienced traders use. There are 4 main “set” categories including: trend trading, inverse, range bound, and buy and hold.

Trend trading is a trading style that “attempts to capture value through statistical and market sentiment analysis of an asset’s momentum”. Users can buy tokens which represent the ETH 20 Day Moving Average Crossover, BTC Range Bound Min Volatility, and ETH RSI 60/40 Crossover strategies.

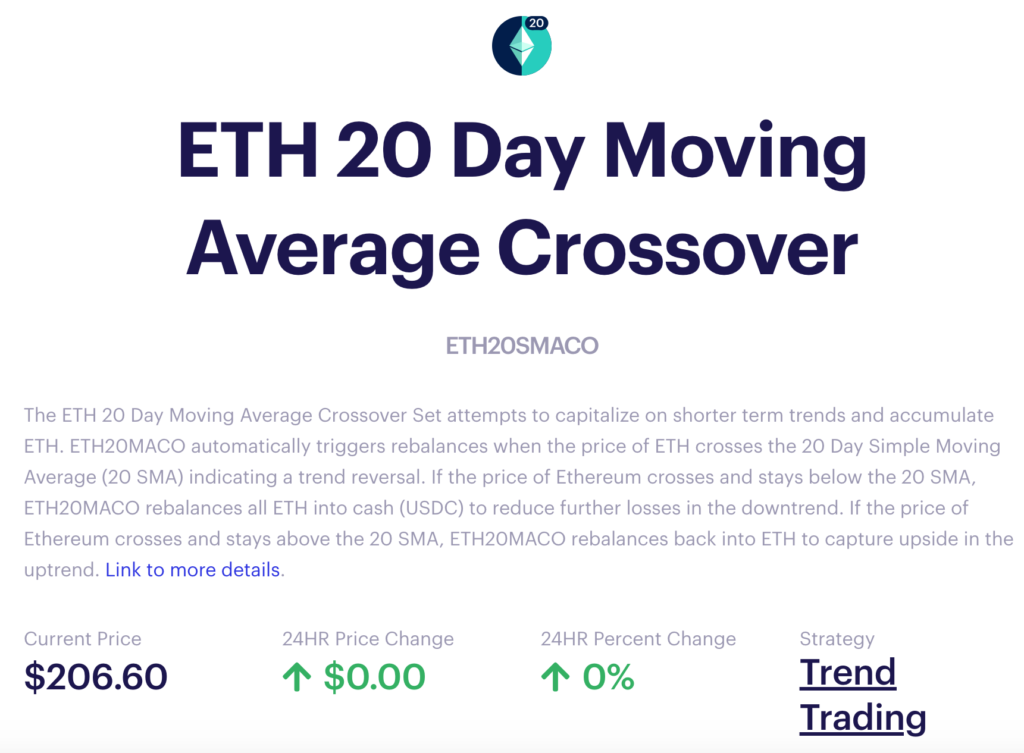

For each set, there is a page which explains exactly how the strategy works. Below you can see how the ETH 20 Day Moving Average Crossover works.

The ETH 20 day MACO set holds the users portfolio entirely in USDC, until the price crosses over the 20 day moving average. Then it re-allocates the entire portfolio into ETH. When the price crosses below the 20day MACO, it sells into USDC.

Range Bound – This set focuses on buying the bottom and selling the top of the price range of a particular asset. “The Range Bound Sets contain a benchmark token (i.e. Bitcoin, Ethereum) and a price stable token (i.e. Dai, USDC), rebalancing between the two when prices rise or fall.”

Inverse – Users can use this strategy when an asset falls below the 20 day SMA and may be due for a move to the opposite direction. If the asset rises above the 20 day SMA, the assets are sold into a stable coin in anticipation of a drop in the market.

Buy and Hold – This strategy buys and holds a portfolio of BTC and ETH. The portfolio will be automatically adjusted to maintain a certain ratio of 75%BTC – 25% ETH, for example.

Social Trading on TokenSets

With social trading, users can buy tokens that represent the “trades of other traders”. Experienced traders can get paid by tokenizing their trading and having a group of copy-traders underneath them.

A trader can then choose the percentage that they charge their followers for each trade. They can take fees on trades, exits, entries, or both. They pick the fee structure. Once traders build up a following, they can create an income based on the fees earned from followers of their trades.

Multiple Security Audits on TokenSets

The biggest risk for defi is smart contract security flaws. Bugs in smart contracts of the protocol are the biggest fears for users, as well as developers. Inje Yeo, co-founder of TokenSets says he and the team are paranoid when it comes to the security of their smart contracts.

For this reason, TokenSets was given a security audit by the top 3 smart contract auditing firms, which includes Chain Security, Trail of Bits, as well as an extensive internal audit.

The Future of TokenSets

In the near future, the team plans on releasing “user created” sets and strategies. The team wants to build a hub for users created custom tokenized sets, which can be purchased by other traders.

They want to create “a one stop shop for any Set they’re looking for given their chosen crypto asset, time horizon, risk profile, etc.”

Inje states that defi is one of the only use cases which is showing traction in the crypto ecosystem. Tokensets is a unique application for defi and blockchain tech. It is definitely one application to watch in the coming years!