Kyber.network is a liquidity protocol for Erc-20 tokens built on the Ethereum blockchain. The protocol can be integrated into any dapp, providing liquidity and improving usability for tokens. Users can also connect to the protocol directly using Metamask, Ledger, Trezor, Json, or their Private Key in order to transfer funds. Once connected, users can then swap for Eth or any other ERC-20 token.

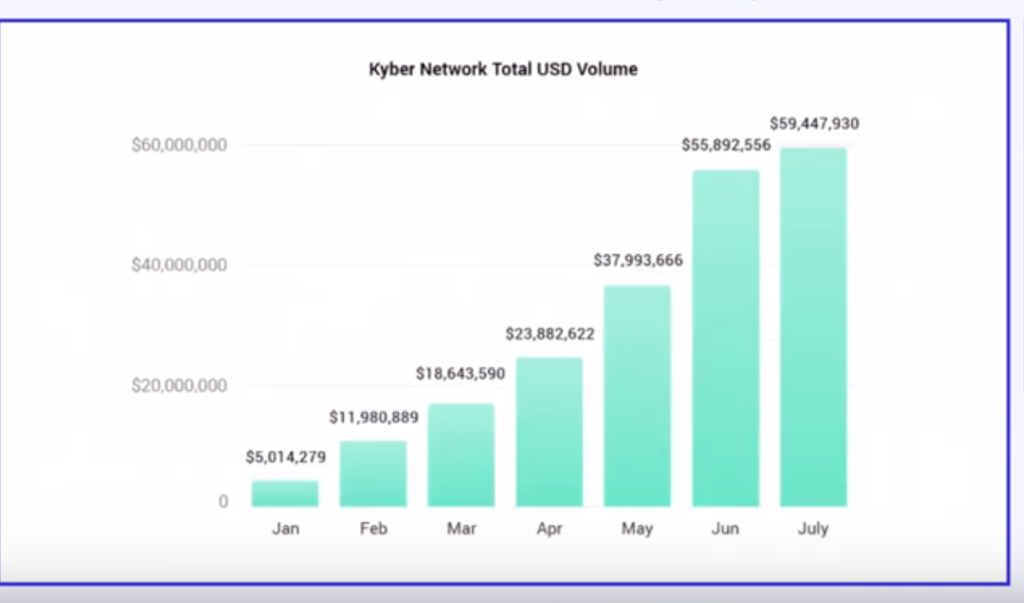

Kyber Network currently has over of $100,000 worth of daily exchange volume. The network has seen explosive growth of over 500% in the first half of 2019.

How does it work?

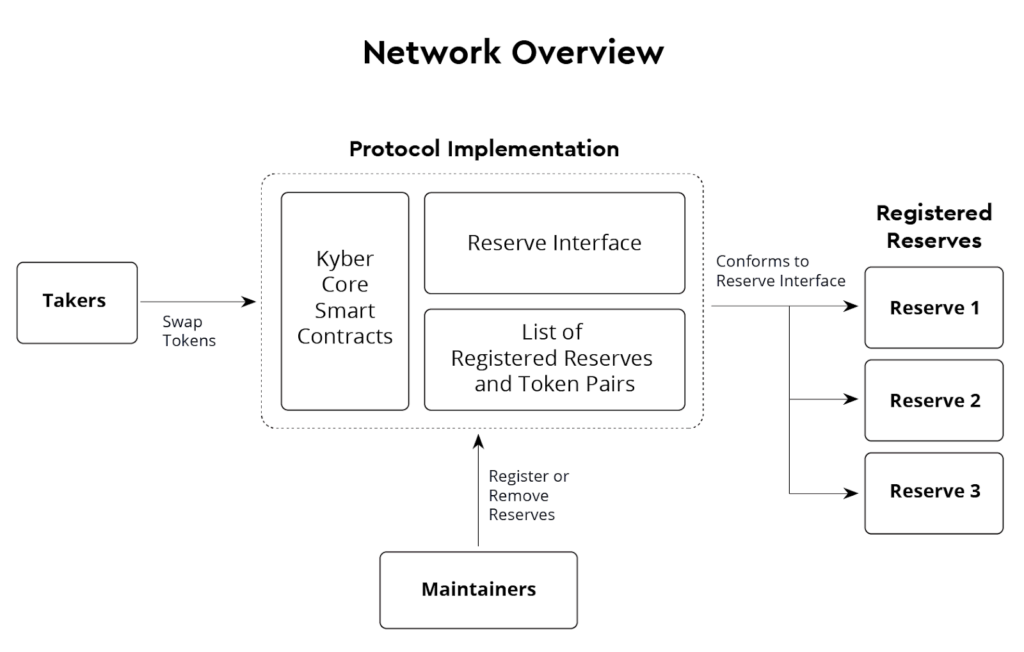

The Kyber protocol works by holding funds in Registered Reserves, which users can access. The reserves provide liquidity for the network. Reserve Managers make these reserves available, allowing them to set prices and profit from the exchanges. The reserves are held in smart contracts, in order to provide liquidity for the network.

Some reserves are held by the Kyber team, some are held by market makers to generate fees, while others are provided by token creators which are looking to provide liquidity for their own tokens.

What are the Applications of the Kyber Protocol?

Users or Dapps can connect directly to the Kyber protocol. This allows them to use the token of their choice, and automatically swap into a token of the vendors choice. This makes all ERC-20 token more usable.

Applications that have integrated the protocol include: Instadapp, Nuo Network, Decentraland.

Since there has been an explosion of coins in the ERC-20 ecosystem, the Kyber protocol will help them become more usable and accepted as payment.

Potential use applications for Kyber include: rebalancing a portfolio in one transaction, submitting a trade across multiple dex’s simultaneously, and having a token automatically exchanged for payment.

The Kyber Network Crystal Token (KNC)

The Kyber token (KNC) is used to connect those that need liquidity, to those that supply liquidity. It has a total supply of 250 million tokens and a current price of $0.18.

Users do NOT need the KNC token in order to user the Kyber protocol. The creators of Kyber realized this would cause a friction point for users wanting to make an exchange on the network.

Kyber Network collects transaction fees for making the trade. A portion of the transaction fee, is burned making the currency deflationary. 30% of the fees are paid to the dapp creators, while 70% is burned after each transaction. This means that tokens are burned, after every transaction fee.

Negatives of using Decentralized Exchanges

There are a few negatives of using a decentralized exchange over a centralized one, which includes gas fees, and slippage.

Slippage can occur in a time of volatility, where there are rapid price fluctuations on the network. It makes the bid-ask spread inaccurate and the orders can fill at a higher or lower price than initially quoted. Different exchanges can have differing amounts of slippage when an order is partially filled at one price, then the rest of the order is filled at a higher price. When there is a low amount of liquidity, slippage can be more significant.

Another negative of a decentralized exchange is the gas fee. In order to make a trade on a DEX, you need to contribute Eth gas in order to power your trade.

Benefits of Decentralized Exchanges

Kyber saves traders the risk of sending their currencies to a centralized exchange where there is a risk of theft or insolvency. The risk is that the exchange might not send back funds.

Other benefits of decentralized exchanges are that they tend to have lower trading fees than centralized exchanges. They are also censorship resistant and provide a service for exchange that cannot be blocked by a third party.