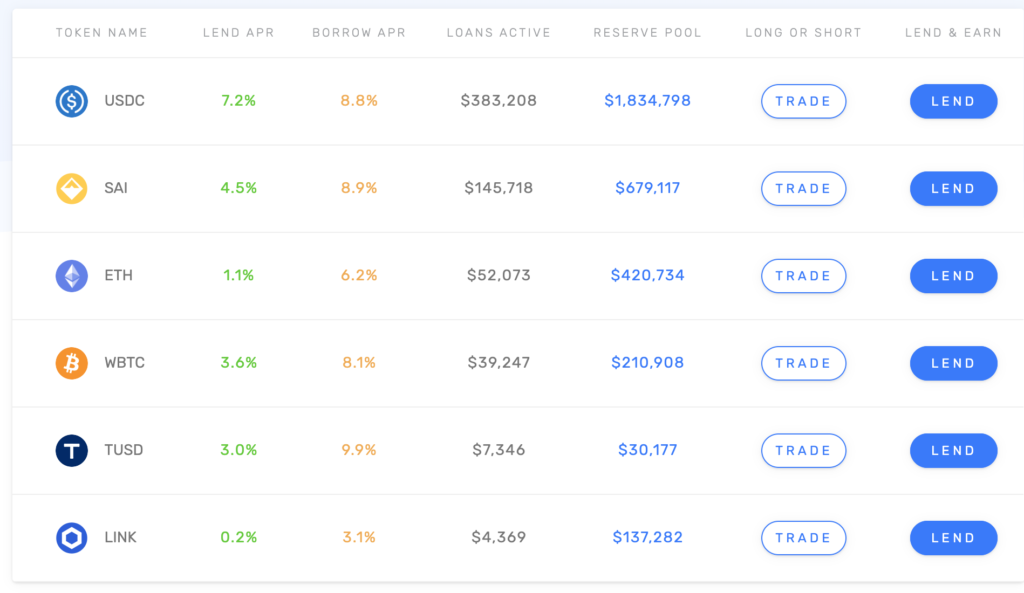

Nuo Network is a decentralized lending, borrowing, and margin trading platform built on the Ethereum blockchain. It allows lenders and borrowers to connect via peer-to-peer Ethereum smart contracts. The interest rate on the network (seen here) is fixed for borrowers, but variable for lenders. It also allows leveraged trading up to 3x.

Loans are backed by a borrowers crypto (used as collateral), which is locked into a smart contract. They are issued quickly, with no credit scores or paperwork needed to gain funding. Stablecoins like USDC and DAI tend to offer the best interest rates on the network. The Nuo platform is also non-custodial, which means that users will always retain access to their funds.

The Nuo platform gives users an interest rate of 0.1 – 7%, depending on which coin a user is lending or borrowing. This is an improvement over a typical money market account rate in the U.S. which is around 1%. All loans on the platform are completely transparent and can be viewed on the blockchain.

Nuo is the 7th largest defi dapp by locked volume of Eth, with a total of 8.2 million dollars. It is currently the number one lending platform in Asia.

Loans and Borrowing on Nuo

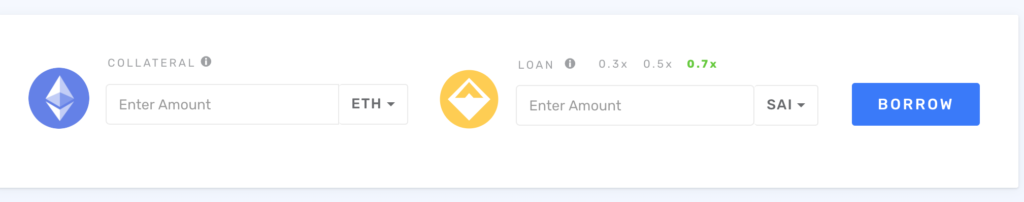

Nuo network allows investors to access the liquidity in their crypto, without permission from a third party. Borrowers can receive up to a 60% loan on their crypto collateral.

Users can lend/borrow 6 tokens including: USDC, Sai, Eth, WBtc, TUSD, and SNX. Nuo is the first margin trading platform for the SNX token. Interest rates on the network will vary by coin, as well as fluctuate daily.

Margin Trading on Nuo

The Nuo network allows margin trading, which lets users trade on borrowed assets. Nuo allows up to 3x leverage for 4 trading pairs including Eth and wrapped BTC.

Recently there has been improvements to the margin platform which includes features like a higher daily trading amount, the entry price and auto liquidation price, the selection of your profit token, as well as analysis of your previous trades.

Security Audits by Quantstamp

Security issues, smart contract malfunctions, and flash crashes are the main risk of decentralized finance.

Smart contracts on Nuo Network have been audited by Quantstamp, which is the top auditing firm for smart contracts. The auditing checks for bugs in contract code or execution time that may be exploited by an attacker.

Code auditing provides a bit more assurance to the lender that their funds will not be lost due to smart contract error, or hacker theft.

Benefits of Nuo Network

Nuo Network and other decentralized lenders in the defi space allow loans to the previously unbanked. This opens up a world of financial services to those without a bank account, via peer to peer transactions. All that is required is an internet connection and a smartphone.

The process to get a loan is fast, without the need for paperwork, or even a good credit score. Since the loans are backed with collateral stored in a smart contract, lenders aren’t at risk of losing their funds.

Negatives of Nuo Network

The negatives of all defi lending platforms are security risks, as well as flash crashes that can cause liquidation.

Although smart contracts on the Nuo platform have been audited by Quantstamp, there is still a risk of losing funds to malicious attacks, but the risk is lessened by the security audit. There is also a risk of smart contract errors or exploits.

Another risk on defi lending platforms is liquidation due to a flash crash. Here and here are a couple reddit posts where users were complaining about liquidations on the network. Defi is a new financial product, with some unforseen risks, so make sure do proper research before engaging with the network.