dYdx is a decentralized derivatives and margin trading platform, with over 24 million dollars in locked funds. This exchange allows for margin trading with over 4x leverage and borrowing/loaning, with no minimums or lock up periods. Users can go short or long by buying into tokenized margin positions. Currently, dYdX is the #6 defi app by volume of locked funds.

dYdX also integrates with other decentralized exchanges for improved liquidity. All funds in a users account balance will accrue interest according to current rates. Users will automatically earn passive income on all deposited funds. The interest rates on the platform are variable and can be found here.

The exchange currently has no trading fees, and no native token. It fills up an important gap in the decentralized economy, due to the fact that the derivatives market is by far the biggest market in the world at 1.2 trillion dollars globally.

Which assets does dYdX support?

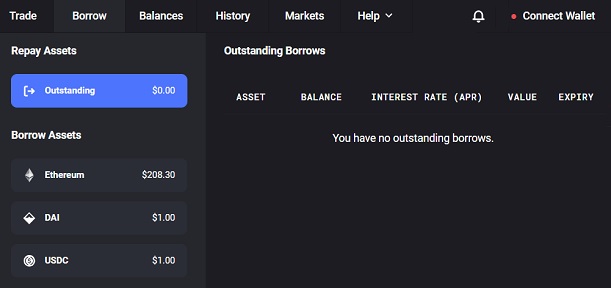

Currently dYdX supports 3 asset types which include: ETH, sDai, and USDC coin. The team has plans to add additional markets, as long as they have decent liquidity and are trading on decentralized exchanges.

Lending and Borrowing on dYdX

Lending your crypto assets on dYdX allows you to automatically earn passive income. Each type of asset has a different variable interest rate (see here). When you deposit funds, you will automatically begin to earning interest, no extra steps are necessary.

The interest you earn is being generated from fees from users who borrow funds on the exchange. There is no need to worry if a borrower will pay back the funds, because they are always backed by an 115% of crypto collateral, which can be liquidated.

A users collateralization ratio has to be over 115% in order for them to borrow. If this ratio falls below 115%, their funds will be liquidated. If a user is liquidated, they will receive a 5% penalty. Tokenized positions are open for a maximum of 28 days, before they will expire.

There is no lock up period on the exchange, or minimum deposit amount. A user can withdrawal their funds whenever they wish.

When you borrow on dYdX, the funds come out of a global lending pool that is managed by smart contracts. Borrowers can deposit and withdrawal funds at any time with no lockup period.

Interest rates for borrowing depends on the utilization ratio which is the borrowed amount/supplied amount. Here is the historical lending rate for dYdX.

In order to borrow, a user has to have a collateralisation ratio of 125%. It is important for a user to maintain a ratio of 115%, or their margin will get liquidated.

How can you go long or short on dYdX?

Users can short ETH on the exchange by purchasing sEth, which is a margin token that gains value as the price of Ethereum drops.

If you purchase the sEth margin token and the market goes down $10, you make $10. The sEth contract expires on a certain time and date, after a 28 day period.

The sEth margin token can even be traded across exchanges. This offers improved liquidity, compared to traditional methods of shorting.

Isolated and Cross Exchange Margin Trading

Two options exist for a user to trade on margin. Cross margin means trading using your account balances as collateral. Isolated margin is when a user opens a position independently collateralized from their account.

Cross trades allow you to use your entire account balance as collateral. Isolated trades use the collateral of what you have deposited in your account balance.

The Future of the dYdX Exchange

The exchange will soon add new markets, assets, relays and features including Eth/Dai, markets and multi-collateral Dai assets in December. They will still support sDai, or single collateral Dai.

They recently integrated the 0x protocol and just added limit orders to the interface. The volume and liquidity will continue to grow for the exchange as new features and markets are added.