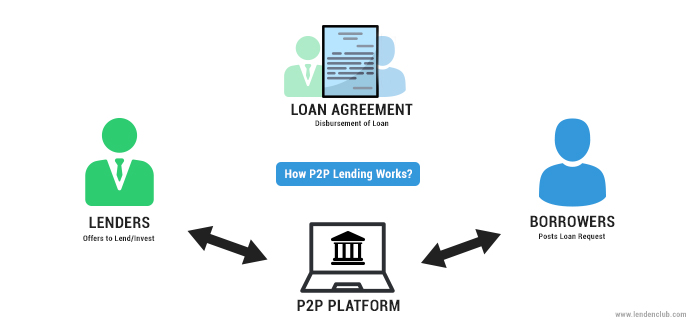

Defi lending allows you to earn compound interest on your cryptocurrency, by placing it in a smart contract, where others can borrow it for a fee. It’s similar to placing your money in a money market fund, which is seen in traditional banking.

The amount of interest you will earn from lending out your crypto will range from 0.02 – 10%. The interest rate you earn will depend on the type of crypto you are lending, which defi protocol you are lending through, and the amount of capital you have locked up in a smart contract.

The rate of return for defi lending is much higher than seen in traditional money markets, which will usually pay out around 2-3%.

Defi can generate you interest on your stablecoins (like DAI), as well as your cryptocurrencies like Bitcoin. Most defi lenders allow users to trade in a variety of cryptocurrencies including: BAT, AUG, ETH, USDC, and wrapped BTC.

Defi is a rapidly growing sector. I nterest bearing defi protocols have quickly grown in numbers to over 100 on the ETH blockchain this past year. Defi protocols include: BlockFi, Nexo, Compound.finance, Celcius, Dharmalever.

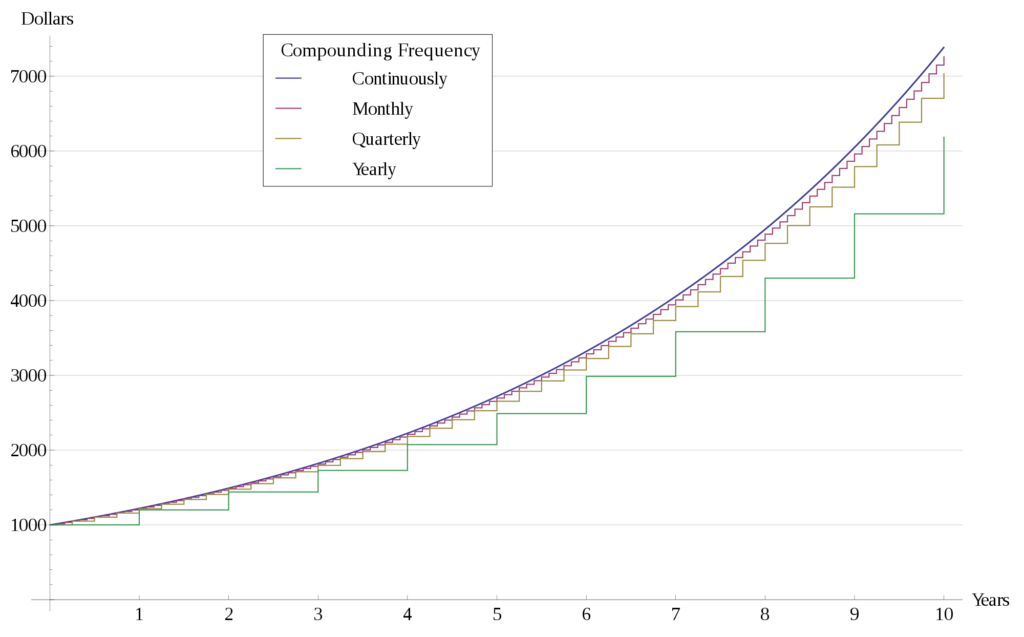

What is compound interest?

Compound interest allows you to earn money on your principle, as well as the interest you generate. You can think of it as earning “interest on your interest”.

For example, if you place $10,000 in a smart contract lending app at an annual lending rate of 6%, you will earn $60 per month. The next month your balance will be $10060 and you will earn a total interest of $63.60 for the next month. The amount of interest you earn will grow each month. After a period of 5 years, the compound interest rate on $10,000 at 6% annually, would generate $3383.00

Compound interest is a powerful financial tool, that allows you to grow wealth over a long period of time.

How to earn passive income on your stablecoins with Defi

Defi protocols like compound.finance allow you to generate interest on stablecoins like DAI, as well as cryptocurrencies like Bitcoin.

Instead of earning a low rate of 1 – 2% in a typical money market account, you might consider earning more significant passive income by placing it in a crypto lending protocol which will allow you to earn up to 6.4% on your DAI.

Stablecoins that you can choose to lend and generate passive income on include: DAI and USDC. These stablecoins have different methods of achieving their stability. Some stablecoins will be better than others for what achieving you are looking to accomplish.

Defi Review: which protocols are best to generate passive income?

There are over 10 defi protocols currently on the ETH blockchain which allow you to earn compound interest on your cryptocurrency and stablecoins. They include: BlockFi, Nexo, Compound.finance, Celcius, Dharmalever.

Below is a review of the top defi services where you can earn compound interest:

Compound.finance – this protocol is built on the ETH blockchain. It uses smart contracts that allow you to lend your DAI, ETH, BAT, AUG, USDC, wrapped BTC, and 0x. Interest rates on Compound will range from 0.02% to 6.51%, with the highest being DAI. The interest rates will fluctuate along with real-time demand.

DharmaLever – Dharma is an open lending and credit marketplace which offers a fixed interest rate, and 28 day loan period. Loan terms, asset class and duration, can be customized. They will even provide users the ability to have their loans back by NFTs (non-fungible tokens) like God’s Unchained cards.

Celsius.Network – Celcius is a peer-to-peer decentralized lending app. The protocol allows you to earn up to 10%, when you lend coins like GUSD, DAI, and PAX. The minimum loan limit on Celcius is $3000 worth of stablecoins in order to provide collateral. You earn 80% on the interest that is generated, while Celcius takes the rest.

Blockfi – this app has the best BTC lending rate based on the size of what you lend. It also offers a very high rate of 8.6% annual return on GUSD. Its interest rate on BTC is 6.2%. Blockfi requires you to have $4000 worth of cryptocurrency to use as collateral. Loans are not available in NV, SD, VT or HI.

Nexo – provides crypto-backed loans, allowing to access your crypto if you believe the price will rise in the future. It allows you to receive your loan in USD or EUR. Nexo has a minimum loan limit of $500 and a maximum of $2,000,000. The interest rate is 8% with Nexo tokens, without it rises to 16%. The interest rate on borrowing has recently dropped to 5.9% APR.

The Future of Blockchain based Finance

Blockchain lending and compound interest is just the beginning for decentralized finance. The future of defi will offer many types of new financial products for crypto holders. This ecosystem will eventually include applications for lending, mortgages, hedging, options, and insurance that are faster, cheaper, and much more efficient than what traditional banks can offer.