DDEX is a decentralized exchange, launched in 2018, for the peer-to-peer trading of ERC-20 tokens. It uses a hybrid of two protocols (hydro and 0x) offering matching that is done off-chain, and settlement that is done on-chain. It was the first exchange to offer off-chain matching, giving it an advantage over the competition with improved speed and liquidity. Off-chain matching provides benefits over the typical block-gas auction mechanism, which can result in unfair matching. Due to this hybrid approach, the DDEX exchange is able to operate 50 times faster than its competitors, with less fees.

DDEX switched to a hybrid of the hydro protocol and 0x protocol, during the downtime of crypto bear market. The benefit of adding the hydro protocol includes: discounts for liquidity providers through rebates and fee structures (which increases liquidity), fees collected in a base token like DAI (rather than a protocol token like 0x), order matching done on a smart contract level, and free order cancellation.

Co-founder Tian Li, states that improved liquidity is the main value proposition which differentiates itself from its competition. Liquidity is increased by the addition of an incentive layer, which offers rewards for sharing access to pools of tokens.

How to Earn Passive Income with Lending Pools on DDEX

DDEX lets it users earn passive income for lending their tokens to other users for leveraged trading.

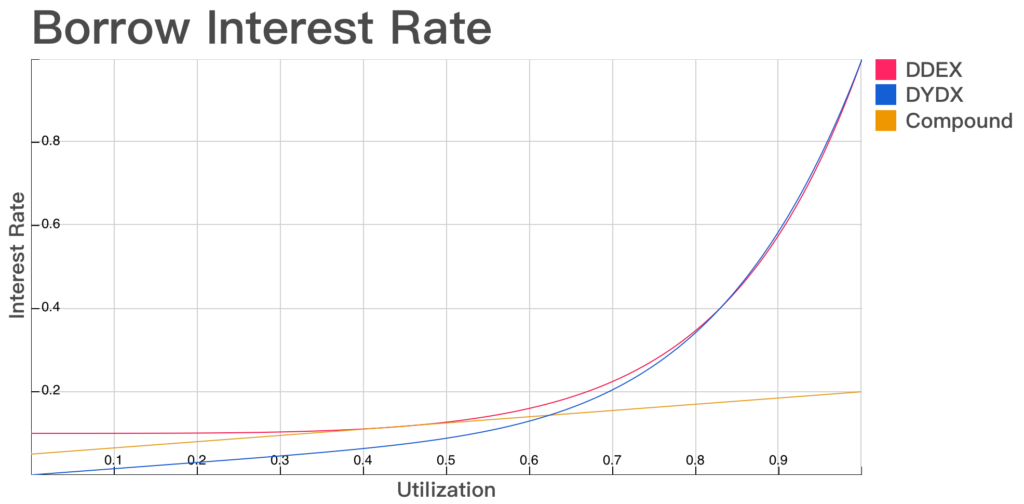

A user will automatically start earning interest, when their money is contributed to the lending pool. When a user trades with leverage, the borrowed funds come out of this pool. If the pool has alot of assets, with little borrowing, the interest rate will be low. If the opposite is true, the interest rate will be high.

Interest rates are calculated algorithmically by supply and demand. Currently, interest rates are 3.42% for USDC, and 3.58% for DAI.

How to Wrap Your Eth to trade on DDEX

A user must first wrap their ETH, in order to trade on DDEX. This allows them to trade directly from a crypto wallet like MetaMask or Ledger. Wrapping Eth converts it into wEth tokens. It allows the smart contract to exchange the tokens once a trade has gone through.

What are the Benefits of a Decentralized Exchange?

Decentralized exchanges (DEX’s) offer benefits over centralized exchanges, including: anonymity, security of funds, no deposit or withdrawl, and no KYC procedure.

Centralized exchanges require trust, while DEX’s are trustless. A user must trust the exchange to release the funds back to them, after the trade occurs. No trust is required with a DEX, as the trade occurs via a smart contract. No withdrawal is required by the user, because the funds never leave their wallet.

DEX’s are completely anonymous and require no personal information in order to trade. A user only has to login with their metamask account or hardware wallet to start.

Another benefit is that a users funds never leave their wallet. The transaction is made directly within the wallet, so a user never loses control of their tokens. The transaction is made via smart contract. It either executes or no trade happens.

Margin Trading on DDEX

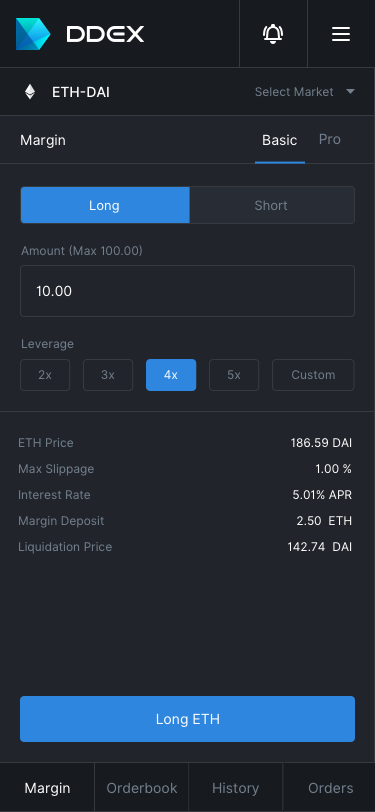

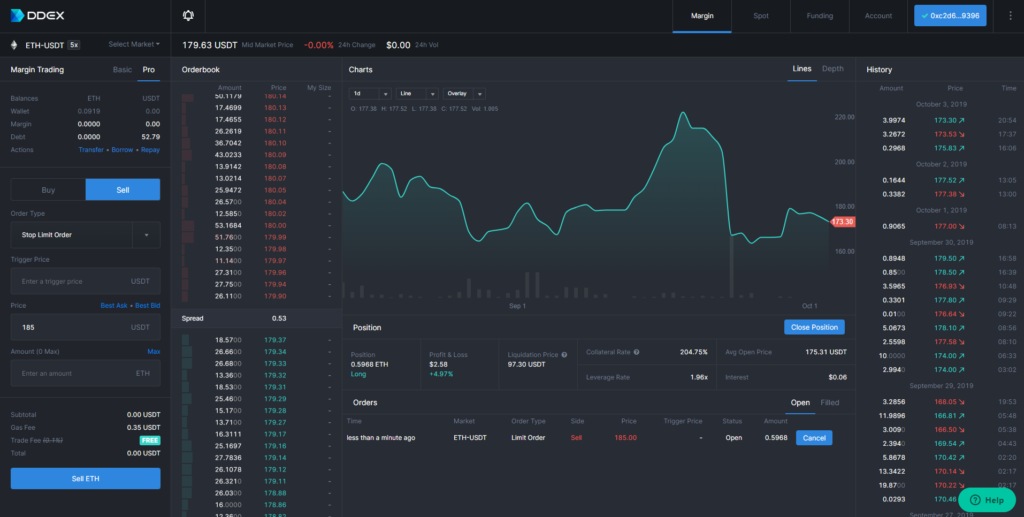

The DDEX exchange allows for leveraged trading of up to 5x, although the architecture of the exchange allows up to 10x. The team wanted to keep the margin level conservative for its initial release. The amount of leverage that is safe to use, depends on the liquidity in the market.

Borrowed funds for leveraged trading come from the liquidity pool. Interest rates for borrowing funds, fluctuate as supply and demand changes. In the rare event that a user is liquidated due to a price oracle malfunction, funds are covered by an insurance pool. Funds for the insurance pool are taken out of the transaction fees.

Leveraged trading can be done on the following pairs: ETH/DAI, ETH/USDT, and WBTC/USDT.

Why use the Hydro Protocol?

The DDEX exchange is built on a hybrid of an open-sourced framework called hydro protocol and the 0x protocol. The team that built DDEX, also built the hydro protocol. The benefits of adding the hydro protocol include speed, security, and tools for developers.

The hydro protocol adds increased speed over other dex’s due to its off-chain matching engine. The protocol also provides audited smart contracts which perform token exchanges via atomic swaps. It is open source and provides the framework to power the exchange.

The Future of DDEX

After two months of beta testing, DDEX has just recently implemented a new trading platform, with new features planned for 2020. It include two types of margin trading: Basic and Pro. The exchange will remove all trading fees for a period after their launch.

DDEX has recently partnered with Trust wallet for mobile trading on iOS and Android. They are also collaborating with three more mobile wallets to allow trading capabilities from your mobile phone.

Tian believes that marketshare of decentralized exchanges will continue to grow against centralized exchanges. He believes that volume will grow to 50% of the exchange market. I think he is right, maybe 2020 will be the year of the DEX!